Conflicting Signals: CNBC's Daily Open On The Diverging US Jobs Reports

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Conflicting Signals: CNBC's Daily Open Highlights Diverging US Jobs Reports

The US economy is sending mixed signals, leaving economists and investors scratching their heads. CNBC's Daily Open highlighted this confusion this morning, focusing on the stark contrast between recent jobs reports and their implications for the Federal Reserve's monetary policy. The seemingly contradictory data is raising concerns about the future direction of interest rates and the overall health of the American economy.

The Puzzle of Conflicting Data:

The core issue revolves around two key employment indicators: the robust non-farm payroll numbers and the unexpectedly high unemployment claims. While the former suggests a thriving job market and economic strength, the latter paints a picture of potential weakness and layoffs. This divergence is perplexing analysts and complicates the Federal Reserve's already difficult task of navigating inflation.

-

Strong Non-Farm Payrolls: Recent non-farm payroll reports have consistently exceeded expectations, indicating strong job growth and a low unemployment rate. This positive data typically points towards a healthy economy and often supports arguments for continued interest rate hikes to combat inflation.

-

Rising Unemployment Claims: However, the recent uptick in initial jobless claims tells a different story. This unexpected increase suggests a potential weakening in the labor market, possibly foreshadowing a slowdown in economic activity. This contradicts the positive signals from the payroll reports, leading to significant uncertainty.

CNBC's Daily Open: Deciphering the Market Reaction:

CNBC's Daily Open dedicated significant airtime to this economic puzzle, inviting leading economists and market analysts to dissect the conflicting data. The discussion highlighted the challenges in interpreting these conflicting signals, emphasizing the need for a nuanced approach beyond simply focusing on headline numbers. The show explored several potential explanations for the divergence, including:

-

Lagging Indicators: Some analysts pointed out that unemployment claims are a leading indicator, reflecting recent layoffs, while payroll numbers are lagging, showing employment figures from a previous period. This time lag can create an apparent discrepancy.

-

Seasonal Adjustments: The impact of seasonal adjustments on the data was also discussed, as these adjustments can sometimes obscure underlying trends.

-

Data Revision Potential: The possibility of future revisions to the data was also acknowledged, highlighting the inherent uncertainties in economic forecasting.

Implications for the Federal Reserve:

The conflicting signals create a significant challenge for the Federal Reserve. The strong payroll numbers might push them towards further interest rate increases to curb inflation, while the rising unemployment claims could argue for a more cautious approach to avoid triggering a recession. The Fed's next move will be closely watched by investors globally. This uncertainty is creating volatility in the stock market and bond yields, as investors attempt to gauge the Fed's likely response.

Looking Ahead:

The coming weeks will be crucial in clarifying the situation. Further economic data releases, including inflation figures and consumer confidence indices, will provide additional insights into the health of the US economy. Analysts are urging caution and advising investors to closely monitor these developments before making any significant investment decisions. The conflicting signals currently dominating the economic landscape underscore the complexity of interpreting economic data and the challenges faced by policymakers in navigating the current environment. Stay tuned for further updates and analysis as the situation unfolds. For in-depth market analysis, consider subscribing to CNBC Pro. [Link to CNBC Pro (Optional - replace with actual link)]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Conflicting Signals: CNBC's Daily Open On The Diverging US Jobs Reports. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Supercells Mo Co Global Launch And Gameplay Details

Jul 07, 2025

Supercells Mo Co Global Launch And Gameplay Details

Jul 07, 2025 -

Drakes What Did I Miss Reflecting On The Kendrick Lamar Beef

Jul 07, 2025

Drakes What Did I Miss Reflecting On The Kendrick Lamar Beef

Jul 07, 2025 -

Ea Sports College Football 2024 Oregon State Player Among Top 100

Jul 07, 2025

Ea Sports College Football 2024 Oregon State Player Among Top 100

Jul 07, 2025 -

Is 0 16 The Floor For Dogecoin Bulls Battle To Maintain Support

Jul 07, 2025

Is 0 16 The Floor For Dogecoin Bulls Battle To Maintain Support

Jul 07, 2025 -

Proteas Unveil Test Debutants A Look At The New Faces

Jul 07, 2025

Proteas Unveil Test Debutants A Look At The New Faces

Jul 07, 2025

Latest Posts

-

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025 -

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025 -

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025 -

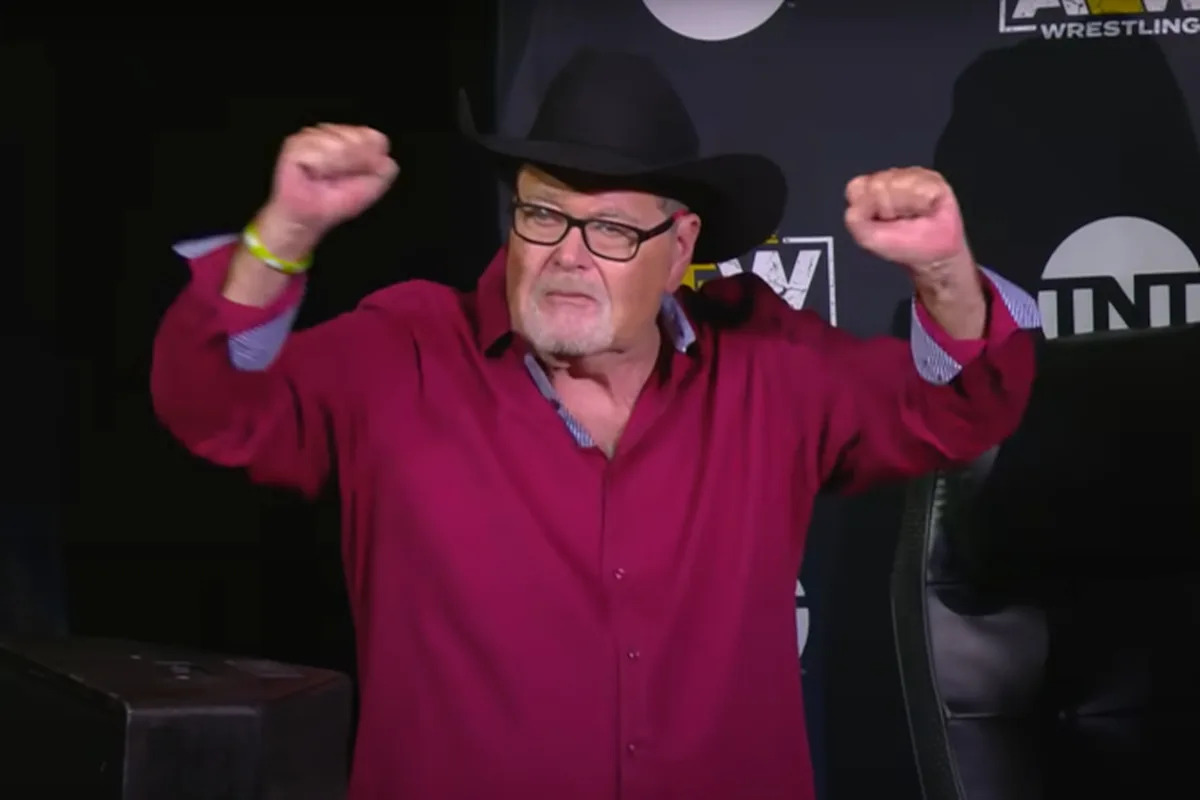

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025 -

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025