Conflicting Signals: CNBC's Daily Open On Diverging Jobs Reports

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Conflicting Signals: CNBC's Daily Open Highlights Diverging Jobs Reports, Leaving Investors Uncertain

The markets are buzzing with uncertainty following conflicting signals emanating from recent jobs reports, a key theme highlighted on CNBC's Daily Open. While some indicators point towards a robust labor market, others suggest a potential slowdown, leaving investors grappling with conflicting narratives and struggling to predict the Federal Reserve's next move. This divergence creates a complex landscape for investors, demanding a careful analysis of the available data and a nuanced understanding of the economic forces at play.

The Bullish Narrative: Strong Employment Numbers

Several recent reports paint a picture of a healthy, even robust, labor market. The latest non-farm payroll figures, for example, showcased [insert specific number] job additions, exceeding analyst expectations and suggesting sustained economic growth. This positive momentum has been further bolstered by [mention other positive employment indicators, e.g., low unemployment rates, strong wage growth in specific sectors]. These figures, as discussed on CNBC's Daily Open, naturally fuel optimism amongst some investors, suggesting continued strength in the economy.

The Bearish Counterpoint: Emerging Signs of Weakness

However, the picture isn't entirely rosy. CNBC's Daily Open also highlighted several factors that temper the initial enthusiasm. The recent decline in [mention specific economic indicators showing weakness, e.g., manufacturing PMI, consumer confidence index] points towards a potential cooling-off period. Furthermore, [mention any specific data contradicting the positive job reports, e.g., rising layoff announcements in specific sectors, slowing job growth in specific regions]. These conflicting signals raise concerns about the sustainability of the current economic expansion.

What the Fed Might Do: A Tightrope Walk

The divergence in economic indicators puts the Federal Reserve in a difficult position. While strong employment numbers might suggest the need for continued interest rate hikes to combat inflation, the emerging signs of economic weakness could prompt a more cautious approach. CNBC's Daily Open analysts debated the likelihood of a [mention potential Fed actions, e.g., pause in interest rate hikes, smaller rate increase, continued aggressive tightening]. The market's reaction to the Fed's decision will significantly influence investor sentiment and market trends in the coming months.

Investor Strategies in a Time of Uncertainty

Given the conflicting signals, investors are faced with a challenging decision-making environment. Several strategies are being considered:

- Diversification: Spreading investments across different asset classes to mitigate risk is crucial in this uncertain climate.

- Defensive Positioning: Shifting towards more defensive assets, like government bonds, might be considered by risk-averse investors.

- Careful Stock Selection: Focusing on companies with strong fundamentals and a proven track record of resilience can be a prudent approach.

- Closely Monitoring Economic Indicators: Staying informed about upcoming economic data releases and analyst forecasts is vital for informed decision-making.

Conclusion: Navigating the Volatility

The conflicting signals highlighted on CNBC's Daily Open underscore the complexity of the current economic landscape. While a robust labor market offers a positive outlook, potential cracks in the economic foundation warrant caution. Investors must carefully analyze the available data, consider multiple perspectives, and adopt a flexible investment strategy to navigate this period of uncertainty. The coming weeks and months will be crucial in determining the trajectory of the economy and the subsequent impact on the markets. Staying informed and adapting to changing economic conditions is key to successful investing. For further analysis and insights, remember to check out CNBC's Daily Open for up-to-date market commentary.

(Note: Remember to replace the bracketed information with actual data and figures from recent reports. Include relevant links to reputable sources like the Bureau of Labor Statistics and other financial news outlets.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Conflicting Signals: CNBC's Daily Open On Diverging Jobs Reports. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Paramount Celebrates 15 Years Of Movie Title With Streaming Debut

