Clean Energy Investment And The Tax Code: Economic Impacts On The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Investment and the Tax Code: A Boon for the US Economy?

The US is undergoing a significant energy transition, spurred by growing concerns about climate change and the pursuit of energy independence. Central to this transition is massive investment in clean energy technologies. But how does the tax code influence this investment, and what are the broader economic impacts on the United States? The answer is complex, involving a delicate interplay of incentives, regulations, and market forces.

The Role of Tax Incentives in Clean Energy Development:

The US tax code employs a variety of mechanisms to incentivize clean energy investment. These include:

- Tax credits: The Investment Tax Credit (ITC) for solar, wind, and other renewable energy projects is a cornerstone of clean energy policy. This credit reduces the tax liability of businesses and individuals investing in these technologies, making them more financially attractive. Recent extensions and enhancements to the ITC have significantly boosted deployment.

- Accelerated depreciation: Allowing businesses to write off the cost of clean energy assets more quickly reduces their tax burden and improves their cash flow, encouraging faster adoption.

- Renewable energy production tax credits: These credits incentivize the generation of renewable energy, rewarding companies for producing clean power.

Economic Impacts: Job Creation and Growth:

The clean energy sector is a significant job creator. Investments spurred by tax incentives lead to:

- Manufacturing jobs: The production of solar panels, wind turbines, and other clean energy equipment generates numerous manufacturing jobs across the country.

- Installation and maintenance jobs: The installation and ongoing maintenance of clean energy systems create a substantial workforce.

- Indirect jobs: The ripple effect of clean energy investment extends to related industries, creating jobs in transportation, logistics, and other supporting sectors.

Studies consistently show a strong correlation between clean energy investment and economic growth. The influx of capital into the sector stimulates innovation, leading to technological advancements and increased efficiency. This, in turn, drives down the cost of clean energy, making it more competitive with fossil fuels.

Challenges and Considerations:

While the economic benefits are undeniable, some challenges remain:

- Equity concerns: Ensuring that the benefits of clean energy investment are distributed equitably across all communities is crucial. Targeted policies are needed to avoid exacerbating existing inequalities.

- Environmental justice: The siting of clean energy projects must be carefully considered to minimize environmental impacts on vulnerable populations.

- International competition: The US needs to remain competitive in the global clean energy market. This requires ongoing innovation and supportive policies.

The Future of Clean Energy and the Tax Code:

The future of clean energy investment in the US hinges on continued political support for tax incentives and a stable regulatory environment. Ongoing debates about the level and design of these incentives are likely to continue, as policymakers grapple with balancing economic growth, environmental protection, and social equity. Understanding the economic impacts of these policies is crucial for informed decision-making. Further research and analysis are needed to fully grasp the long-term effects of current and future tax policies on the US clean energy sector and the broader economy. This includes assessing the effectiveness of various incentives, identifying potential unintended consequences, and developing strategies to maximize the positive economic and environmental outcomes.

Call to Action: Stay informed about the latest developments in clean energy policy and advocate for policies that promote sustainable economic growth and environmental protection. Learn more about the Investment Tax Credit and other clean energy incentives through reputable government and academic resources.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Investment And The Tax Code: Economic Impacts On The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ai Programming Chat Gpt Launches Codex For Developers

May 17, 2025

Ai Programming Chat Gpt Launches Codex For Developers

May 17, 2025 -

Predicted Chelsea Xi Vs Man Utd Jackson Or Someone Else Reece Jamess Inclusion

May 17, 2025

Predicted Chelsea Xi Vs Man Utd Jackson Or Someone Else Reece Jamess Inclusion

May 17, 2025 -

Flash Flood Threat Bucks County Residents Urged To Prepare Through Friday

May 17, 2025

Flash Flood Threat Bucks County Residents Urged To Prepare Through Friday

May 17, 2025 -

Pga Championship Preview Jon Rahms Confidence And Contender Status

May 17, 2025

Pga Championship Preview Jon Rahms Confidence And Contender Status

May 17, 2025 -

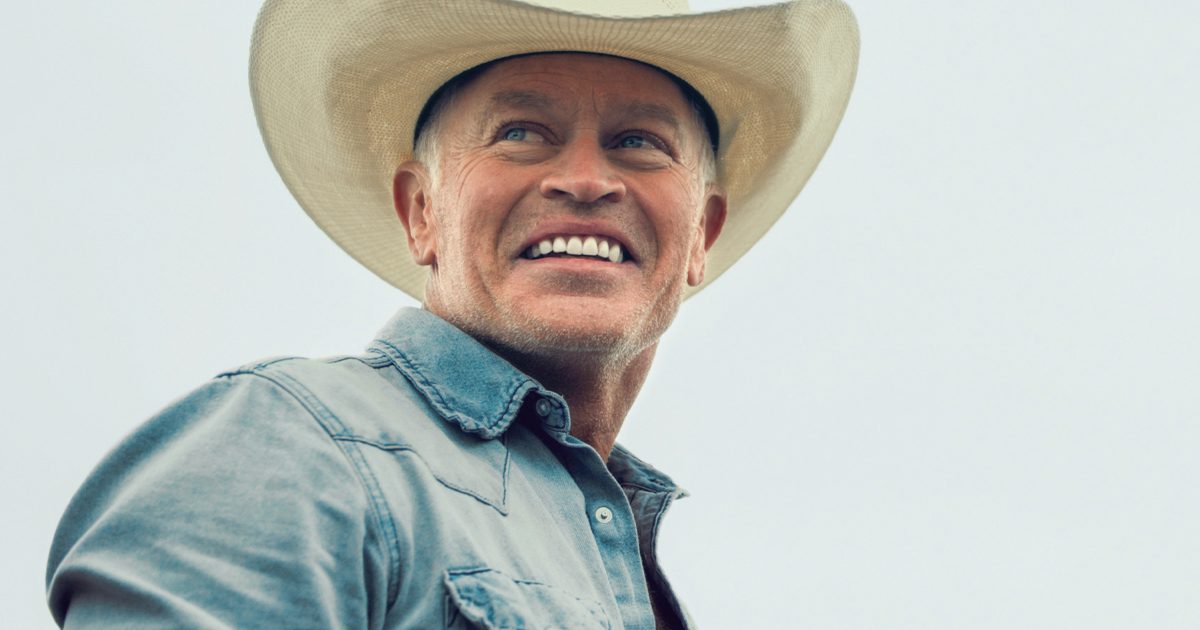

The Last Rodeo Is This Film Worth Watching A Critical Review

May 17, 2025

The Last Rodeo Is This Film Worth Watching A Critical Review

May 17, 2025