Clean Energy Investment And Tax Policy: Economic Opportunities And Challenges For The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Investment and Tax Policy: Economic Opportunities and Challenges for the US

The United States stands at a critical juncture in its energy future. Massive investments in clean energy technologies are not just an environmental imperative; they represent a significant economic opportunity, capable of driving job creation, boosting innovation, and strengthening national competitiveness. However, realizing this potential hinges on smart, effective tax policies that incentivize investment and address potential challenges. This article explores the economic landscape of clean energy in the US, analyzing the opportunities and challenges presented by current and potential tax policies.

H2: The Alluring Promise of Clean Energy Investment

The clean energy sector is booming globally. From solar and wind power to energy storage and electric vehicles, the industry is ripe with potential for economic growth. The US, with its robust research capabilities and entrepreneurial spirit, is uniquely positioned to capitalize on this. This potential translates into:

- Job Creation: The clean energy sector is a significant job creator. Manufacturing, installation, maintenance, and research all contribute to a diverse employment landscape, offering opportunities across various skill levels. A recent report by the [insert credible source, e.g., Department of Energy] highlighted the potential for millions of new jobs in the coming decades.

- Technological Innovation: Investment in clean energy fuels innovation. Competition drives the development of more efficient and cost-effective technologies, leading to a virtuous cycle of progress and economic growth. This includes breakthroughs in battery technology, advanced solar panels, and smart grid infrastructure.

- Economic Diversification: A shift towards clean energy helps diversify the US economy, reducing dependence on fossil fuels and creating new markets for American businesses. This diversification strengthens national resilience against global energy price fluctuations and geopolitical instability.

- Export Opportunities: As a global leader in clean energy technology, the US can significantly benefit from exporting its innovations and expertise to other countries striving to meet their climate goals. This creates export revenue and enhances the nation's international standing.

H2: Navigating the Tax Policy Landscape: Incentives and Hurdles

Effective tax policy is crucial for maximizing the economic benefits of clean energy investment. Current policies, such as the Investment Tax Credit (ITC) for renewable energy and tax credits for electric vehicles, are vital incentives. However, there are areas for improvement and potential challenges to consider:

- Extending and Expanding Tax Credits: Many clean energy tax credits have been subject to periodic extensions and modifications, creating uncertainty for investors. Long-term certainty through extended and potentially expanded credits would encourage greater investment and planning.

- Addressing Equity Concerns: Tax incentives should be designed to ensure equitable access to clean energy benefits across all communities, particularly those historically disadvantaged by pollution and lacking access to clean energy resources.

- Streamlining Permitting Processes: Regulatory hurdles and lengthy permitting processes can significantly delay clean energy projects, impacting investor confidence. Streamlining these processes is essential for accelerating deployment.

- Investing in Workforce Development: The rapid growth of the clean energy sector requires a skilled workforce. Investing in training and education programs is crucial to ensure the US has the necessary talent to meet the demands of this expanding industry.

- International Competition: The global clean energy market is competitive. Maintaining a competitive tax landscape is crucial to attracting investment and preventing the loss of jobs and economic opportunities to other nations.

H2: The Road Ahead: A Call for Strategic Action

The economic potential of clean energy investment in the US is undeniable. However, realizing this potential requires a strategic approach involving comprehensive tax policies that incentivize investment, address equity concerns, and promote innovation. By strengthening existing tax credits, streamlining regulatory processes, and investing in workforce development, the US can unlock the immense economic and environmental benefits of a clean energy future. Further research and ongoing dialogue are essential to refine policy approaches and ensure the sustainable growth of this vital sector. This includes exploring policies that support grid modernization, energy storage solutions, and carbon capture technologies. The future of the US economy, in part, hinges on making the right energy choices today.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Investment And Tax Policy: Economic Opportunities And Challenges For The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Balis Tourism Safety A Need For International Assistance

May 20, 2025

Balis Tourism Safety A Need For International Assistance

May 20, 2025 -

Tornado Watch Lifted In North Texas Dallas Weather Report

May 20, 2025

Tornado Watch Lifted In North Texas Dallas Weather Report

May 20, 2025 -

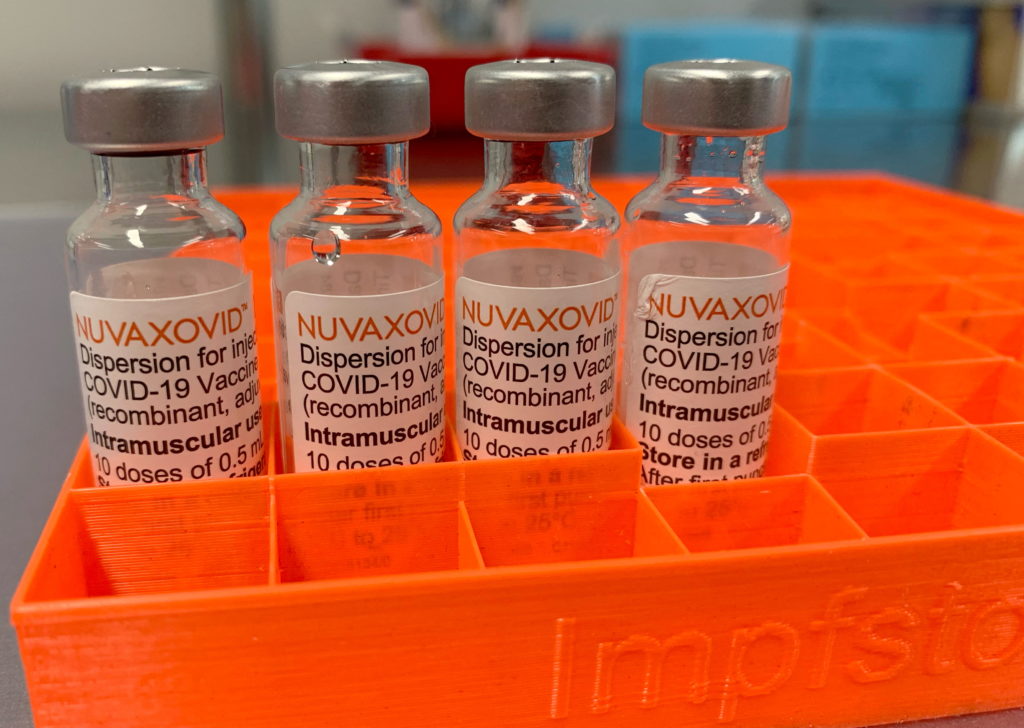

Fda Approves Novavax Covid 19 Vaccine Use Restricted

May 20, 2025

Fda Approves Novavax Covid 19 Vaccine Use Restricted

May 20, 2025 -

Jamie Lee Curtis Defends Lindsay Lohan Shes Always Been Honest With Me

May 20, 2025

Jamie Lee Curtis Defends Lindsay Lohan Shes Always Been Honest With Me

May 20, 2025 -

Beyond The Screen Jamie Lee Curtis On Her Deep Bond With Lindsay Lohan

May 20, 2025

Beyond The Screen Jamie Lee Curtis On Her Deep Bond With Lindsay Lohan

May 20, 2025