Coinbase And Tariff Agreements Drive Bitcoin Above $102,000

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Coinbase and Tariff Agreements Drive Bitcoin Above $102,000: A New Era for Crypto?

Bitcoin's price has surged past the $102,000 mark, marking a significant milestone in the cryptocurrency's history. This dramatic rise is attributed to a confluence of factors, primarily the easing of international trade tensions and a renewed confidence in cryptocurrency fueled by Coinbase's recent expansion.

The cryptocurrency market has witnessed unprecedented volatility in recent years. However, the sustained climb above the $102,000 threshold signals a potential shift in the broader economic landscape and investor sentiment. This remarkable jump represents a significant gain compared to Bitcoin's price just a few months ago, fueling speculation about a potential new bull market.

The Role of Coinbase's Expansion

Coinbase, one of the world's largest cryptocurrency exchanges, has been instrumental in driving mainstream adoption of Bitcoin and other cryptocurrencies. Their recent expansion into new markets and improved user experience have significantly increased accessibility, attracting both institutional and retail investors. This influx of new capital into the market has undoubtedly contributed to the price surge. The platform's robust security measures and user-friendly interface also instill confidence in new investors, further driving demand. [Link to Coinbase's latest news release].

Tariff Agreements and Global Market Stability

Beyond Coinbase's influence, the recent easing of international trade tensions, particularly the announcement of new tariff agreements between major global economies, played a pivotal role. Reduced trade uncertainty provides a more stable global economic outlook, making riskier assets like Bitcoin more attractive to investors seeking diversification and potential high returns. This positive economic sentiment spills over into the cryptocurrency market, increasing investor confidence and driving demand.

This positive correlation between global economic stability and Bitcoin's price is not new. Historically, periods of economic uncertainty often see a surge in Bitcoin's value as investors seek refuge in decentralized, non-correlated assets. However, the current surge feels different, driven by a combination of factors that suggest a more sustained upward trend.

What Does This Mean for the Future of Bitcoin?

The Bitcoin price exceeding $102,000 is a landmark achievement, marking a significant leap forward for the cryptocurrency. However, it's crucial to remember that the cryptocurrency market remains highly volatile. While this price surge is incredibly positive, investors should approach the market with caution and diversify their portfolios. [Link to a reputable source on cryptocurrency investment strategies].

Key Factors Contributing to Bitcoin's Price Surge:

- Coinbase's expansion and increased user adoption: The platform's accessibility and security are attracting a wider range of investors.

- Easing of international trade tensions: Reduced uncertainty in the global economy boosts investor confidence.

- Increased institutional investment: More institutional investors are entering the cryptocurrency market, driving up demand.

- Growing acceptance of Bitcoin as a store of value: Bitcoin's decentralized nature and limited supply continue to appeal to investors.

While the future of Bitcoin's price remains unpredictable, the current surge above $102,000, driven by factors like Coinbase's growth and global market stability, paints a positive picture for the cryptocurrency's long-term prospects. This is certainly a moment to watch closely as the cryptocurrency market continues its evolution. What are your thoughts on this recent surge? Share your opinions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Coinbase And Tariff Agreements Drive Bitcoin Above $102,000. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fernando Alonsos Struggles Echoes Of Hamiltons Ferrari Woes

