Clean Energy Tax Reform: Economic Impacts And Policy Implications For The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Reform: Boosting the US Economy While Protecting the Planet

The US is at a crossroads. The need to combat climate change is undeniable, but transitioning to a clean energy economy presents significant economic challenges and opportunities. Clean energy tax reform is at the heart of this transition, offering a powerful tool to stimulate innovation, create jobs, and reduce harmful emissions. However, its implementation requires careful consideration of its potential economic impacts and policy implications.

The Current Landscape: A Patchwork of Incentives

Currently, the US utilizes a complex system of tax credits, deductions, and grants to incentivize clean energy development. This patchwork approach, while well-intentioned, suffers from inconsistencies and lacks the cohesive strategy needed for large-scale transformation. Some incentives are temporary, leading to uncertainty for investors. Others are poorly targeted, failing to maximize their impact. This fragmented system creates complexities for businesses and hinders the growth of the clean energy sector.

Proposed Reforms: A Focus on Efficiency and Equity

Several proposals aim to streamline and enhance the existing system. These reforms generally focus on:

-

Extending and expanding existing tax credits: Proposals often suggest extending the lifespan of crucial tax credits for renewable energy technologies like solar, wind, and geothermal. Expanding these credits could incentivize greater investment and deployment.

-

Investing in clean energy research and development: Significant investment in R&D is crucial for driving down the cost of clean energy technologies and making them more competitive. Tax incentives can play a pivotal role in fostering innovation.

-

Addressing equity concerns: Clean energy transition must benefit all communities, not just wealthy ones. Reforms should focus on ensuring that disadvantaged communities have access to clean energy jobs and benefits. This might include targeted incentives for projects in underserved areas.

-

Implementing a carbon tax or cap-and-trade system: While controversial, some proposals advocate for a carbon tax or cap-and-trade system to put a price on carbon emissions. This could encourage businesses to reduce their carbon footprint and stimulate investment in clean energy alternatives.

Economic Impacts: Jobs, Growth, and Investment

Clean energy tax reform has the potential to significantly boost the US economy. Studies suggest that substantial investments in clean energy could create millions of high-paying jobs across various sectors – from manufacturing and construction to research and development. Moreover, it can attract significant foreign investment, bolstering economic growth and competitiveness on a global scale. A shift towards cleaner energy sources also reduces reliance on volatile fossil fuel markets, enhancing energy security.

Policy Implications: Balancing Competing Interests

Implementing effective clean energy tax reform requires navigating complex policy challenges. Balancing the need for environmental protection with the concerns of industries reliant on fossil fuels is crucial. Careful consideration must be given to potential impacts on electricity prices and the overall energy mix. Moreover, ensuring transparency and accountability in the implementation of these reforms is vital to maintain public trust.

The Road Ahead: Collaboration and Long-Term Vision

Successful clean energy tax reform requires a bipartisan approach and a long-term vision. Collaboration between policymakers, industry stakeholders, and environmental groups is essential to ensure the creation of effective and equitable policies. By carefully designing and implementing these reforms, the US can accelerate its transition to a clean energy economy, creating economic opportunities while mitigating the devastating effects of climate change. The future of the US economy, and indeed the planet, may depend on it. Further research into specific policy proposals is recommended for a deeper understanding of the potential benefits and challenges. You can find more information on the Department of Energy's website [link to relevant DOE page].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Reform: Economic Impacts And Policy Implications For The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

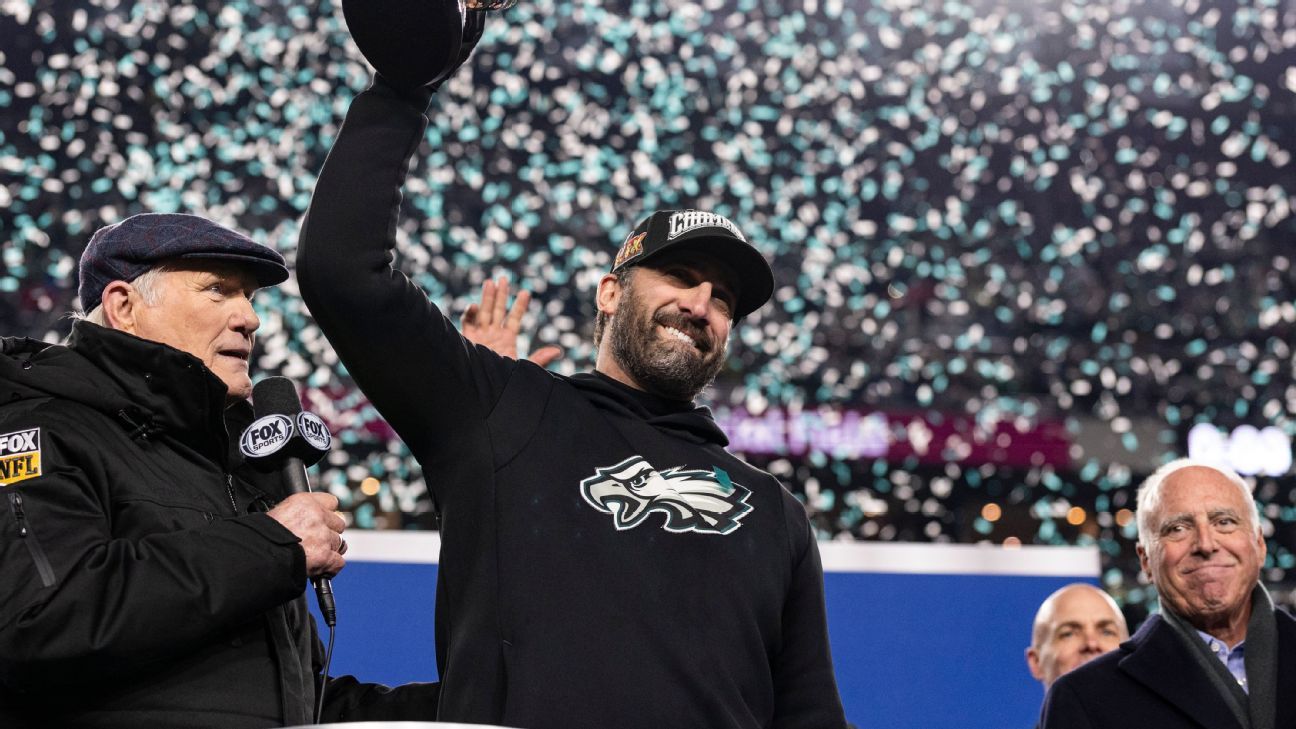

Nfl News Philadelphia Eagles Reward Sirianni With Contract Extension

May 20, 2025

Nfl News Philadelphia Eagles Reward Sirianni With Contract Extension

May 20, 2025 -

Industry Buzz Pierpaolo Picciolis New Role At Balenciaga

May 20, 2025

Industry Buzz Pierpaolo Picciolis New Role At Balenciaga

May 20, 2025 -

Impact Of Feds Rate Cut Outlook U S Treasury Yields Decline

May 20, 2025

Impact Of Feds Rate Cut Outlook U S Treasury Yields Decline

May 20, 2025 -

Nick Sirianni Agrees To Multi Year Deal Eagles Super Bowl Success Secures Coachs Future

May 20, 2025

Nick Sirianni Agrees To Multi Year Deal Eagles Super Bowl Success Secures Coachs Future

May 20, 2025 -

Department Of Homeland Security Exploring A Citizenship Reality Competition

May 20, 2025

Department Of Homeland Security Exploring A Citizenship Reality Competition

May 20, 2025