Clean Energy Tax Reform: Balancing Environmental Goals And Economic Realities

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Reform: Balancing Environmental Goals and Economic Realities

The push for a greener future is gaining momentum globally, but transitioning to clean energy isn't just an environmental endeavor; it's a complex economic balancing act. Clean energy tax reform sits at the heart of this challenge, promising to accelerate the adoption of renewable sources while mitigating potential economic disruptions. Finding the right balance between environmental goals and economic realities is crucial for successful implementation and widespread public support.

The Current Landscape: A Patchwork of Incentives

Currently, many countries employ a patchwork of tax incentives and subsidies to encourage clean energy investment. These range from tax credits for solar panel installations and wind turbine construction to deductions for energy-efficient home improvements. While these measures have spurred growth in the renewable energy sector, inconsistencies and limitations exist. Some argue that current policies are insufficient to achieve ambitious climate targets, while others express concern about the potential for unfair competition and market distortions.

Proposed Reforms: A Focus on Efficiency and Equity

Clean energy tax reform proposals vary widely, but many share common themes:

- Streamlining Tax Credits: Simplifying the application process and standardizing tax credit amounts could significantly reduce administrative burdens and encourage broader participation. This would involve consolidating existing programs and eliminating redundancies.

- Investing in Research and Development: Increased funding for clean energy R&D is vital for driving innovation and reducing the cost of renewable technologies. Tax incentives for research and development could attract private investment and accelerate the transition.

- Addressing Distributional Impacts: Clean energy transitions can disproportionately affect certain communities and workers. Reform proposals often include provisions to mitigate these impacts, such as job training programs for workers in fossil fuel industries and targeted support for low-income households.

- Carbon Pricing Mechanisms: Implementing a carbon tax or cap-and-trade system is a popular policy option to internalize the environmental costs of carbon emissions. Revenue generated from such schemes could be used to fund further clean energy initiatives or to offset other taxes.

Economic Considerations: Job Creation and Investment

The economic benefits of clean energy tax reform are significant. The sector is a major job creator, offering opportunities in manufacturing, installation, maintenance, and research. Targeted tax incentives can attract significant private investment, stimulating economic growth and fostering innovation. However, concerns remain about the potential for job losses in traditional energy sectors and the need for effective retraining and transition support.

Environmental Impacts: Achieving Climate Goals

Ultimately, the success of clean energy tax reform will be judged by its contribution to achieving climate goals. Ambitious targets require substantial investments in renewable energy and energy efficiency measures. Effective tax policies can play a critical role in accelerating the deployment of clean technologies and reducing greenhouse gas emissions.

The Road Ahead: Collaboration and Transparency

Successfully navigating the complexities of clean energy tax reform requires collaboration between governments, businesses, and civil society. Transparent policymaking and robust public consultation are essential to ensure that reforms are both effective and equitable. Careful consideration of both environmental and economic realities is crucial to create a policy framework that fosters a sustainable and prosperous future.

Call to Action: Stay informed about clean energy policy developments in your region and participate in public consultations to ensure your voice is heard in shaping the future of energy. Learn more about sustainable living practices and consider making eco-friendly choices in your daily life.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Reform: Balancing Environmental Goals And Economic Realities. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Week 8 Ufl Betting Odds And Predictions For Defenders Vs Renegades

May 19, 2025

Week 8 Ufl Betting Odds And Predictions For Defenders Vs Renegades

May 19, 2025 -

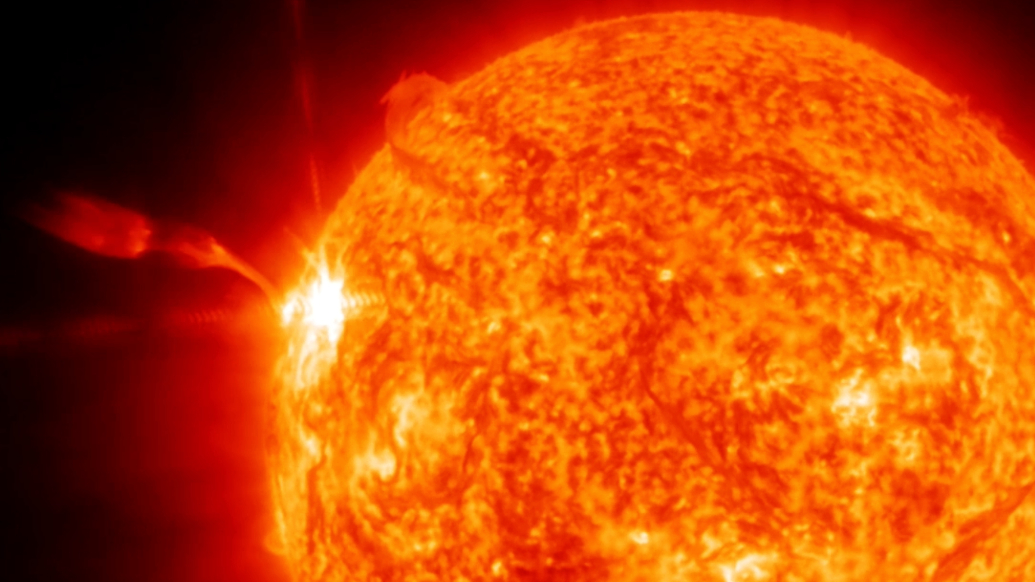

Solar Flare Disrupts Radio Communications Impact On Europe Asia And The Middle East

May 19, 2025

Solar Flare Disrupts Radio Communications Impact On Europe Asia And The Middle East

May 19, 2025 -

Brooklyn Half Marathon Runner Dies Mid Race Investigation Underway

May 19, 2025

Brooklyn Half Marathon Runner Dies Mid Race Investigation Underway

May 19, 2025 -

Marsh Markram Power Srh To 206 Must Win For Lsg

May 19, 2025

Marsh Markram Power Srh To 206 Must Win For Lsg

May 19, 2025 -

Nba Sun 2024 Season Preview In Depth Roster Analysis And Key Players

May 19, 2025

Nba Sun 2024 Season Preview In Depth Roster Analysis And Key Players

May 19, 2025