Clean Energy Investment And Tax Reform: Analyzing The Economic Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Investment and Tax Reform: Analyzing the Economic Impact

The shift towards clean energy is no longer a distant possibility; it's a rapidly unfolding economic reality. Government policies, particularly tax reforms, play a crucial role in accelerating this transition and shaping its economic impact. This article delves into the complex interplay between clean energy investment and tax reform, examining both the benefits and challenges.

The Incentive Power of Tax Reform:

Tax incentives are powerful tools for driving investment in clean energy technologies. They can significantly reduce the upfront costs associated with projects ranging from solar and wind farms to energy storage solutions and green building initiatives. Examples include:

- Investment Tax Credits (ITCs): These credits offer a percentage reduction in the cost of qualifying clean energy investments. The ITC for solar, for instance, has been instrumental in boosting solar energy adoption. Learn more about current ITC rates on the . (Note: Always consult a tax professional for personalized advice.)

- Production Tax Credits (PTCs): These credits provide incentives based on the amount of clean energy produced, further encouraging the development and deployment of renewable energy sources.

- Accelerated Depreciation: This allows businesses to deduct a larger portion of the cost of clean energy assets in the early years of their operation, improving cash flow and encouraging faster deployment.

Economic Benefits of Clean Energy Investment:

The economic benefits extend far beyond the direct impact of tax incentives. Investing in clean energy creates:

- Job Creation: The clean energy sector is a significant job creator, offering opportunities across manufacturing, installation, maintenance, and research. A recent report from [insert credible source, e.g., the International Renewable Energy Agency (IRENA)] highlights the substantial employment potential of the renewable energy sector.

- Economic Diversification: Clean energy investments can diversify local economies, reducing reliance on fossil fuels and creating new revenue streams. This is particularly relevant in regions transitioning away from traditional industries.

- Technological Innovation: Investment in clean energy fuels innovation, leading to advancements in energy storage, efficiency, and grid management. This innovation can have spillover effects on other sectors of the economy.

- Reduced Healthcare Costs: Cleaner air and water resulting from a transition to cleaner energy sources can lead to significant reductions in healthcare costs associated with pollution-related illnesses.

Challenges and Considerations:

While the economic benefits are substantial, challenges remain:

- Intermittency of Renewable Sources: Solar and wind power are intermittent, requiring investment in energy storage solutions and grid modernization to ensure reliable electricity supply.

- Infrastructure Development: Expanding the clean energy infrastructure requires significant investment in transmission lines, charging stations, and other supporting infrastructure.

- Policy Stability: Consistent and long-term government policies are crucial to attract private investment. Changes in tax regulations can create uncertainty and hinder investment.

- Equity and Accessibility: It's crucial to ensure that the benefits of clean energy investments are distributed equitably and that access to clean energy is available to all communities.

Conclusion:

Clean energy investment, fueled by strategic tax reform, presents a significant opportunity for economic growth and environmental sustainability. By carefully considering both the incentives and the challenges, governments can create a policy environment that fosters innovation, job creation, and a cleaner future. Further research and analysis are needed to continuously refine policies and maximize the economic benefits of this crucial transition. Stay informed about the latest developments in clean energy policy and tax reform to understand how these changes impact your community and your investments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Investment And Tax Reform: Analyzing The Economic Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is It Allowed Cleaning Mud From Your Ball In Games

May 19, 2025

Is It Allowed Cleaning Mud From Your Ball In Games

May 19, 2025 -

Tyler O Neill Orioles Send Outfielder To 10 Day Injured List

May 19, 2025

Tyler O Neill Orioles Send Outfielder To 10 Day Injured List

May 19, 2025 -

Pga Championship A Recap Of Moving Days Key Moments And Schefflers Surge

May 19, 2025

Pga Championship A Recap Of Moving Days Key Moments And Schefflers Surge

May 19, 2025 -

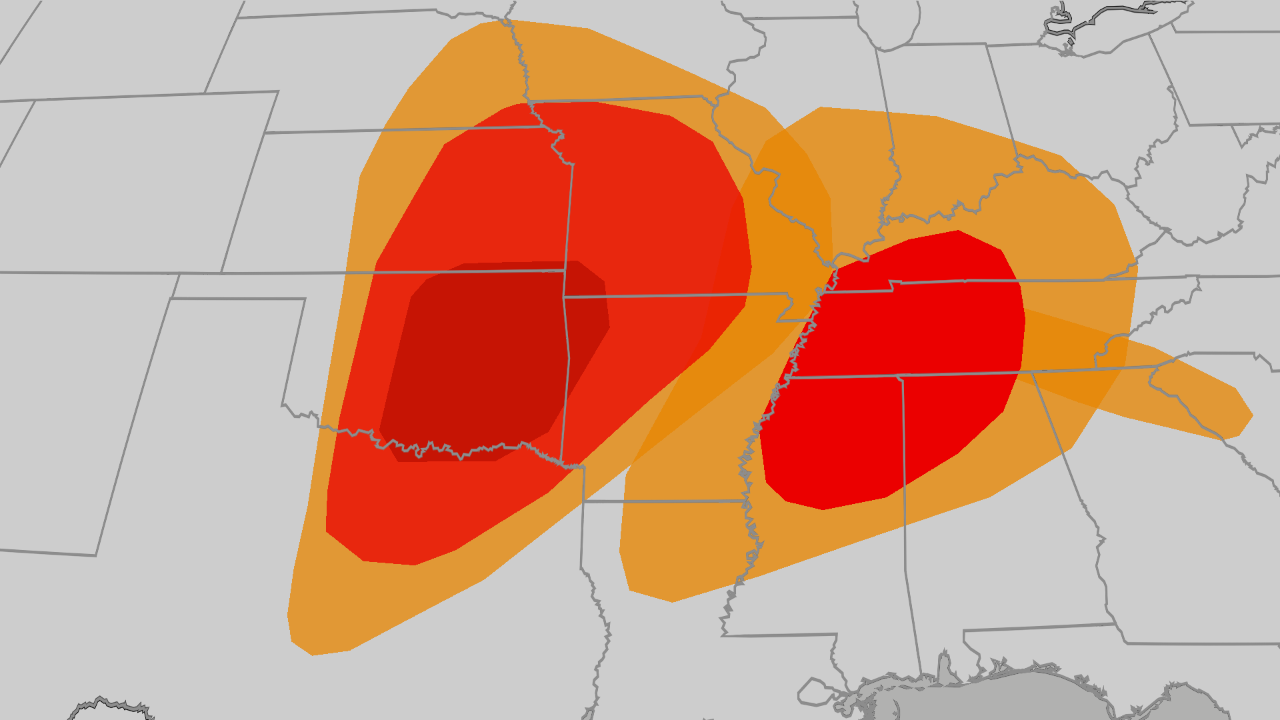

Plains Midwest And South Brace For Severe Weather Tornado Outbreak

May 19, 2025

Plains Midwest And South Brace For Severe Weather Tornado Outbreak

May 19, 2025 -

Lady Vols Pickens Shines In Knoxville Regional Semifinal Victory

May 19, 2025

Lady Vols Pickens Shines In Knoxville Regional Semifinal Victory

May 19, 2025