Climate Change: The Business And Finance Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Climate Change: The Looming Crisis and the Rewarding Opportunity for Business and Finance

Climate change is no longer a distant threat; it's a present reality impacting businesses and financial markets globally. From extreme weather events disrupting supply chains to stringent environmental regulations reshaping industries, the financial implications are profound and far-reaching. However, this crisis also presents a significant opportunity for businesses and investors willing to adapt and innovate. This article delves into the multifaceted relationship between climate change and the business and finance landscape, exploring both the risks and the rewards.

H2: The Mounting Financial Risks of Climate Change

The financial sector is increasingly recognizing the material risks associated with climate change. These risks can be broadly categorized into:

-

Physical Risks: These include direct damage from extreme weather events like hurricanes, floods, and wildfires. Businesses located in vulnerable areas face significant property damage, operational disruptions, and potential supply chain breakdowns. The insurance industry, for example, is already grappling with rising payouts related to climate-driven disasters.

-

Transition Risks: These arise from the shift towards a low-carbon economy. Companies heavily reliant on fossil fuels face potential stranded assets as demand for their products declines. Regulations aimed at reducing greenhouse gas emissions, such as carbon pricing mechanisms and stricter environmental standards, also impose significant costs on businesses unprepared for the transition. [Link to a relevant article on carbon pricing].

-

Liability Risks: Companies could face legal challenges and compensation claims related to their contribution to climate change and its impacts. This includes lawsuits from individuals and communities affected by climate-related damages.

H2: Navigating the Transition: Opportunities for Businesses and Investors

While the risks are substantial, the transition to a low-carbon economy also offers lucrative opportunities for businesses and investors:

-

Green Investments: The burgeoning green technology sector presents exciting investment prospects. Renewable energy sources like solar and wind power, energy-efficient technologies, and sustainable agriculture are all areas experiencing rapid growth and attracting significant capital. [Link to a report on green investment trends].

-

Sustainable Finance: The demand for sustainable and responsible investments is soaring. Investors are increasingly seeking opportunities aligned with environmental, social, and governance (ESG) criteria. This has led to the growth of green bonds, ESG funds, and other sustainable finance instruments. [Link to a resource on ESG investing].

-

Innovation and Efficiency: Companies that embrace sustainability often find themselves gaining a competitive advantage. Improving energy efficiency, reducing waste, and adopting circular economy principles can lead to cost savings, enhanced brand reputation, and increased customer loyalty.

H3: ESG Integration: A Necessity, Not a Trend

The integration of ESG factors into investment decisions is no longer a niche strategy; it's becoming a mainstream necessity. Investors are recognizing that climate-related risks and opportunities are material to financial performance and long-term value creation. Companies that fail to address ESG concerns face the risk of lower valuations, reduced investor appeal, and reputational damage.

H2: The Role of Governments and International Cooperation

Governments play a crucial role in shaping the response to climate change. Policies like carbon taxes, emissions trading schemes, and subsidies for renewable energy technologies can incentivize businesses to adopt sustainable practices. International cooperation is also essential for coordinating global efforts to mitigate climate change and promote a just transition to a low-carbon economy. The Paris Agreement serves as a key framework for global climate action. [Link to the UNFCCC website].

H2: Conclusion: Embracing the Challenge, Seizing the Opportunity

Climate change presents a formidable challenge, but it also presents a unique opportunity for businesses and the financial sector to drive innovation, create value, and contribute to a more sustainable future. By proactively managing climate-related risks and embracing the opportunities associated with the transition to a low-carbon economy, businesses and investors can not only safeguard their interests but also play a vital role in shaping a more resilient and prosperous world. The time to act is now. Proactive adaptation and strategic investment are key to navigating the challenges and capitalizing on the transformative potential of a low-carbon future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Climate Change: The Business And Finance Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Preventing Premature Deaths The Impact Of Emission Reduction On Air Quality

