Clean Energy Tax Credits: A Pivotal Moment For America's Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Credits: A Pivotal Moment for America's Economy

The Inflation Reduction Act (IRA) of 2022 unleashed a torrent of clean energy tax credits, marking a potential turning point for the American economy. These incentives, far more substantial than previous efforts, are poised to reshape industries, create jobs, and accelerate the transition to a cleaner energy future. But are they enough to achieve the ambitious goals set forth, and what challenges lie ahead?

A Boon for Renewable Energy Development:

The IRA's clean energy tax credits are not just minor tweaks; they represent a significant investment in renewable energy sources. Tax credits for solar, wind, geothermal, and other renewable energy projects are significantly expanded, making these options more financially attractive than ever before. This is expected to trigger a surge in new project development, boosting domestic manufacturing and creating thousands of high-paying jobs.

- Manufacturing Boom: The credits incentivize the domestic production of solar panels, wind turbines, and battery components, reducing reliance on foreign imports and strengthening the U.S. supply chain. This is crucial for national security and economic resilience. [Link to article on US supply chain resilience].

- Job Creation: The clean energy sector is a significant job creator. The IRA's incentives are expected to lead to a substantial increase in employment across various sectors, from manufacturing and installation to research and development. [Link to Bureau of Labor Statistics data on clean energy jobs].

- Investment Surge: The enhanced tax credits are attracting billions of dollars in private investment into clean energy projects. This influx of capital will accelerate innovation and deployment, further driving down costs and making clean energy more accessible.

Beyond Renewables: A Broader Economic Impact:

The benefits extend beyond renewable energy generation. The IRA also includes credits for:

- Energy efficiency upgrades: Incentives for homeowners and businesses to improve energy efficiency will reduce energy consumption, lower utility bills, and create jobs in the retrofitting industry.

- Electric vehicle (EV) adoption: Tax credits for purchasing new and used electric vehicles are aimed at accelerating the transition to electric transportation, reducing emissions and boosting the EV industry. [Link to article on the future of electric vehicles].

- Carbon capture technologies: Investment in carbon capture, utilization, and storage (CCUS) technologies is crucial for mitigating emissions from hard-to-decarbonize industries like cement and steel.

Challenges and Uncertainties:

Despite the significant potential, challenges remain:

- Supply chain bottlenecks: The rapid expansion of clean energy projects could strain existing supply chains, leading to delays and increased costs. Addressing these bottlenecks requires strategic planning and investment in domestic manufacturing capacity.

- Permitting and regulatory hurdles: Streamlining the permitting process for renewable energy projects is crucial to accelerate deployment. Excessive bureaucratic delays can hinder progress and negate the benefits of the tax credits.

- Equity and access: Ensuring that the benefits of clean energy development reach all communities, particularly disadvantaged ones, is paramount. Targeted programs and policies are needed to address potential disparities.

A Pivotal Moment, Indeed:

The clean energy tax credits represent a pivotal moment for the American economy. Their success hinges on effective implementation, strategic investment, and addressing the challenges outlined above. While the road ahead is not without obstacles, the potential for economic growth, job creation, and a cleaner environment is undeniable. The coming years will be critical in determining whether this significant investment translates into the transformative change envisioned. This is a story that deserves continued attention and critical analysis. What are your thoughts on the future of clean energy in the United States? Share your perspectives in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Credits: A Pivotal Moment For America's Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Manchester United Vs Chelsea Premier League Predictions And Betting Analysis

May 17, 2025

Manchester United Vs Chelsea Premier League Predictions And Betting Analysis

May 17, 2025 -

Villa Vs Spurs Team News Head To Head And Key Stats Before Kick Off

May 17, 2025

Villa Vs Spurs Team News Head To Head And Key Stats Before Kick Off

May 17, 2025 -

Analyzing Taylor Jenkins Reids Impact On Contemporary Fiction

May 17, 2025

Analyzing Taylor Jenkins Reids Impact On Contemporary Fiction

May 17, 2025 -

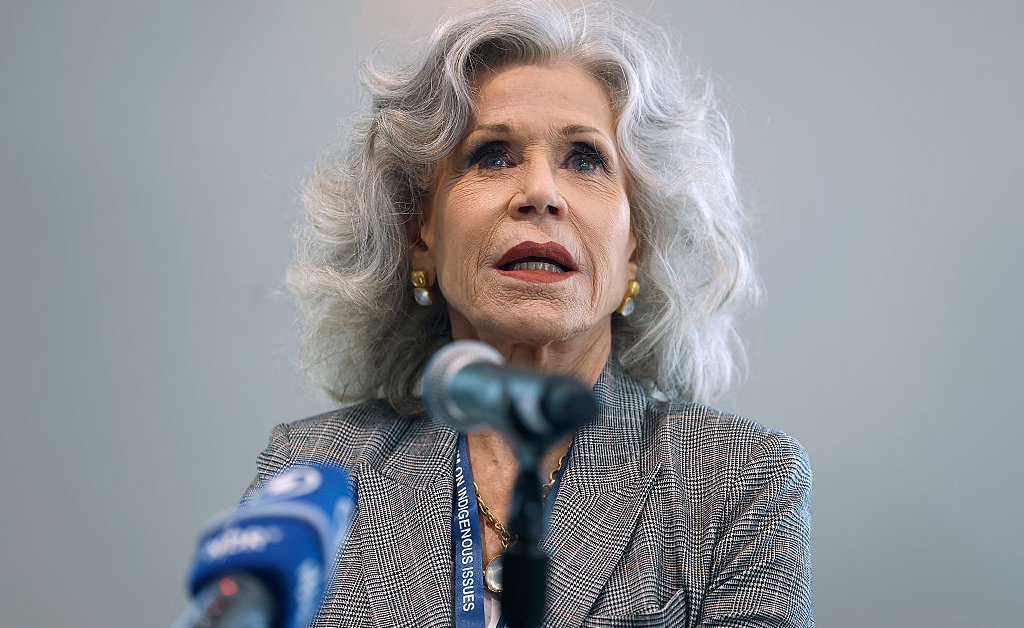

Jane Fondas Advocacy For Ecuadors Rainforest Preservation

May 17, 2025

Jane Fondas Advocacy For Ecuadors Rainforest Preservation

May 17, 2025 -

Climate Changes Effect On Healthy Pregnancies Threats And Potential Solutions

May 17, 2025

Climate Changes Effect On Healthy Pregnancies Threats And Potential Solutions

May 17, 2025