Climate Change And Corporate Finance: A New Reality

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Climate Change and Corporate Finance: A New Reality

The financial landscape is shifting dramatically, and climate change is the driving force. No longer a distant threat, the impacts of global warming are directly impacting corporate balance sheets, investment strategies, and regulatory landscapes. This new reality demands that businesses, investors, and financial institutions fundamentally rethink their approaches to risk management and long-term value creation.

The urgency is undeniable. From increasingly frequent extreme weather events causing billions in damages to stricter environmental regulations imposing significant compliance costs, climate change poses significant financial risks. Ignoring these risks is no longer an option; it's a recipe for financial instability and long-term failure.

H2: Financial Risks Associated with Climate Change

Businesses face a multitude of climate-related financial risks, broadly categorized as:

-

Physical Risks: These are the direct impacts of climate change, such as:

- Increased frequency and severity of extreme weather events: Hurricanes, floods, droughts, and wildfires can cause significant damage to infrastructure, disrupt operations, and lead to substantial financial losses.

- Sea-level rise: Coastal businesses and infrastructure are increasingly vulnerable to rising sea levels, requiring costly adaptation measures or relocation.

- Resource scarcity: Changes in water availability and agricultural yields can impact supply chains and production costs.

-

Transition Risks: These are the financial risks associated with the transition to a low-carbon economy, including:

- Policy and regulatory changes: Governments worldwide are implementing stricter environmental regulations, carbon pricing mechanisms (like carbon taxes and emissions trading schemes), and phasing out fossil fuel subsidies. Non-compliance can lead to hefty fines and reputational damage. [Link to relevant government resource on climate policy]

- Technological changes: The rapid advancement of renewable energy technologies and energy efficiency measures is disrupting traditional industries and creating new competitive landscapes. Companies slow to adapt risk obsolescence and market share loss.

- Reputational risks: Consumers and investors are increasingly demanding greater corporate transparency and accountability on environmental, social, and governance (ESG) issues. Companies with poor environmental performance face reputational damage, leading to decreased consumer loyalty and investor interest.

H2: The Growing Importance of ESG Investing

The financial sector is responding to these risks through the burgeoning field of Environmental, Social, and Governance (ESG) investing. ESG investing considers environmental, social, and governance factors alongside financial returns when making investment decisions. This approach recognizes that companies with strong ESG profiles are better positioned to manage climate-related risks and opportunities, ultimately leading to better long-term financial performance. [Link to a reputable source on ESG investing]

H2: Opportunities in the Green Economy

While climate change presents significant challenges, it also unlocks substantial opportunities. The transition to a low-carbon economy is creating a vast market for green technologies, sustainable products, and climate-resilient infrastructure. Companies that are early adopters of sustainable practices and innovative solutions are poised to capture significant market share and reap substantial financial rewards.

H2: Navigating the New Reality: A Call to Action

For corporations, effective climate risk management is no longer a "nice-to-have" but a "must-have." This requires:

- Comprehensive climate risk assessments: Identifying and quantifying the potential financial impacts of climate change on the business.

- Developing climate-resilient strategies: Implementing adaptation measures to mitigate physical risks and transition plans to align with a low-carbon future.

- Transparent and consistent ESG reporting: Providing stakeholders with clear and reliable information on environmental performance.

- Engaging with stakeholders: Building relationships with investors, customers, and communities to foster trust and collaboration.

The future of corporate finance is inextricably linked to the climate. By proactively addressing climate-related risks and embracing the opportunities of the green economy, businesses can not only safeguard their financial future but also contribute to a more sustainable and prosperous world. The time for decisive action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Climate Change And Corporate Finance: A New Reality. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