May 11, 2025

Preventing Premature Deaths The Impact Of Emission Reduction On Air Quality

May 11, 2025 -

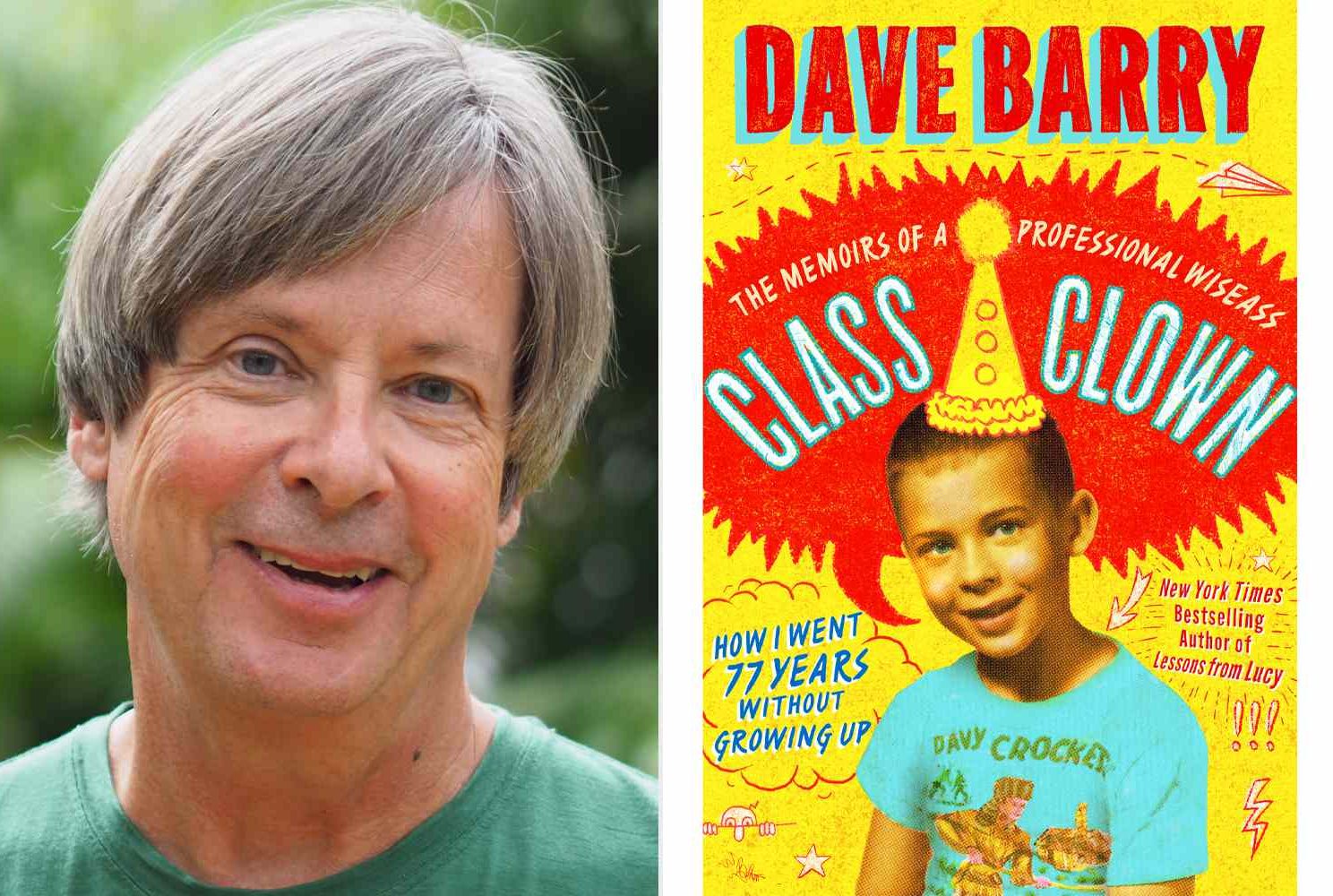

Dave Barry And Angie Corio In Conversation At Keplers Bookstore May 12

May 11, 2025

Dave Barry And Angie Corio In Conversation At Keplers Bookstore May 12

May 11, 2025 -

Znakomity Wystep Lewandowskiego Przeciwko Realowi Analiza Meczu

May 11, 2025

Znakomity Wystep Lewandowskiego Przeciwko Realowi Analiza Meczu

May 11, 2025 -

The Time 100 2025s Most Influential Individuals And Their Global Impact

May 11, 2025

The Time 100 2025s Most Influential Individuals And Their Global Impact

May 11, 2025 -

Navigating Us China Trade Jim Cramer Highlights 10 Stocks To Monitor

May 11, 2025

Navigating Us China Trade Jim Cramer Highlights 10 Stocks To Monitor

May 11, 2025