Clean Energy Investment: Examining The Economic Impact Of Tax Policies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Investment: Examining the Economic Impact of Tax Policies

The global shift towards clean energy is rapidly accelerating, driven by environmental concerns and technological advancements. However, the speed and success of this transition are significantly influenced by government policies, particularly tax incentives. This article delves into the complex relationship between clean energy investment and tax policies, exploring their economic impact and highlighting key considerations for policymakers.

The Powerful Role of Tax Credits and Incentives

Governments worldwide utilize various tax policies to stimulate clean energy investment. These include:

- Production Tax Credits (PTCs): These credits incentivize the production of renewable energy, such as wind and solar power. The Investment Tax Credit (ITC) in the United States, for example, has played a crucial role in boosting solar energy development. [Link to relevant government resource on ITC].

- Investment Tax Credits (ITCs): Similar to PTCs, ITCs offer tax breaks for investing in clean energy technologies and infrastructure. They can significantly reduce the upfront cost of projects, making them more financially viable.

- Accelerated Depreciation: This allows businesses to deduct a larger portion of the cost of clean energy assets in the early years of their operation, improving cash flow and encouraging quicker deployment.

- Tax Exemptions: Certain clean energy projects or activities may be entirely exempt from certain taxes, further lowering the cost of investment.

Economic Benefits: Job Creation and Growth

The economic benefits of incentivizing clean energy investment are substantial and multifaceted. Studies consistently demonstrate that:

- Job Creation: The clean energy sector is a significant job creator. Tax incentives accelerate this growth by making projects more attractive to investors, leading to increased deployment and employment opportunities in manufacturing, installation, maintenance, and related fields. [Link to a reputable study on clean energy job creation].

- Economic Growth: Investment in clean energy stimulates economic growth through increased demand for goods and services, improved energy efficiency, and reduced reliance on volatile fossil fuel markets.

- Technological Innovation: Tax incentives foster innovation by encouraging research and development in clean energy technologies, leading to cost reductions and performance improvements.

Challenges and Considerations

While the economic benefits are clear, there are challenges associated with designing effective clean energy tax policies:

- Targeting Efficiency: Policies need to be designed to effectively target investments in truly clean and sustainable technologies, avoiding unintended consequences or subsidies for less efficient or environmentally beneficial projects.

- Distributional Effects: The impact of tax incentives on different income groups and regions needs careful consideration to ensure equitable benefits.

- Budgetary Constraints: Governments need to balance the costs of tax incentives with other budgetary priorities. Careful cost-benefit analysis is crucial.

- Policy Stability: Long-term policy stability is essential to attract long-term investments. Frequent changes to tax regulations can create uncertainty and discourage investment.

The Future of Clean Energy Tax Policies

The future of clean energy hinges significantly on the design and implementation of effective tax policies. As technologies evolve and the urgency of climate change intensifies, governments must adapt their approaches to maximize the economic benefits while ensuring environmental sustainability and social equity. This requires ongoing research, data analysis, and collaboration between policymakers, industry stakeholders, and researchers. [Link to a relevant think tank or research organization focused on clean energy policy].

Call to Action: Stay informed about evolving clean energy tax policies in your region and advocate for sustainable and equitable policies that promote economic growth and environmental protection.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Investment: Examining The Economic Impact Of Tax Policies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

