Climate Change: The Business And Finance Sector's Honest Conversation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Climate Change: The Business and Finance Sector's Honest Conversation

The climate crisis is no longer a distant threat; it's a present-day reality impacting businesses and financial markets globally. For too long, the conversation surrounding climate change within the business and finance sector has been fraught with hesitancy and greenwashing. But a crucial shift is underway – a move towards honest and transparent dialogue about the risks and opportunities presented by a changing climate. This marks a pivotal moment, demanding immediate action and collaborative strategies.

The Growing Urgency: Beyond Greenwashing

For years, many companies paid lip service to environmental concerns, engaging in superficial "greenwashing" initiatives rather than implementing substantial changes. However, mounting pressure from investors, consumers, and regulators is forcing a reckoning. The financial implications of climate change are becoming increasingly undeniable. Extreme weather events, resource scarcity, and shifting consumer preferences are already disrupting supply chains, impacting profitability, and threatening long-term business viability.

Financial Institutions Leading the Charge

Financial institutions, in particular, are stepping up to the plate. Many major banks, investment firms, and insurance companies are incorporating Environmental, Social, and Governance (ESG) factors into their investment decisions. This involves not only assessing the climate risks associated with their portfolios but also actively seeking out and investing in companies committed to sustainable practices. This shift is driven by several factors:

- Increased regulatory scrutiny: Governments worldwide are implementing stricter regulations on climate-related financial disclosures, forcing greater transparency.

- Investor demand: A growing number of investors are prioritizing ESG factors, demanding that their investments align with their values and contribute to a sustainable future.

- Reputational risk: Companies and institutions are realizing that failing to address climate change poses significant reputational risks, potentially leading to boycotts and loss of investor confidence.

The Opportunities of a Green Transition

While the challenges are significant, the transition to a low-carbon economy also presents immense opportunities for businesses and investors. The green sector is booming, creating new markets and jobs in renewable energy, sustainable agriculture, green technology, and more. Companies that proactively adapt to the changing climate and embrace sustainable practices are likely to be better positioned for long-term success.

What Does an Honest Conversation Look Like?

This "honest conversation" requires several key elements:

- Accurate risk assessment: Businesses and financial institutions need to conduct thorough assessments of their climate-related risks and vulnerabilities.

- Transparent reporting: Accurate and comprehensive disclosure of climate-related information is crucial for building investor trust and facilitating informed decision-making.

- Collaborative action: Addressing climate change requires collaborative efforts across sectors, industries, and governments. This includes sharing best practices, developing industry standards, and supporting innovative solutions.

- Investing in climate solutions: Significant investment is needed to develop and deploy clean technologies, enhance climate resilience, and support the transition to a sustainable economy.

Looking Ahead: A Call to Action

The shift towards an honest conversation about climate change within the business and finance sector is encouraging. However, much work remains to be done. Companies and financial institutions need to accelerate their efforts to mitigate climate risks, embrace the opportunities of a green transition, and collaborate to create a more sustainable future. The time for action is now. The future of our planet, and the stability of our global economy, depends on it. Learn more about and . Engage in the conversation and demand accountability from your leaders. The future is in our hands.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Climate Change: The Business And Finance Sector's Honest Conversation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rome R3 Tennis Predictions De Jong Vs Sinner And Marozsan Vs Mensik

May 13, 2025

Rome R3 Tennis Predictions De Jong Vs Sinner And Marozsan Vs Mensik

May 13, 2025 -

Espns Fall Launch A Closer Look At Its Dtc Streaming Plans

May 13, 2025

Espns Fall Launch A Closer Look At Its Dtc Streaming Plans

May 13, 2025 -

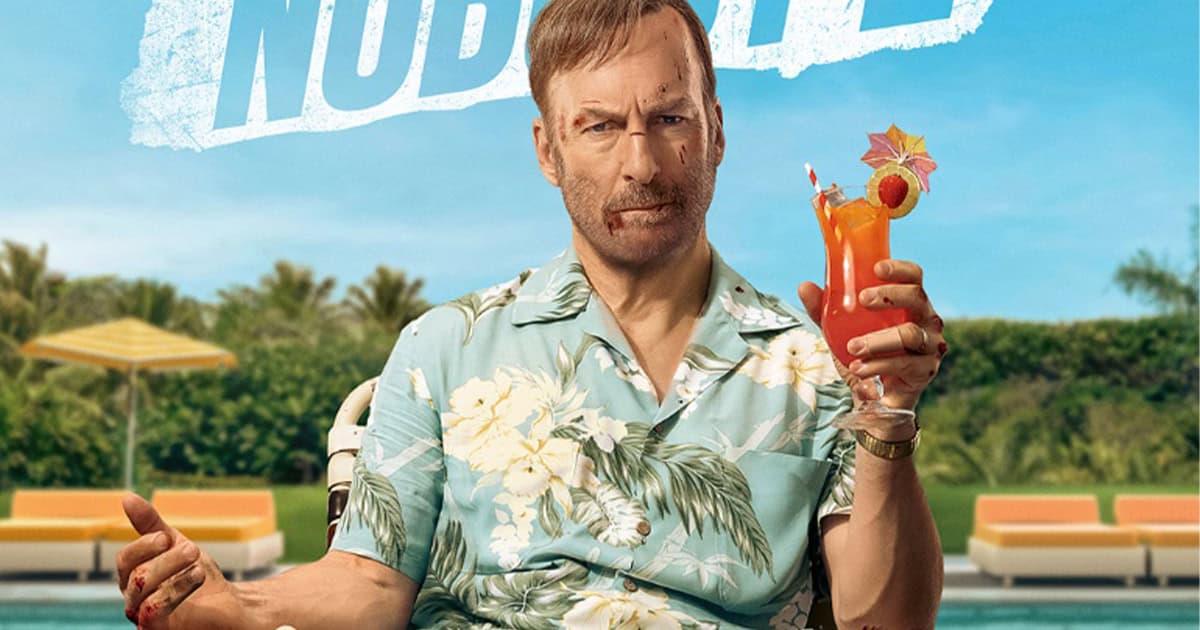

Buckle Up The Nobody 2 Trailer Shows A Wildly Violent Family Vacation

May 13, 2025

Buckle Up The Nobody 2 Trailer Shows A Wildly Violent Family Vacation

May 13, 2025 -

Sean Combs Faces Hollywood Backlash Children Stand Firm

May 13, 2025

Sean Combs Faces Hollywood Backlash Children Stand Firm

May 13, 2025 -

De Jong Vs Sinner Expert Prediction For Atp Italian Open 2025

May 13, 2025

De Jong Vs Sinner Expert Prediction For Atp Italian Open 2025

May 13, 2025