Clean Energy Tax Credits: A Critical Factor In America's Economic Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Credits: A Critical Factor in America's Economic Future

America stands at a crossroads. The urgent need to combat climate change intersects with the immense opportunity to reshape our economy, creating millions of high-paying jobs and boosting global competitiveness. A crucial element in navigating this transition? Clean energy tax credits. These aren't just financial incentives; they're a cornerstone of America's economic future.

The Inflation Reduction Act (IRA), signed into law in 2022, significantly expanded clean energy tax credits. This landmark legislation offers substantial financial support for a wide range of clean energy technologies, from solar and wind power to energy storage and electric vehicles. This isn't just about environmental protection; it's about fostering economic growth and ensuring American leadership in a rapidly evolving global energy market.

Boosting Economic Growth Through Green Jobs

One of the most compelling arguments for clean energy tax credits is their potential to create jobs. The transition to a clean energy economy isn't just about replacing fossil fuels; it's about building a new infrastructure, requiring skilled workers across numerous sectors. From manufacturing solar panels and wind turbines to installing smart grids and developing advanced energy storage solutions, the opportunities are vast. The IRA's tax credits are designed to incentivize this growth, attracting investment and driving job creation in communities across the nation. This isn't just about green jobs; it's about good jobs – high-paying, skilled positions that offer a pathway to a prosperous middle class.

Attracting Investment and Fostering Innovation

Clean energy technologies require significant upfront investment. Tax credits mitigate this risk, making investments in renewable energy more attractive to both domestic and international investors. This influx of capital fuels innovation, driving down the cost of clean energy technologies and accelerating their adoption. The result? A virtuous cycle of investment, innovation, and economic growth. Furthermore, the focus on domestic manufacturing, spurred by these credits, strengthens America's energy independence and reduces reliance on foreign sources.

Addressing Energy Security and Climate Change

Beyond economic benefits, clean energy tax credits are vital for addressing energy security and climate change. By incentivizing the development and deployment of renewable energy sources, these credits reduce our reliance on volatile fossil fuel markets, bolstering our national security. Simultaneously, they contribute significantly to reducing greenhouse gas emissions, helping the US meet its climate goals and contribute to global efforts to mitigate the effects of climate change. This is crucial not only for environmental reasons but also to avoid the devastating economic consequences of climate inaction.

The Challenges and Opportunities Ahead

While the IRA's tax credits represent a significant step forward, challenges remain. Navigating the complexities of the tax code, ensuring equitable access to these benefits, and addressing potential supply chain bottlenecks are all crucial considerations. However, the potential rewards are immense. Effective implementation of these credits, combined with continued innovation and supportive policies, can unlock unprecedented economic opportunities, create a cleaner environment, and secure America's leadership in the global clean energy market.

Conclusion: Investing in Our Future

Clean energy tax credits are not just a financial tool; they are a strategic investment in America's economic future. By fostering job growth, attracting investment, enhancing energy security, and mitigating climate change, these credits are essential for building a more prosperous, sustainable, and secure nation. The future of American prosperity is inextricably linked to the success of our clean energy transition, and tax credits are a key driver of that success. Learn more about the specifics of the IRA's clean energy tax credits by visiting the . Understanding these incentives is crucial for businesses and individuals alike looking to contribute to and benefit from this critical transformation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Credits: A Critical Factor In America's Economic Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Recurring Accusation Philippine Ngos And The Terrorism Label

May 17, 2025

The Recurring Accusation Philippine Ngos And The Terrorism Label

May 17, 2025 -

Chelsea Manchester United Form Guide And Potential Starting Xis May 16 2025

May 17, 2025

Chelsea Manchester United Form Guide And Potential Starting Xis May 16 2025

May 17, 2025 -

Supreme Court Case Challenges Birthright Citizenship And Federal Power

May 17, 2025

Supreme Court Case Challenges Birthright Citizenship And Federal Power

May 17, 2025 -

Chelsea Vs Manchester United Preview May 16th 2025 Match Breakdown

May 17, 2025

Chelsea Vs Manchester United Preview May 16th 2025 Match Breakdown

May 17, 2025 -

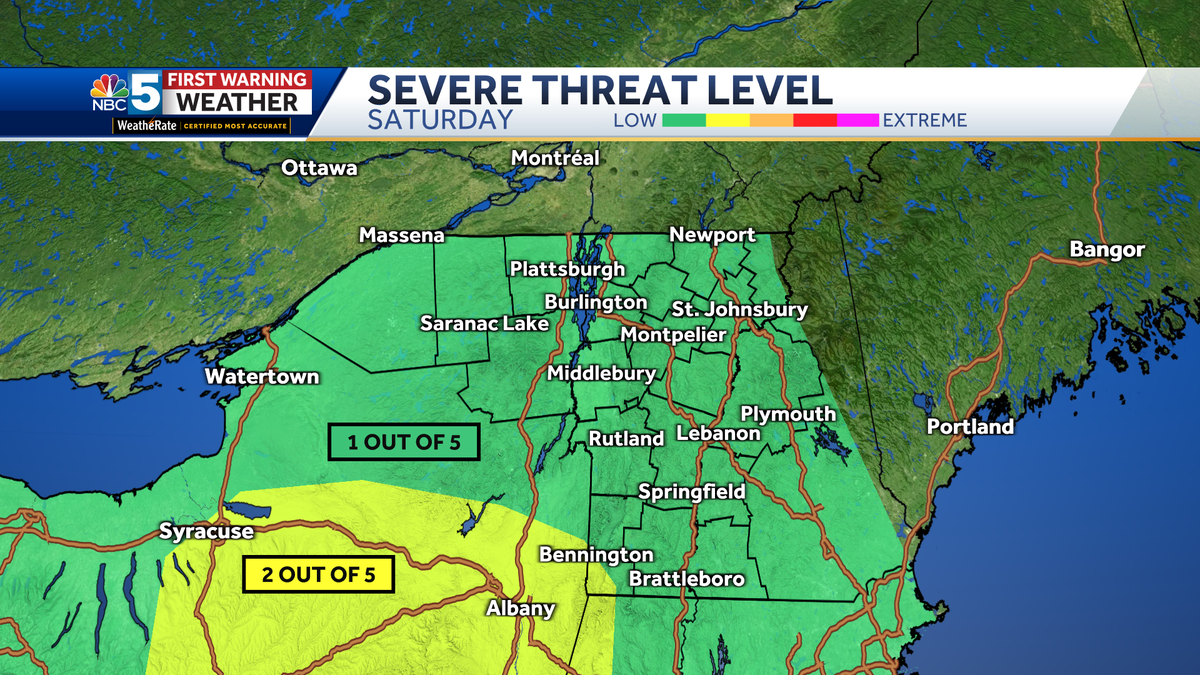

Pop Up Storms To Drench Vermont And New York Thursday Wet Weather To Continue Into Weekend

May 17, 2025

Pop Up Storms To Drench Vermont And New York Thursday Wet Weather To Continue Into Weekend

May 17, 2025