CoreWeave (CRWV): Citizens JMP Offers Conservative Investment View

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (CRWV): Citizens JMP Sounds a Note of Caution Amidst the Hype

CoreWeave (CRWV), the rapidly expanding cloud computing company specializing in AI infrastructure, has been making headlines. Its recent IPO and subsequent stock performance have generated significant buzz, attracting both excitement and skepticism. Now, financial analysts at Citizens JMP Securities are offering a more conservative perspective, prompting investors to consider a measured approach. Their assessment provides crucial context for navigating the complexities of this burgeoning sector.

Citizens JMP's Conservative Stance on CRWV

Citizens JMP, a respected financial institution, recently issued a cautious outlook on CoreWeave's stock. While acknowledging the company's strong position in the rapidly growing AI infrastructure market, analysts expressed concerns about several key factors influencing their conservative rating. These concerns aren't necessarily negative predictions about CoreWeave's future, but rather a call for careful consideration by potential investors. The report highlights the need for a nuanced understanding of the current market landscape and the inherent risks involved in investing in a relatively young company, even one with considerable potential.

Key Concerns Raised by Citizens JMP:

-

Valuation: The report suggests that CoreWeave's current valuation might be somewhat inflated, considering the competitive nature of the cloud computing market and the potential for future market corrections. This is a common concern with high-growth tech stocks.

-

Competition: The AI infrastructure market is becoming increasingly crowded, with major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) already established. CoreWeave faces stiff competition from these tech giants, each possessing vast resources and established customer bases.

-

Profitability: While CoreWeave is experiencing rapid revenue growth, achieving sustained profitability remains a key challenge. Investors need to carefully assess the company's path to profitability and its ability to manage operating expenses effectively.

-

Market Volatility: The overall tech sector, and particularly the AI segment, is prone to significant volatility. Economic downturns or shifts in investor sentiment can significantly impact the performance of even the most promising companies.

Navigating the Risks: A Balanced Perspective

Citizens JMP's cautious outlook isn't necessarily a bearish prediction for CoreWeave's long-term prospects. The report acknowledges the company's technological advantages and its strong potential for growth within the AI sector. However, it underscores the importance of a balanced investment strategy, emphasizing the need to carefully assess the risks involved before committing significant capital.

The AI Infrastructure Landscape: A Booming Market

The demand for AI infrastructure is undoubtedly booming. The increasing adoption of AI across various industries is driving significant growth in this market segment. CoreWeave's focus on providing specialized infrastructure for AI workloads positions it strategically within this expanding market. However, this rapid growth also attracts intense competition, making it a challenging environment for even the most well-positioned companies.

What This Means for Investors:

Investors considering CoreWeave should carefully weigh the potential rewards against the inherent risks. Due diligence, a diversified portfolio, and a long-term investment horizon are crucial considerations. The Citizens JMP report serves as a valuable reminder that even promising companies in rapidly growing markets come with inherent risks. Thorough research and a balanced approach are essential for informed investment decisions.

Call to Action: Further research into CoreWeave's financial statements and competitive landscape is strongly advised before making any investment decisions. Consulting with a qualified financial advisor can also provide valuable guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (CRWV): Citizens JMP Offers Conservative Investment View. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stephanie Mc Mahons Regretted Wwe Tattoo Idea A Missed Opportunity

May 28, 2025

Stephanie Mc Mahons Regretted Wwe Tattoo Idea A Missed Opportunity

May 28, 2025 -

Predicting The Juan Manuel Cerundolo Vs Hamad Medjedovic Showdown At Roland Garros 2025

May 28, 2025

Predicting The Juan Manuel Cerundolo Vs Hamad Medjedovic Showdown At Roland Garros 2025

May 28, 2025 -

Stephanie Mc Mahon On Family Legacy And An Almost Permanent Mark

May 28, 2025

Stephanie Mc Mahon On Family Legacy And An Almost Permanent Mark

May 28, 2025 -

Joe Burrows Baltimore Complaint Mike North Weighs In On Bengals Qbs Primetime Concerns

May 28, 2025

Joe Burrows Baltimore Complaint Mike North Weighs In On Bengals Qbs Primetime Concerns

May 28, 2025 -

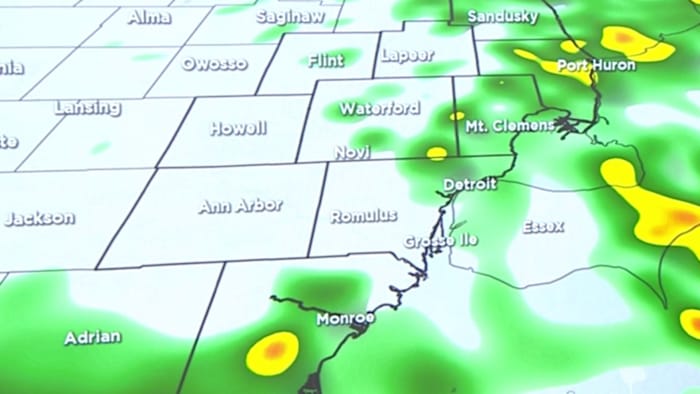

Metro Detroiters Brace For Scattered Showers What To Expect This Week

May 28, 2025

Metro Detroiters Brace For Scattered Showers What To Expect This Week

May 28, 2025