Jul 06, 2025

Paramount Celebrates 15 Years Of Movie Title With Streaming Debut

Jul 06, 2025 -

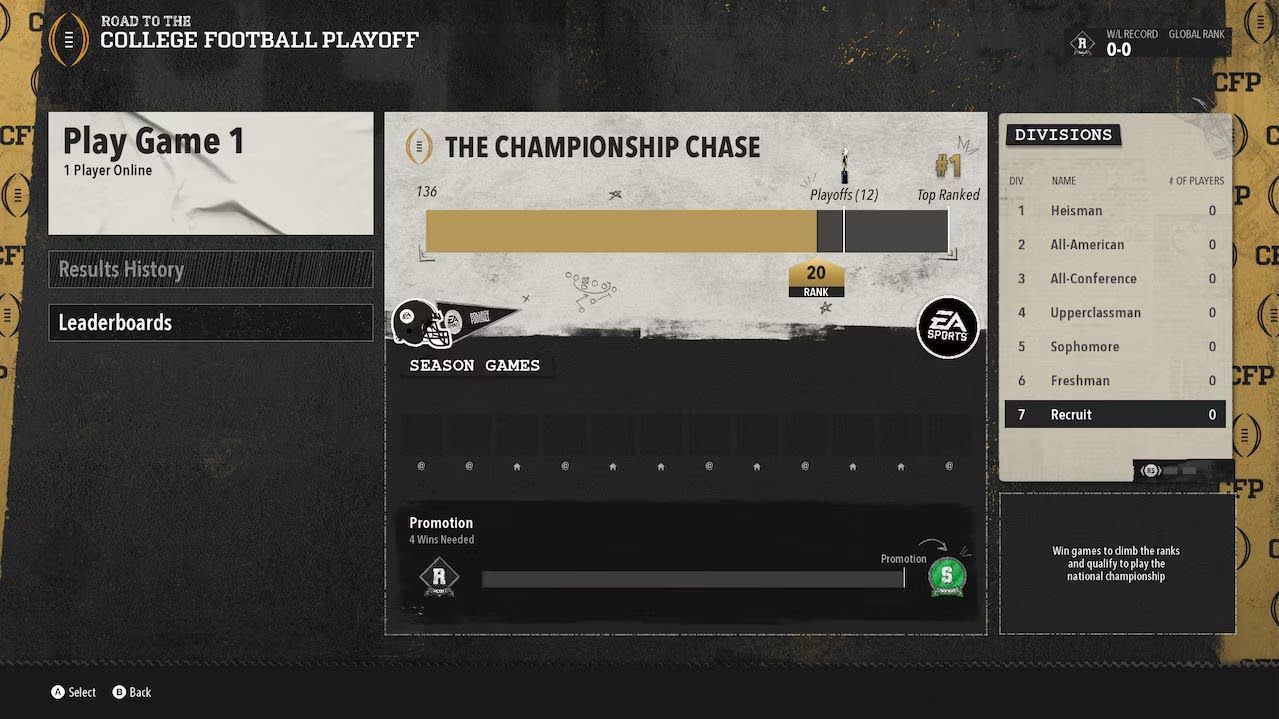

Oregon State Beavers Star Makes Ea Sports College Football 2024 Top 100

Jul 06, 2025

Oregon State Beavers Star Makes Ea Sports College Football 2024 Top 100

Jul 06, 2025 -

College Football 26 Team Ratings And Gameplay Changes Unveiled By Ea

Jul 06, 2025

College Football 26 Team Ratings And Gameplay Changes Unveiled By Ea

Jul 06, 2025 -

How Magda Linettes Coaching Fuels Hubert Hurkaczs Wimbledon Success

Jul 06, 2025

How Magda Linettes Coaching Fuels Hubert Hurkaczs Wimbledon Success

Jul 06, 2025 -

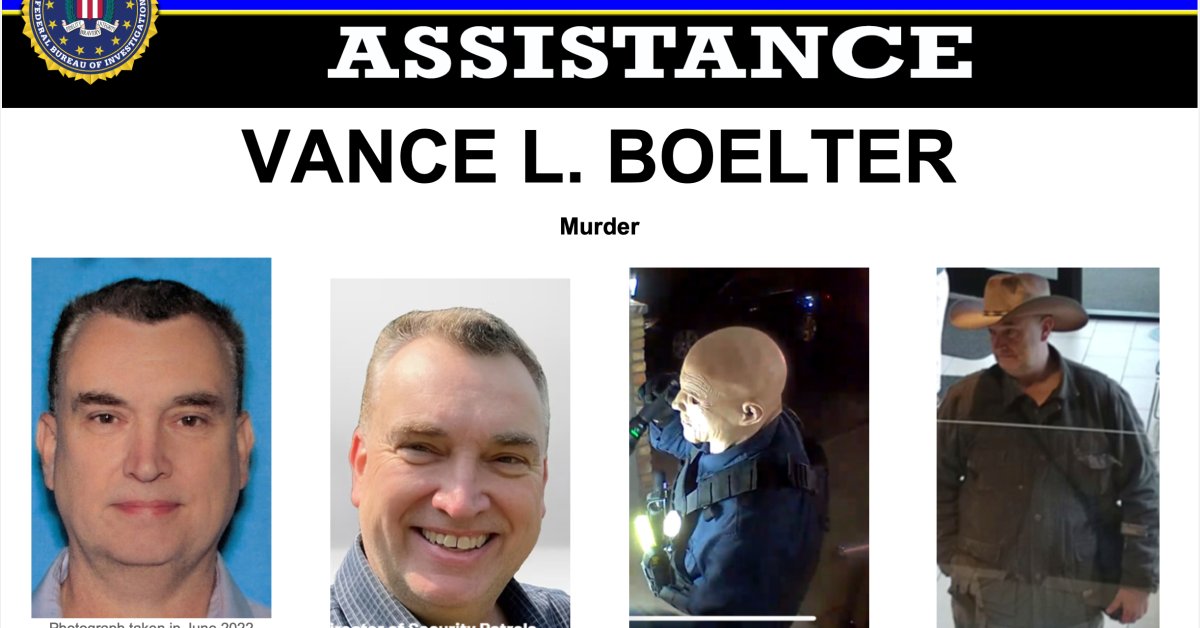

Who Is Vance L Boelter Suspect Identified In Minnesota Lawmakers Shooting

Jul 06, 2025

Who Is Vance L Boelter Suspect Identified In Minnesota Lawmakers Shooting

Jul 06, 2025

Latest Posts

-

Mo Co Supercells New Game Now Available Globally

Jul 07, 2025

Mo Co Supercells New Game Now Available Globally

Jul 07, 2025 -

Us Israel Relations And The Attack On Iran A Detailed Examination

Jul 07, 2025

Us Israel Relations And The Attack On Iran A Detailed Examination

Jul 07, 2025 -

Summer 2024 The Fight Over Climate Science Intensifies Under Trump

Jul 07, 2025

Summer 2024 The Fight Over Climate Science Intensifies Under Trump

Jul 07, 2025 -

Confirmed Jim Ross Back On Commentary For All In 2025

Jul 07, 2025

Confirmed Jim Ross Back On Commentary For All In 2025

Jul 07, 2025 -

Yemeni Port Infrastructure And Galaxy Leader Ship Damaged In Israeli Strikes

Jul 07, 2025

Yemeni Port Infrastructure And Galaxy Leader Ship Damaged In Israeli Strikes

Jul 07, 2025