May 10, 2025

Fernando Alonsos Struggles Echoes Of Hamiltons Ferrari Woes

May 10, 2025 -

Beyond The Track Fellow F1 Driver Offers Hamilton Emotional Support

May 10, 2025

Beyond The Track Fellow F1 Driver Offers Hamilton Emotional Support

May 10, 2025 -

Market Update Bitcoin Tops 102 000 Following Coinbase And Tariff News

May 10, 2025

Market Update Bitcoin Tops 102 000 Following Coinbase And Tariff News

May 10, 2025 -

Ukraine And Russia Trade Blame As Moscow Celebrates Victory Day

May 10, 2025

Ukraine And Russia Trade Blame As Moscow Celebrates Victory Day

May 10, 2025 -

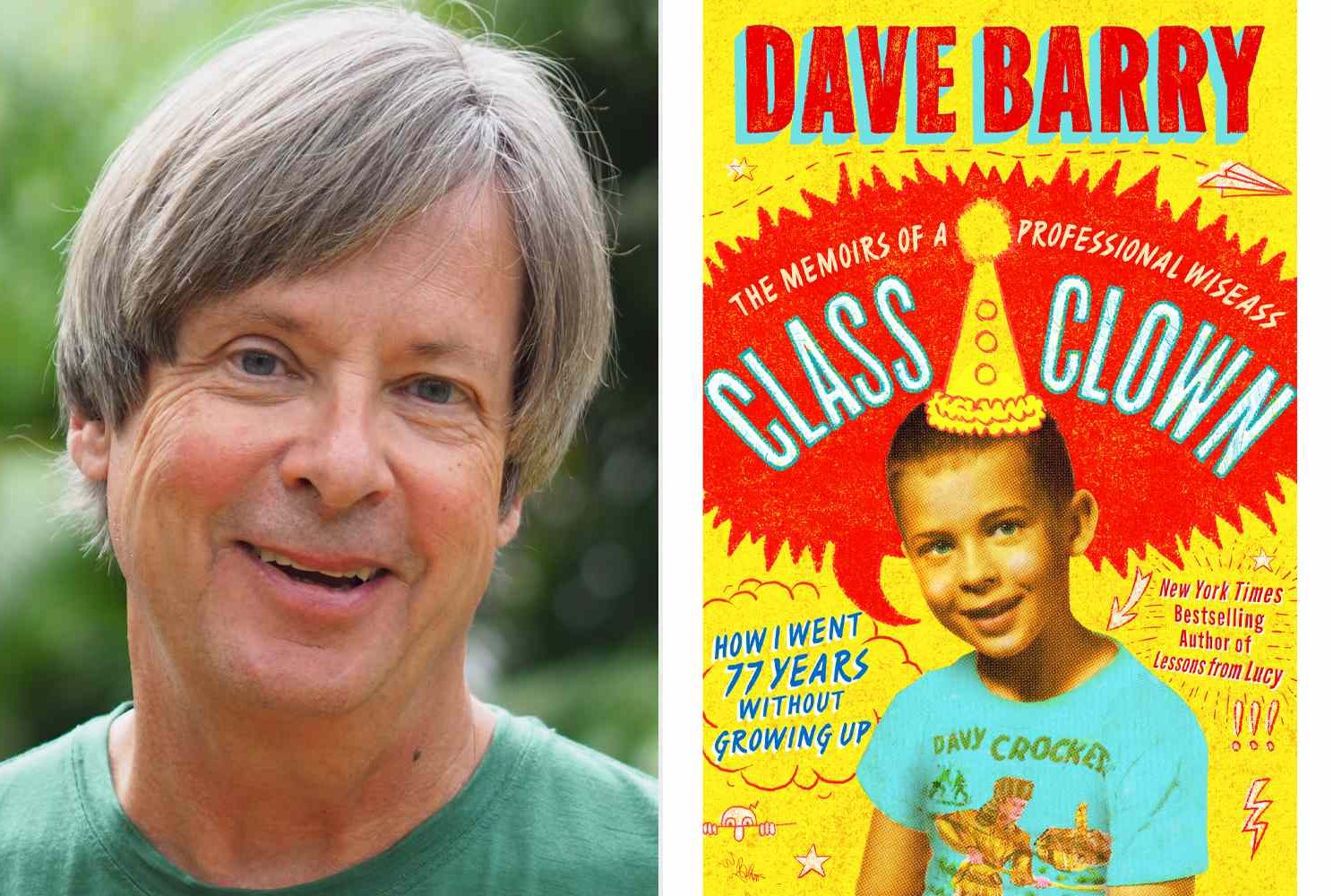

Author Event Dave Barry With Angie Corio At Keplers Bookstore May 12

May 10, 2025

Author Event Dave Barry With Angie Corio At Keplers Bookstore May 12

May 10, 2025