Coinbase Expands: Deribit Acquisition Confirmed At $2.9 Billion (WSJ)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Coinbase's Crypto Expansion: $2.9 Billion Deribit Acquisition Shakes Up the Market

Coinbase Global, Inc. (COIN) has sent shockwaves through the cryptocurrency market with its confirmation of a staggering $2.9 billion acquisition of Deribit, the leading cryptocurrency derivatives exchange, as first reported by the Wall Street Journal (WSJ). This bold move signifies Coinbase's aggressive strategy to dominate the increasingly competitive landscape and expand its offerings beyond spot trading.

The acquisition, finalized earlier this week, represents a significant leap for Coinbase, solidifying its position as a major player in the global crypto derivatives market. Deribit, known for its high trading volumes and robust platform, brings a wealth of expertise and a substantial user base to Coinbase's already extensive network. This strategic acquisition is expected to significantly boost Coinbase's revenue streams and solidify its position against rivals like Binance and Kraken.

Why is this Acquisition so Significant?

This isn't just another acquisition; it's a game-changer. Several key factors highlight the significance of Coinbase's purchase of Deribit:

- Market Domination: By acquiring Deribit, Coinbase gains immediate access to a large segment of the derivatives market, a crucial area for professional traders and institutional investors. This significantly strengthens its competitive standing against other major cryptocurrency exchanges.

- Diversification of Revenue Streams: The derivatives market offers significantly higher trading volumes than spot trading, potentially leading to a considerable increase in Coinbase's transaction fees and overall revenue. This diversification reduces reliance on fluctuating spot market activity.

- Enhanced Product Offering: Integrating Deribit's sophisticated trading platform and technology will allow Coinbase to offer a more comprehensive suite of products to its users, attracting both retail and institutional clients. This includes access to futures, options, and other sophisticated derivatives instruments.

- Increased Institutional Adoption: Deribit's strong presence among institutional investors will likely accelerate Coinbase's own efforts to attract larger institutional clients, a crucial aspect of long-term growth and stability in the cryptocurrency market.

What Does This Mean for the Future of Coinbase and the Crypto Market?

The acquisition has already sparked considerable discussion among market analysts and crypto enthusiasts. Many believe this move signals a more aggressive, expansionist phase for Coinbase, pushing the company towards becoming a truly dominant force in the global cryptocurrency ecosystem.

However, the deal also raises several questions:

- Regulatory Scrutiny: The acquisition will likely face intense regulatory scrutiny, especially given the evolving regulatory landscape surrounding cryptocurrencies in various jurisdictions. Coinbase will need to navigate these challenges effectively to ensure a smooth integration process.

- Integration Challenges: Merging two large and complex platforms like Coinbase and Deribit will require careful planning and execution. Any integration hiccups could negatively impact user experience and trading volumes.

- Competitive Response: The acquisition is likely to trigger a competitive response from other major crypto exchanges, potentially leading to further consolidation or innovation in the market.

The $2.9 billion acquisition of Deribit marks a pivotal moment for Coinbase and the cryptocurrency industry as a whole. This bold move underlines the company’s ambition and its belief in the long-term growth potential of the crypto derivatives market. Only time will tell the full impact of this significant deal, but one thing is certain: the cryptocurrency landscape has just shifted dramatically. We will continue to monitor the situation and provide updates as they become available. for further information.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Coinbase Expands: Deribit Acquisition Confirmed At $2.9 Billion (WSJ). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Frontier Airlines Customers Rdu Airport Experience A Viral Video Story From North Carolina

May 09, 2025

Frontier Airlines Customers Rdu Airport Experience A Viral Video Story From North Carolina

