Clean Energy Investment And Tax Policy: Economic Implications For The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Investment and Tax Policy: Boosting the US Economy or Busting the Budget?

The United States is at a crossroads. The push for a greener future, fueled by climate concerns and technological advancements, is colliding with complex economic realities. Clean energy investment, driven significantly by tax policies, is shaping the nation's economic landscape, prompting crucial questions about its long-term impact. Will these investments stimulate growth and create jobs, or will they strain the budget and hinder overall economic progress? Let's delve into the intricate relationship between clean energy tax policies and their economic implications for the US.

The Allure of Clean Energy Tax Incentives:

The US government employs a range of tax incentives to encourage investment in clean energy technologies. These include:

- Tax credits for renewable energy: Projects utilizing solar, wind, geothermal, and other renewable sources often qualify for significant tax credits, reducing the upfront cost and making them more financially viable. The Investment Tax Credit (ITC) for solar, for instance, has been a major driver of solar energy adoption.

- Energy efficiency tax credits: Incentives are also available for homeowners and businesses investing in energy-efficient upgrades, such as insulation, high-efficiency appliances, and smart home technologies. These credits not only lower energy bills but also stimulate demand for energy-efficient products.

- Production tax credits: These credits incentivize the domestic production of clean energy technologies, supporting American jobs and reducing reliance on foreign manufacturers. This approach aims to bolster the domestic clean energy industry's competitiveness.

Economic Benefits: A Green Growth Narrative?

Proponents of robust clean energy tax policies argue that the economic benefits far outweigh the costs. They point to:

- Job creation: The clean energy sector is a significant job creator, encompassing manufacturing, installation, maintenance, and research and development. Investments spurred by tax incentives lead to a ripple effect, creating jobs in related industries. Learn more about the (link to a relevant BLS page).

- Technological innovation: Tax incentives foster innovation by reducing the risk associated with developing and deploying new clean energy technologies. This competition leads to improved efficiency, lower costs, and a wider range of options for consumers and businesses.

- Reduced energy dependence: Shifting towards domestic renewable energy sources reduces reliance on volatile global fossil fuel markets, improving national energy security and potentially lowering energy costs in the long run.

- Improved public health: The transition to cleaner energy sources reduces air and water pollution, leading to significant improvements in public health and reduced healthcare costs.

Economic Challenges: Concerns and Criticisms:

However, the picture isn't entirely rosy. Critics raise concerns about:

- Budgetary impact: Significant tax expenditures can strain government budgets, potentially requiring cuts in other crucial areas or increased national debt. Careful analysis of the cost-benefit ratio is essential.

- Distributional effects: The benefits of clean energy tax policies may not be evenly distributed, potentially exacerbating existing economic inequalities. Targeted policies are needed to ensure equitable access to clean energy benefits.

- Market distortions: Excessive subsidies could distort market forces, hindering the natural evolution of the energy sector and potentially leading to inefficiencies. A balanced approach is needed to avoid unintended consequences.

Finding the Right Balance: Policy Considerations for the Future:

Navigating the economic implications of clean energy investment requires a nuanced approach. Effective policymaking necessitates:

- Cost-benefit analysis: Thorough evaluation of the economic costs and benefits of specific tax incentives is paramount. This includes assessing their impact on job creation, budget deficits, and market efficiency.

- Targeted incentives: Focusing incentives on the most promising technologies and regions can maximize their impact while minimizing potential negative consequences.

- Phased implementation: Gradually phasing in incentives can allow the market to adjust and minimize disruptive effects.

- Transparency and accountability: Regularly monitoring and evaluating the effectiveness of tax policies ensures that they achieve their intended goals and are modified as needed.

The future of the US economy is inextricably linked to its approach to clean energy. By carefully considering the economic implications of clean energy investment and tax policy, policymakers can pave the way for a sustainable and prosperous future. The challenge lies in finding the optimal balance between incentivizing clean energy adoption and maintaining economic stability and equity.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Investment And Tax Policy: Economic Implications For The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lady Vols Advance Pickens Stars In Knoxville Regional Semifinal Victory

May 19, 2025

Lady Vols Advance Pickens Stars In Knoxville Regional Semifinal Victory

May 19, 2025 -

Climate Changes Devastating Effect On Maternal Health And Fetal Development

May 19, 2025

Climate Changes Devastating Effect On Maternal Health And Fetal Development

May 19, 2025 -

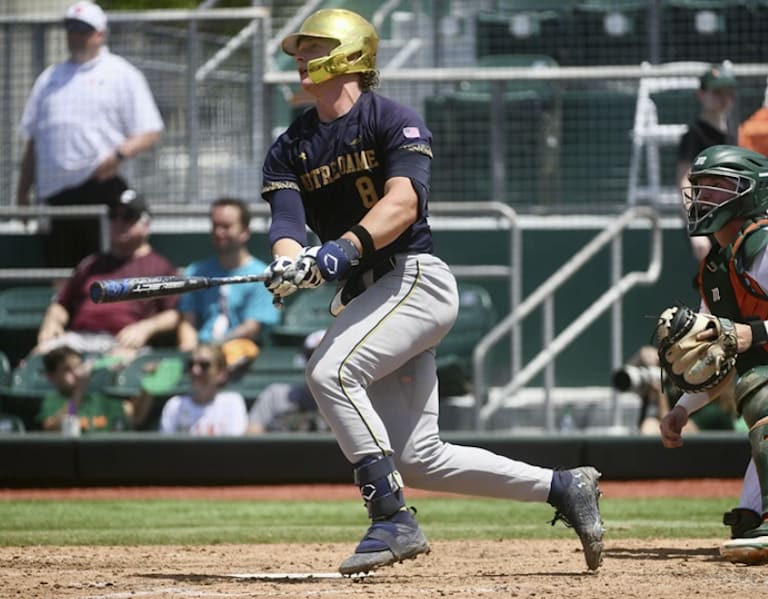

Notre Dame Baseball Secures Miami Series Win Tinneys Impact

May 19, 2025

Notre Dame Baseball Secures Miami Series Win Tinneys Impact

May 19, 2025 -

Lgbtq Rights Take Center Stage As World Pride Meets Trumps Washington

May 19, 2025

Lgbtq Rights Take Center Stage As World Pride Meets Trumps Washington

May 19, 2025 -

Maryland Lottery Results Pick 5 Evening Winning Numbers Sunday

May 19, 2025

Maryland Lottery Results Pick 5 Evening Winning Numbers Sunday

May 19, 2025