Climate Risk And Opportunity: A Business And Finance Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Climate Risk and Opportunity: A Business and Finance Analysis

The world is grappling with the undeniable reality of climate change, and its impact extends far beyond environmental concerns. For businesses and the finance sector, climate change presents both significant risks and unprecedented opportunities. This analysis delves into the multifaceted implications of climate change, exploring how companies are adapting, investing, and navigating this new landscape.

The Growing Landscape of Climate-Related Financial Risk

Climate change poses a wide array of financial risks, broadly categorized as physical and transition risks. Physical risks encompass the direct damage caused by extreme weather events like hurricanes, floods, and wildfires, impacting infrastructure, supply chains, and operational capacity. The increasing frequency and intensity of these events translate to higher insurance premiums, asset write-downs, and potential business interruptions. For example, coastal communities facing rising sea levels face significant property devaluation and increased relocation costs.

Transition risks, on the other hand, stem from the shift towards a low-carbon economy. This includes policy changes like carbon pricing, stricter environmental regulations, and evolving consumer preferences for sustainable products and services. Companies heavily reliant on fossil fuels, for instance, face the risk of stranded assets as demand decreases and regulations tighten. This transition also presents opportunities for innovation and investment in renewable energy, green technologies, and sustainable business models.

Investing in a Sustainable Future: Opportunities for Growth

Despite the challenges, the climate crisis also presents a wealth of opportunities for businesses and investors. The global transition to a low-carbon economy is driving significant investment in:

- Renewable Energy: The solar, wind, and hydropower sectors are experiencing explosive growth, attracting billions in investment and creating new jobs.

- Green Technologies: Innovation in energy efficiency, carbon capture, and sustainable materials is creating new markets and opportunities for technological advancement.

- Sustainable Finance: The growth of ESG (Environmental, Social, and Governance) investing reflects increasing investor demand for companies with strong sustainability profiles. This includes green bonds, impact investing, and sustainable equity funds. [Link to a relevant article on ESG investing]

- Climate-Resilient Infrastructure: Investments in infrastructure designed to withstand the impacts of climate change, such as flood defenses and drought-resistant agriculture, are crucial for long-term sustainability.

Navigating the Challenges: Strategies for Businesses

Businesses must proactively address climate-related risks and seize emerging opportunities. Key strategies include:

- Climate Risk Assessment: Conducting thorough assessments to identify and quantify potential physical and transition risks.

- Carbon Footprint Reduction: Implementing measures to reduce greenhouse gas emissions across the value chain.

- Sustainable Supply Chain Management: Ensuring that suppliers are committed to environmental sustainability.

- Disclosure and Transparency: Providing clear and transparent reporting on climate-related risks and opportunities. The Task Force on Climate-related Financial Disclosures (TCFD) provides a widely accepted framework for this. [Link to TCFD website]

- Innovation and Adaptation: Investing in research and development to develop climate-resilient products and services.

The Role of Governments and International Cooperation

Governments play a crucial role in shaping the response to climate change through policy initiatives, regulations, and international cooperation. Agreements like the Paris Agreement are essential for setting global targets and fostering collaborative efforts. Effective policy frameworks are vital for creating a level playing field and incentivizing investment in sustainable solutions.

Conclusion: A Call to Action

Climate change presents a defining challenge for the 21st century, demanding a fundamental shift in how businesses and the finance sector operate. By proactively managing climate-related risks and embracing the opportunities presented by the transition to a low-carbon economy, businesses can not only contribute to a sustainable future but also enhance their long-term profitability and resilience. Ignoring these issues is not an option; it's a strategic imperative for sustainable growth and long-term value creation. This necessitates a collaborative effort involving businesses, governments, investors, and consumers to build a more sustainable and prosperous future for all.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Climate Risk And Opportunity: A Business And Finance Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Barcos Varados En Maracaibo Un Reflejo De La Fragilidad Economica Bajo Maduro

May 11, 2025

Barcos Varados En Maracaibo Un Reflejo De La Fragilidad Economica Bajo Maduro

May 11, 2025 -

Aston Villa Vs Bournemouth Best Bets Odds And Premier League Predictions For The Weekend

May 11, 2025

Aston Villa Vs Bournemouth Best Bets Odds And Premier League Predictions For The Weekend

May 11, 2025 -

Only 50 Made Exclusive Look At The Air Jordan 9 Unc Player Edition

May 11, 2025

Only 50 Made Exclusive Look At The Air Jordan 9 Unc Player Edition

May 11, 2025 -

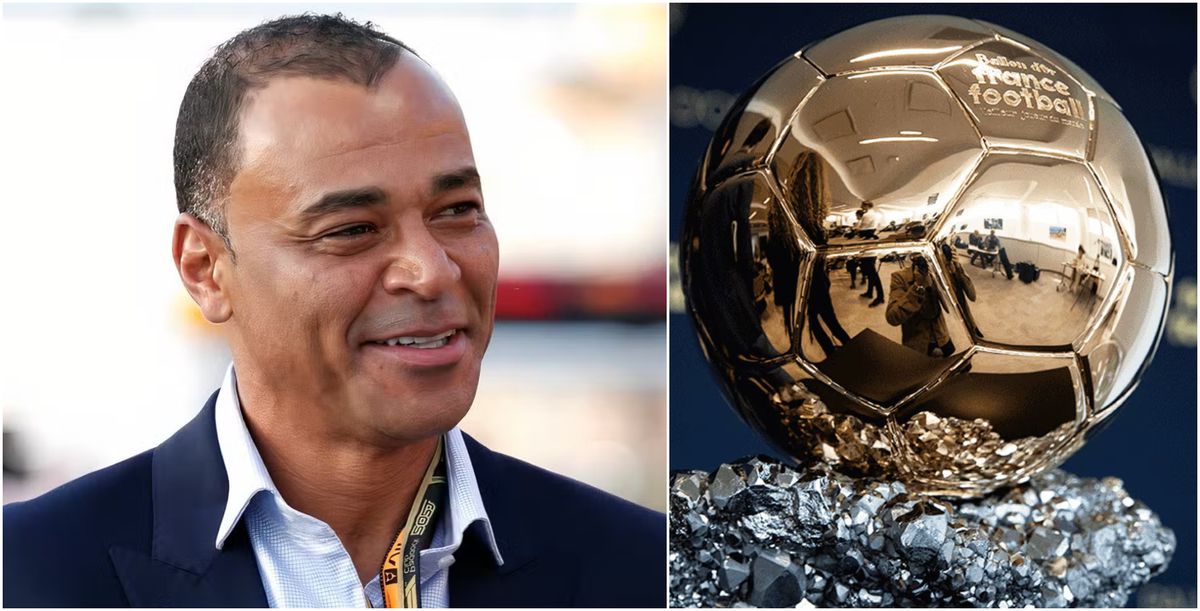

Cafu Predicts 2025 Ballon D Or Snubs Yamal Favors These Two Stars

May 11, 2025

Cafu Predicts 2025 Ballon D Or Snubs Yamal Favors These Two Stars

May 11, 2025 -

Breakthrough In Austin Tice Case Report Indicates Discovery Of Remains

May 11, 2025

Breakthrough In Austin Tice Case Report Indicates Discovery Of Remains

May 11, 2025