Clean Energy Tax Credits: A Critical Economic Debate For America's Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Credits: A Critical Economic Debate for America's Future

The future of the American economy is inextricably linked to its energy future. A pivotal aspect of this future hinges on the ongoing debate surrounding clean energy tax credits. These incentives, designed to accelerate the adoption of renewable energy sources and energy efficiency technologies, are sparking a critical economic discussion with far-reaching consequences. Are they a vital investment in a sustainable future, or an expensive government overreach? Let's delve into the arguments.

The Case for Clean Energy Tax Credits:

Proponents argue that clean energy tax credits are essential for several key reasons:

-

Job Creation: The clean energy sector is a burgeoning job market. Tax credits incentivize investment in solar, wind, geothermal, and other renewable energy technologies, leading to the creation of manufacturing, installation, and maintenance jobs across the country. This is particularly beneficial for rural communities and those transitioning away from fossil fuel-dependent industries. A recent report by the National Renewable Energy Laboratory (NREL) [link to NREL report if available] highlights the significant job growth potential.

-

Technological Innovation: Incentivizing clean energy technologies fosters innovation and competition. Tax credits encourage research and development, leading to more efficient and cost-effective renewable energy solutions. This ultimately benefits consumers through lower energy costs and a more reliable energy grid.

-

Environmental Benefits: The most compelling argument is the environmental impact. Transitioning to clean energy sources is crucial in mitigating climate change and reducing air pollution. Tax credits accelerate this transition, contributing to a healthier environment and improved public health. The Environmental Protection Agency (EPA) [link to relevant EPA page] provides comprehensive data on the environmental benefits of renewable energy.

-

Energy Independence: Reducing reliance on fossil fuels enhances America's energy independence and national security. Domestic renewable energy sources provide a more stable and secure energy supply, lessening vulnerability to global energy price fluctuations and geopolitical instability.

The Counterarguments: Economic Concerns and Potential Drawbacks

Opponents raise concerns about the economic efficiency and potential drawbacks of these tax credits:

-

Cost to Taxpayers: The substantial cost of these tax credits is a major point of contention. Critics argue that the financial burden on taxpayers outweighs the economic benefits. They question the long-term return on investment and call for a more targeted and efficient approach.

-

Market Distortion: Some argue that tax credits distort the free market, artificially inflating the clean energy sector while potentially hindering the development of other potentially more efficient technologies.

-

Inequity Concerns: Concerns exist about the distribution of benefits from these credits. Do they disproportionately benefit large corporations rather than small businesses and individuals? This issue demands careful consideration and potentially targeted adjustments to the programs.

-

Administrative Complexity: The complexity of the tax credit system can be a barrier to entry for smaller businesses and individuals, making it challenging to navigate and claim the available incentives.

Finding a Balance: The Path Forward

The debate surrounding clean energy tax credits is far from settled. Finding a balance between promoting clean energy development and managing taxpayer costs is crucial. This requires:

-

Transparency and Accountability: Rigorous evaluation and transparency regarding the effectiveness and cost-efficiency of these programs are paramount. Independent analysis can help inform policy decisions and ensure accountability.

-

Targeted Incentives: Focusing incentives on specific technologies or sectors with the highest potential for job creation and environmental impact could improve efficiency.

-

Streamlined Administration: Simplifying the application process and making the system more user-friendly will encourage greater participation from small businesses and individuals.

The future of America's energy landscape, and indeed its economy, depends on navigating this complex debate effectively. A balanced approach that considers both the economic and environmental implications is essential to ensuring a sustainable and prosperous future. The conversation needs to continue, focusing on data-driven solutions and a commitment to responsible and efficient energy policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Credits: A Critical Economic Debate For America's Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