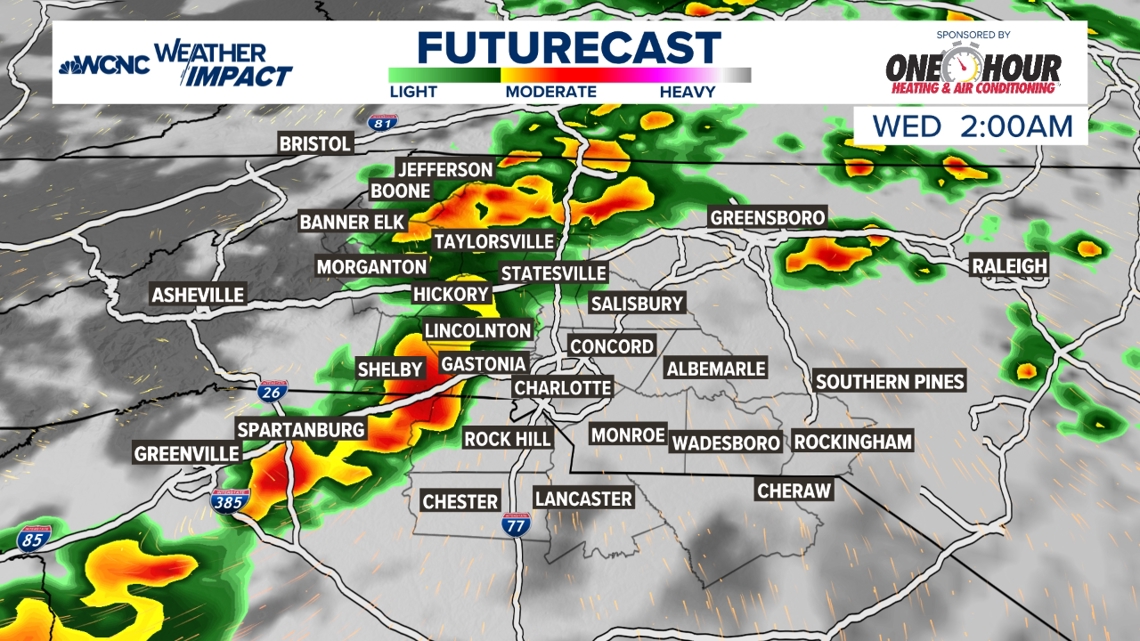

Limited Chance Of Strong Storms Tuesday Night Very Isolated Threat

May 21, 2025

Limited Chance Of Strong Storms Tuesday Night Very Isolated Threat

May 21, 2025 -

League Of Legends Hall Of Fame 2025 Is The New Skin Too Expensive

May 21, 2025

League Of Legends Hall Of Fame 2025 Is The New Skin Too Expensive

May 21, 2025 -

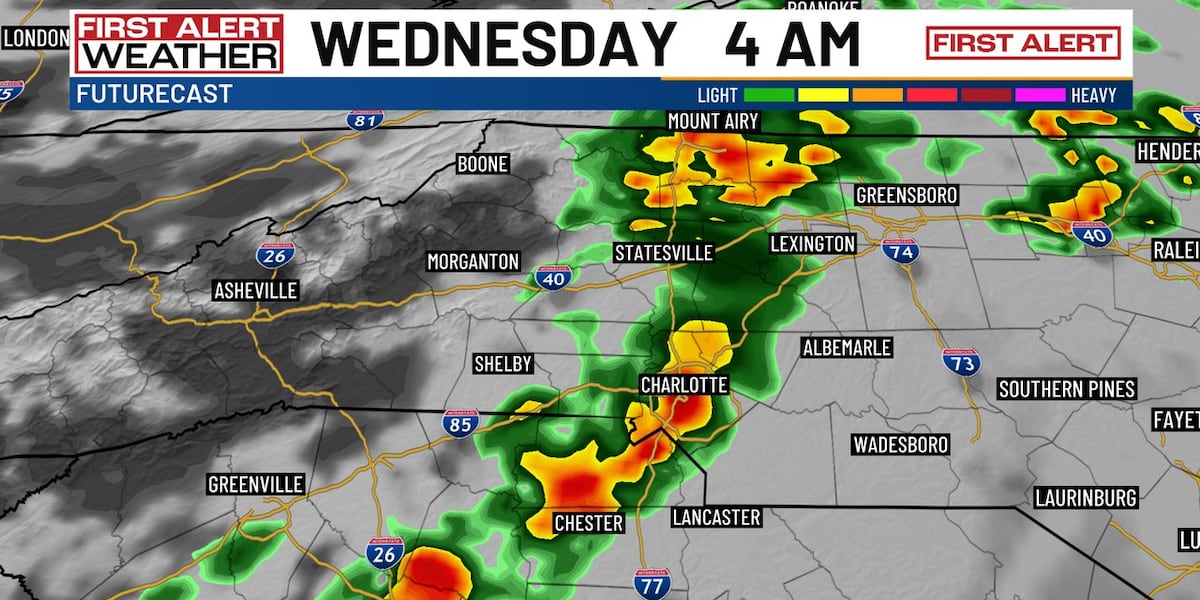

Cooler Temperatures Expected In Charlotte After Tonights Stormy Weather

May 21, 2025

Cooler Temperatures Expected In Charlotte After Tonights Stormy Weather

May 21, 2025 -

Ufc News Jon Jones Latest Comments On Tom Aspinall Cause A Stir

May 21, 2025

Ufc News Jon Jones Latest Comments On Tom Aspinall Cause A Stir

May 21, 2025 -

Church Vandalism Two Youths Accused Of Entering And Defecating

May 21, 2025

Church Vandalism Two Youths Accused Of Entering And Defecating

May 21, 2025