May 09, 2025 -

Gary Hall Jr Awarded Replacement Olympic Medals Following Wildfires

May 09, 2025

Gary Hall Jr Awarded Replacement Olympic Medals Following Wildfires

May 09, 2025 -

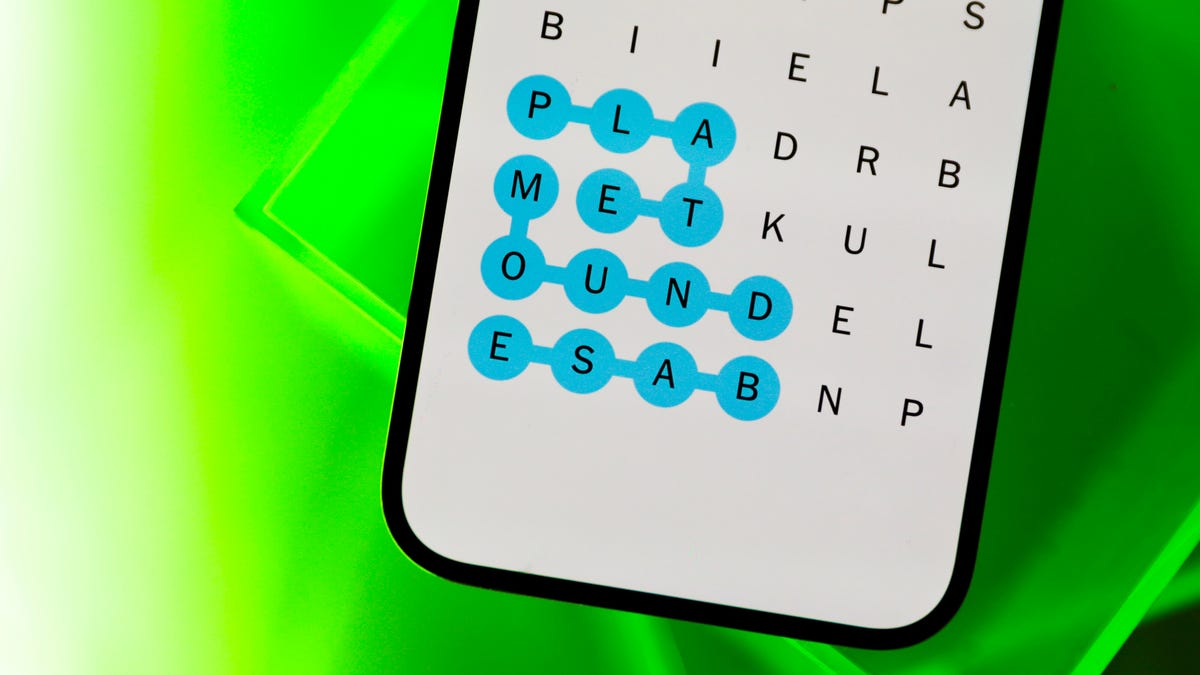

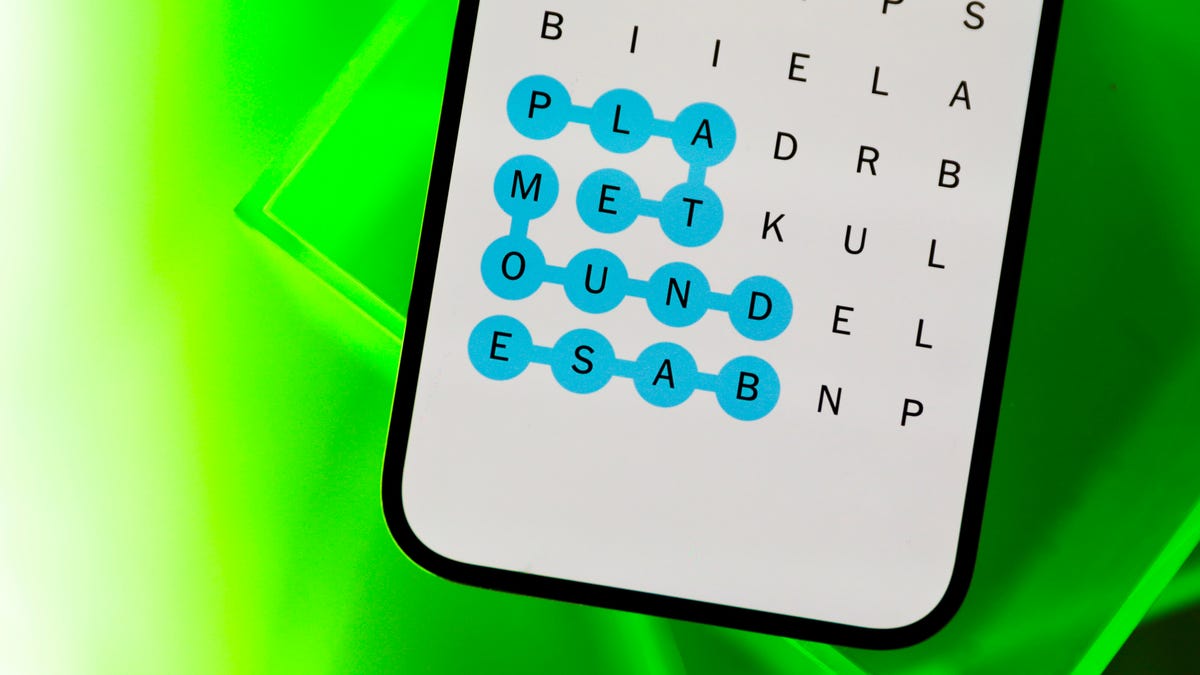

Struggling With Nyt Spelling Bee 431 May 8 Find Help Here

May 09, 2025

Struggling With Nyt Spelling Bee 431 May 8 Find Help Here

May 09, 2025 -

Stuck On Nyt Spelling Bee 431 May 8 Find Solutions Here

May 09, 2025

Stuck On Nyt Spelling Bee 431 May 8 Find Solutions Here

May 09, 2025 -

Paula Badosa Vs Naomi Osaka Rome Preview Tv Listings And Odds Comparison

May 09, 2025

Paula Badosa Vs Naomi Osaka Rome Preview Tv Listings And Odds Comparison

May 09, 2025