Clean Energy Tax Debate: A Pivotal Moment For The US Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Debate: A Pivotal Moment for the US Economy

The US is at a crossroads. A heated debate surrounding clean energy tax incentives is shaping the future of the American economy, impacting everything from job creation to national security. The potential ramifications are vast, demanding careful consideration from policymakers, businesses, and citizens alike. This pivotal moment requires understanding the intricacies of the proposed tax policies and their far-reaching consequences.

The Current Landscape: A Clash of Ideologies

The debate centers around the expansion and extension of existing tax credits for renewable energy sources like solar, wind, and geothermal power. Proponents argue these incentives are crucial for accelerating the transition to a cleaner energy future, boosting domestic manufacturing, and creating high-paying jobs in the burgeoning green sector. They point to the success of previous tax credits in driving down the cost of solar panels and wind turbines, making renewable energy increasingly competitive with fossil fuels. Organizations like the American Clean Power Association actively lobby for continued and expanded support.

Conversely, opponents raise concerns about the cost to taxpayers and potential market distortions. They argue that government intervention distorts the free market and may lead to inefficient allocation of resources. Some express skepticism about the long-term viability of certain renewable energy technologies, questioning the true economic benefits. These arguments often highlight the potential impact on taxpayers and the need for fiscal responsibility.

Key Tax Credits Under Scrutiny:

Several key tax credits are at the heart of this debate:

- Investment Tax Credit (ITC) for solar and wind: This credit offers a significant reduction in the cost of investing in renewable energy projects. Its extension is vital for continued growth in the sector.

- Production Tax Credit (PTC) for wind energy: This credit incentivizes the production of wind energy, further promoting its competitiveness.

- Clean Vehicle Tax Credit: This credit encourages the purchase of electric vehicles (EVs), a key component of a cleaner transportation sector. The debate here often focuses on eligibility requirements and the overall effectiveness of incentivizing EV adoption.

Economic Implications: Jobs, Innovation, and Global Competitiveness

The economic impact of these tax policies is multifaceted. The clean energy sector is a significant job creator, offering opportunities in manufacturing, installation, maintenance, and research. Extending tax credits would likely lead to further job growth, particularly in regions transitioning away from fossil fuel-dependent industries. Moreover, investment in renewable energy technologies fosters innovation and strengthens US global competitiveness in a rapidly evolving energy market. Failing to act decisively could see the US fall behind other nations aggressively pursuing clean energy solutions.

Environmental Considerations: A Necessary Shift Towards Sustainability

Beyond the economic arguments, the environmental implications are undeniable. Transitioning to clean energy is crucial for mitigating climate change and reducing harmful emissions. The tax debate is therefore inextricably linked to the broader conversation about environmental sustainability and the responsibility of governments to address climate challenges. This aspect is becoming increasingly important for younger generations who are demanding swift action.

The Path Forward: Finding a Balance

Finding a balance between incentivizing clean energy development and maintaining fiscal responsibility is crucial. This may involve refining existing tax credits to target specific needs, focusing on efficiency and transparency. A robust and transparent review process is needed to ensure tax dollars are spent effectively and achieve their intended goals. Furthermore, engaging in open and informed public dialogue is essential for bridging the ideological divide and forging a path toward a sustainable and economically prosperous future.

Call to Action: Stay informed about the evolving clean energy tax debate. Contact your elected officials to express your views and encourage responsible policymaking that balances economic growth with environmental sustainability. The future of the US economy, and indeed the planet, may depend on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Debate: A Pivotal Moment For The US Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Road To Knoxville Final Pickens Powers Lady Vols Tournament Run

May 19, 2025

Road To Knoxville Final Pickens Powers Lady Vols Tournament Run

May 19, 2025 -

Analysis Souceks Impact West Hams Wins Over Tottenham And Manchester United

May 19, 2025

Analysis Souceks Impact West Hams Wins Over Tottenham And Manchester United

May 19, 2025 -

From Coufal To The Irons A Personal Message To The West Ham Family

May 19, 2025

From Coufal To The Irons A Personal Message To The West Ham Family

May 19, 2025 -

Ufl Week 8 In Depth Analysis And Predictions For Defenders Vs Renegades

May 19, 2025

Ufl Week 8 In Depth Analysis And Predictions For Defenders Vs Renegades

May 19, 2025 -

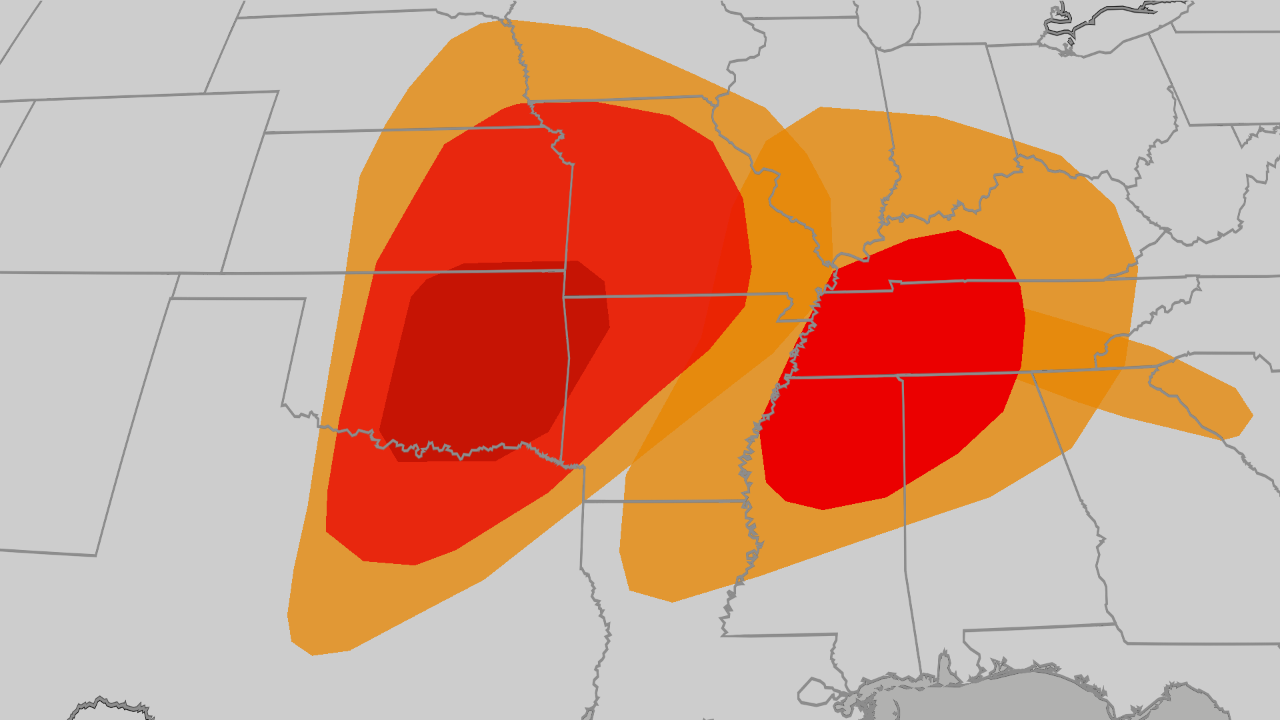

Severe Weather Outbreak Tornado Threat Sweeps Plains Midwest And South

May 19, 2025

Severe Weather Outbreak Tornado Threat Sweeps Plains Midwest And South

May 19, 2025