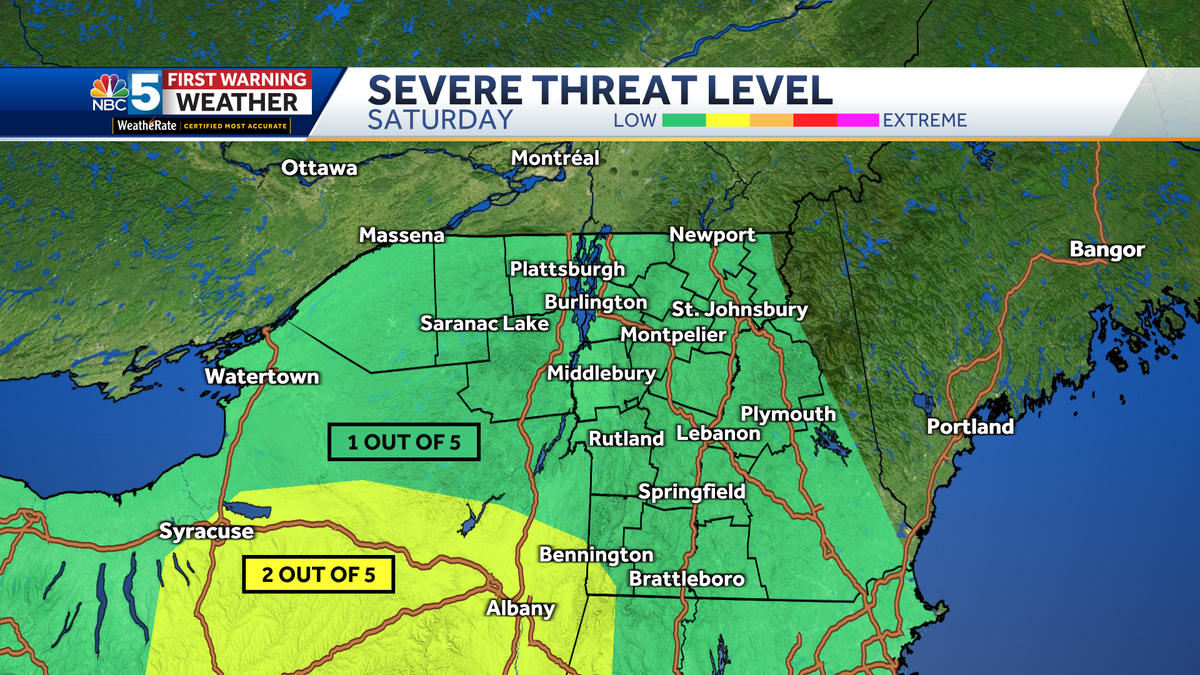

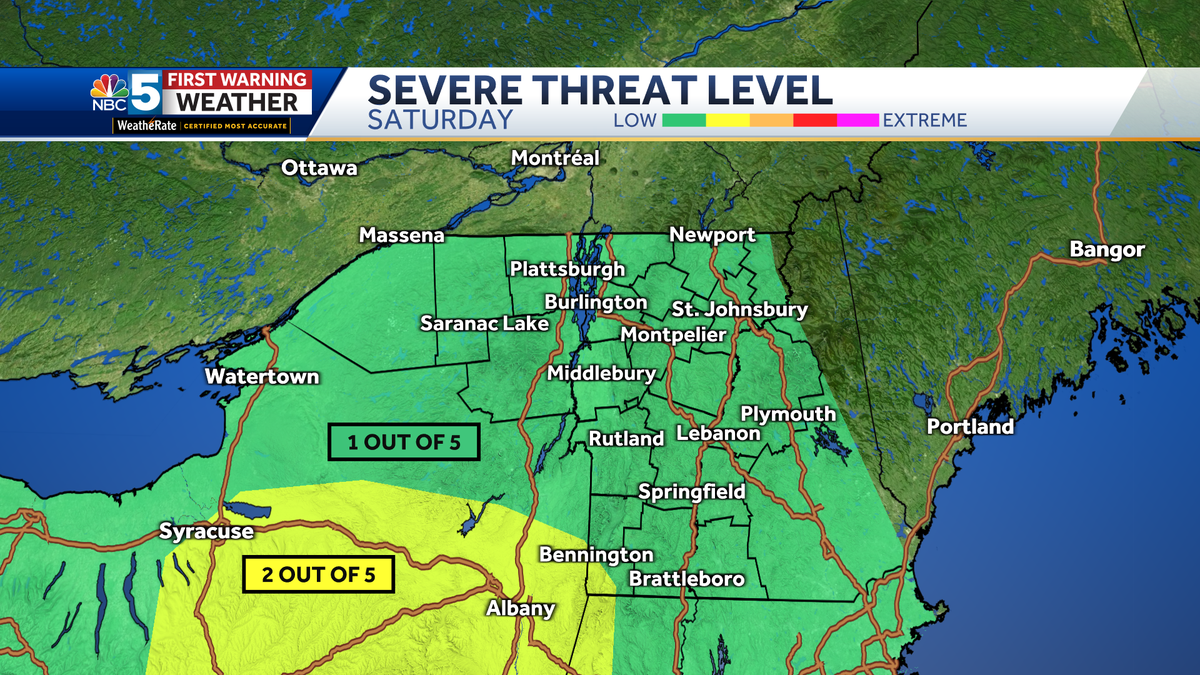

New York And Vermont Weather Pop Up Storms And Heavy Rain Likely Thursday

May 17, 2025

New York And Vermont Weather Pop Up Storms And Heavy Rain Likely Thursday

May 17, 2025 -

New York And Vermont Weather Forecast Pop Up Storms And Downpours Expected Thursday

May 17, 2025

New York And Vermont Weather Forecast Pop Up Storms And Downpours Expected Thursday

May 17, 2025 -

Controversy Erupts At Famu Presidential Candidates Public Appearance

May 17, 2025

Controversy Erupts At Famu Presidential Candidates Public Appearance

May 17, 2025 -

Aston Villa Vs Tottenham Starting Xi Predictions And Confirmed Team News

May 17, 2025

Aston Villa Vs Tottenham Starting Xi Predictions And Confirmed Team News

May 17, 2025 -

Chelsea Vs Manchester United Key Players And Tactical Battleground May 16 2025

May 17, 2025

Chelsea Vs Manchester United Key Players And Tactical Battleground May 16 2025

May 17, 2025