En Vivo Villarreal Recibe Al Leganes En Partido De La Liga Ea Sports

May 14, 2025

En Vivo Villarreal Recibe Al Leganes En Partido De La Liga Ea Sports

May 14, 2025 -

Reframing Climate Change A Business And Finance Focus

May 14, 2025

Reframing Climate Change A Business And Finance Focus

May 14, 2025 -

Admiral Lisa Franchetti Rotc Scholarship Dozen High School Recipients Announced

May 14, 2025

Admiral Lisa Franchetti Rotc Scholarship Dozen High School Recipients Announced

May 14, 2025 -

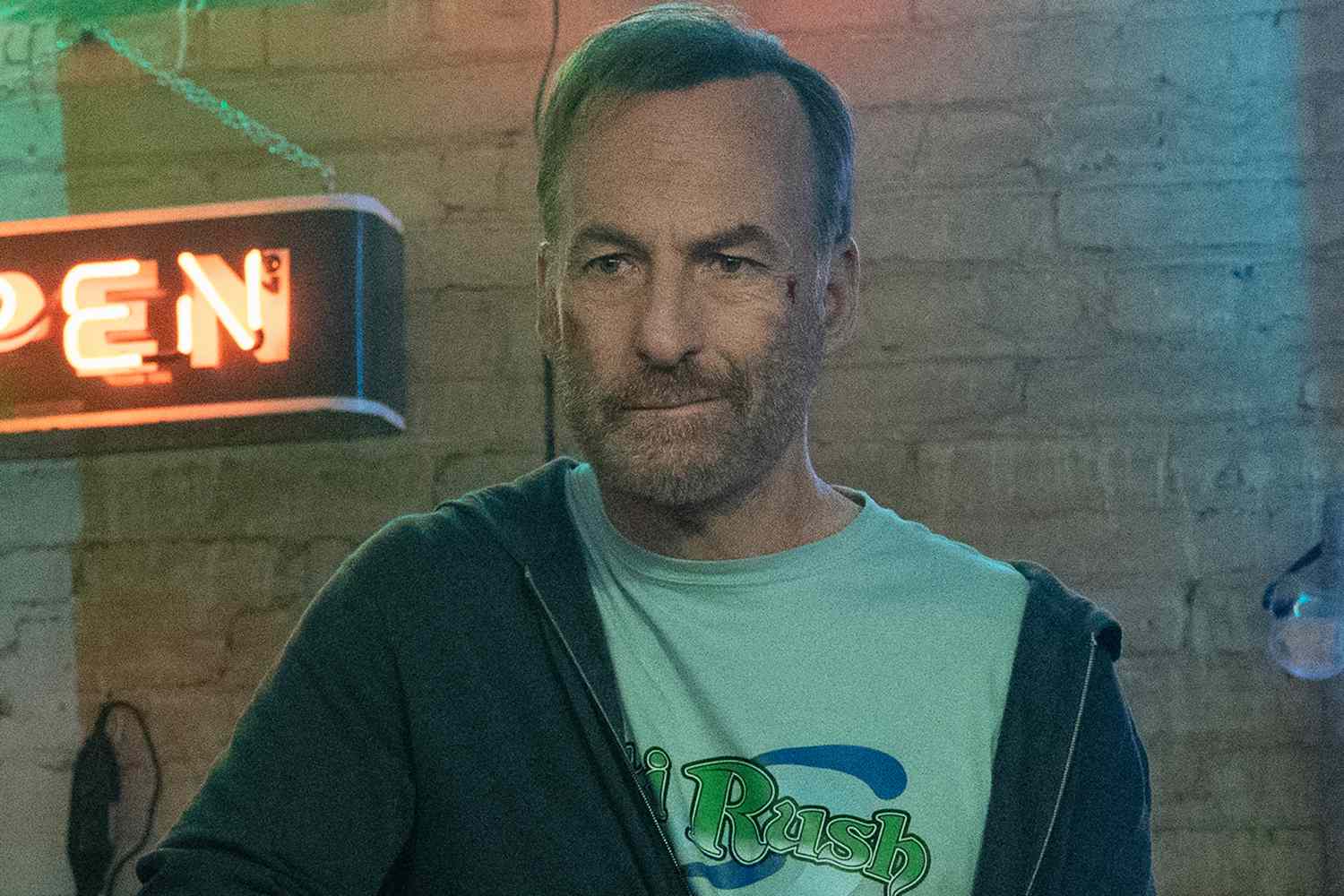

Dangerous Family Fun The Nobody 2 Trailer Is Here

May 14, 2025

Dangerous Family Fun The Nobody 2 Trailer Is Here

May 14, 2025 -

Alaves Vs Valencia Match Preview Starting Lineups And Prediction

May 14, 2025

Alaves Vs Valencia Match Preview Starting Lineups And Prediction

May 14, 2025