Clean Energy Taxes: Economic Impacts And The Path Forward For The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Taxes: Economic Impacts and the Path Forward for the US

The US is at a crossroads. Meeting ambitious climate goals requires a significant shift towards clean energy, but the economic implications of this transition are complex and far-reaching. One key lever in this transition is the use of taxes – both to incentivize clean energy adoption and to discourage fossil fuel reliance. Understanding the economic impacts of these clean energy taxes, and charting a path forward, is crucial for both environmental sustainability and economic prosperity.

The Double-Edged Sword of Clean Energy Taxes

Taxes on carbon emissions, fossil fuels, or even subsidies for renewable energy sources are not without controversy. While proponents argue they're essential for driving investment in clean technologies and reducing pollution, critics cite potential negative impacts on jobs, competitiveness, and consumer costs. The truth, as is often the case, lies somewhere in the middle.

Economic Benefits of Clean Energy Tax Policies:

- Job Creation: The clean energy sector is a burgeoning job creator. Tax incentives can accelerate this growth, fostering employment in manufacturing, installation, maintenance, and research & development of solar panels, wind turbines, energy storage systems, and smart grids. A recent study by the National Renewable Energy Laboratory (NREL) highlights the significant potential for job creation in the renewable energy sector. [Link to NREL study].

- Technological Innovation: Taxes that penalize carbon emissions indirectly incentivize innovation in cleaner technologies. Companies are pushed to develop and deploy more efficient and cost-effective solutions, driving technological advancements and potentially creating new export markets for US-made clean energy technologies.

- Improved Public Health: Reduced air pollution from fossil fuels, a direct consequence of transitioning to cleaner energy, leads to significant public health benefits, translating to lower healthcare costs and increased productivity. The Environmental Protection Agency (EPA) provides detailed information on the health impacts of air pollution. [Link to EPA report].

- Energy Security: Reducing reliance on imported fossil fuels enhances national energy security, making the US less vulnerable to global price fluctuations and geopolitical instability. This increased energy independence can bolster economic stability.

Potential Economic Drawbacks:

- Increased Energy Costs: Taxes on fossil fuels can increase energy prices for consumers and businesses in the short term. However, long-term cost savings from reduced healthcare costs and energy independence need to be considered.

- Impact on Specific Industries: Industries heavily reliant on fossil fuels may face challenges during the transition. Careful planning, retraining programs, and targeted support are crucial to mitigate job losses and ensure a just transition for affected workers.

- Competitiveness Concerns: If clean energy taxes are not implemented consistently across countries, US businesses could face a competitive disadvantage against those in nations with less stringent regulations. International cooperation on climate policy is essential.

The Path Forward: A Balanced Approach

Navigating these complexities requires a strategic approach. A well-designed tax policy should:

- Be Revenue-Neutral or Redirect Revenue: Revenue generated from carbon taxes could be used to offset other taxes, provide tax relief for low- and middle-income families, or invest in clean energy infrastructure and workforce development.

- Phase in Gradually: A gradual implementation allows businesses and consumers time to adapt, minimizing economic disruption.

- Include Mechanisms for a Just Transition: Support for workers and communities affected by the transition is crucial for ensuring broad public support and avoiding social unrest. This includes retraining programs, investment in affected regions, and potentially targeted assistance for specific industries.

- Foster International Cooperation: Harmonizing clean energy policies internationally levels the playing field and prevents businesses from relocating to countries with less stringent regulations.

Conclusion:

Clean energy taxes are a vital tool in the fight against climate change, but their economic impacts must be carefully considered and managed. By implementing a balanced approach that prioritizes a just transition, encourages innovation, and fosters international cooperation, the US can harness the economic benefits of clean energy while mitigating potential downsides. The future of the US economy and its environment depends on getting this right.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Taxes: Economic Impacts And The Path Forward For The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Daniel Craig Cillian Murphy And Tom Hardy Star In New Wwi Film Now Streaming

May 20, 2025

Daniel Craig Cillian Murphy And Tom Hardy Star In New Wwi Film Now Streaming

May 20, 2025 -

May 15th Brings New Warbond Drops To Helldivers 2s Masters Of Ceremony

May 20, 2025

May 15th Brings New Warbond Drops To Helldivers 2s Masters Of Ceremony

May 20, 2025 -

Clean Energy Tax Credits Analyzing The Economic Benefits And Challenges For America

May 20, 2025

Clean Energy Tax Credits Analyzing The Economic Benefits And Challenges For America

May 20, 2025 -

Philadelphia Eagles Coach Nick Sirianni Signs Multi Year Extension After Super Bowl Lvii Victory

May 20, 2025

Philadelphia Eagles Coach Nick Sirianni Signs Multi Year Extension After Super Bowl Lvii Victory

May 20, 2025 -

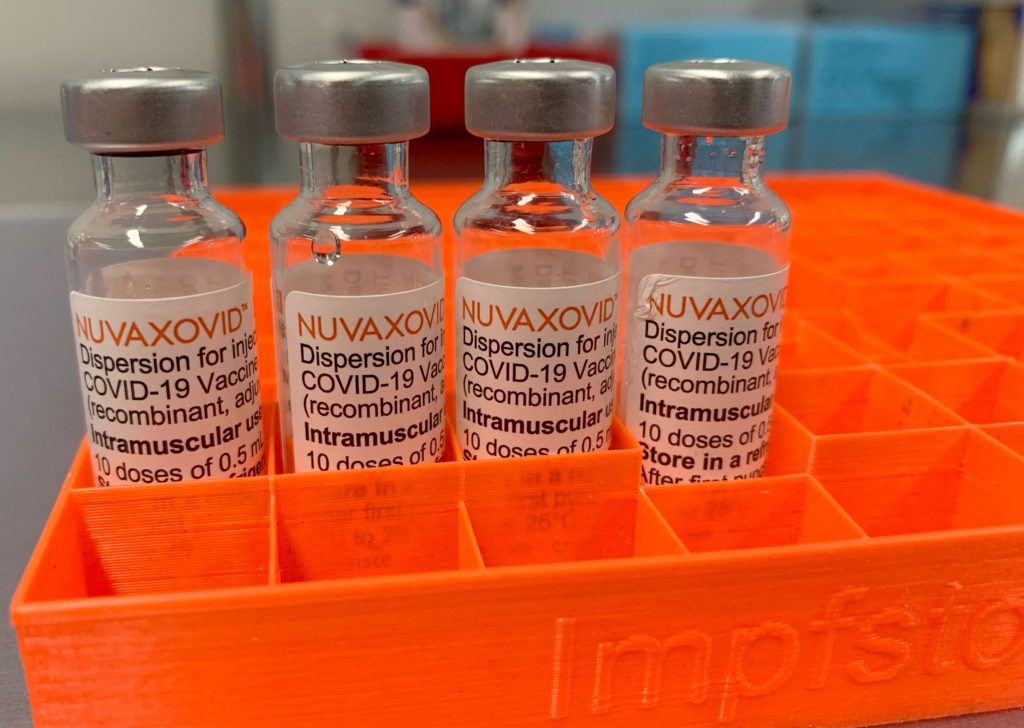

Novavax Covid 19 Vaccine Gets Fda Nod Significant Usage Restrictions Apply

May 20, 2025

Novavax Covid 19 Vaccine Gets Fda Nod Significant Usage Restrictions Apply

May 20, 2025