Clean Energy Investment And Tax Policy: Boosting Jobs And Economic Competitiveness

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Investment and Tax Policy: Boosting Jobs and Economic Competitiveness

The global shift towards clean energy is no longer a distant prospect; it's a rapidly unfolding reality. This transition presents a monumental opportunity: to create a robust, sustainable economy while combating climate change. A critical component of realizing this potential lies in strategically designed tax policies that incentivize clean energy investment. These policies aren't just about environmental responsibility; they're about boosting job creation, fostering economic competitiveness, and ensuring long-term prosperity.

The Economic Engine of Clean Energy Investment

The clean energy sector is a burgeoning job creator. From manufacturing solar panels and wind turbines to installing smart grids and developing innovative energy storage solutions, the industry demands a skilled workforce across diverse disciplines. According to the International Renewable Energy Agency (IRENA), the renewable energy sector employed over 12 million people globally in 2021, a number projected to grow significantly in the coming years. This growth isn't confined to specialized roles; it encompasses construction, engineering, research, and many supporting industries.

Tax Policies as Catalysts for Growth

Smart tax policies are essential for unlocking the full economic potential of clean energy. Several key strategies can significantly impact investment and job creation:

-

Tax Credits for Renewable Energy Projects: Offering generous tax credits for installing solar panels, wind turbines, and other renewable energy technologies directly reduces the upfront cost for businesses and homeowners. This makes clean energy more accessible and attractive, stimulating demand and driving further investment. Examples include the Investment Tax Credit (ITC) in the United States and similar schemes in the European Union.

-

Accelerated Depreciation for Clean Energy Assets: Allowing businesses to depreciate clean energy assets more rapidly reduces their tax burden and improves their cash flow. This encourages businesses to invest in new technologies and expand their operations, leading to job growth and economic expansion.

-

Tax Incentives for Research and Development: Investing in research and development (R&D) is crucial for innovation in the clean energy sector. Tax credits for R&D expenditure incentivize companies to develop new technologies, leading to breakthroughs that can further reduce costs and improve efficiency.

-

Carbon Pricing Mechanisms: While controversial, carbon pricing mechanisms like carbon taxes or cap-and-trade systems can effectively incentivize emissions reductions. The revenue generated can be reinvested in clean energy initiatives, creating a virtuous cycle of economic growth and environmental protection. Learn more about the effectiveness of carbon pricing from the .

Boosting Economic Competitiveness

Investing in clean energy isn't just about environmental responsibility; it's about securing a competitive edge in the global market. Countries that lead in clean energy technologies and infrastructure will attract foreign investment, create high-paying jobs, and enjoy a competitive advantage in various industries. This includes manufacturing, transportation, and even agriculture, as these sectors become increasingly reliant on sustainable energy sources.

Addressing Challenges and Ensuring Equity

While the benefits of clean energy investment are clear, there are challenges to address. Ensuring equitable access to clean energy technologies and jobs is crucial to avoid exacerbating existing inequalities. Careful planning and targeted support for disadvantaged communities are essential to ensure a just transition to a clean energy economy.

Conclusion: A Sustainable Future, a Prosperous Economy

The convergence of environmental responsibility and economic opportunity presents a compelling case for increased clean energy investment. Strategic tax policies play a pivotal role in unlocking this potential, creating a virtuous cycle of job growth, economic competitiveness, and a healthier planet. By embracing innovative policies and addressing potential challenges proactively, governments can pave the way for a sustainable future and a prosperous economy for all. This is not merely an environmental imperative; it's an economic imperative for the 21st century.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Investment And Tax Policy: Boosting Jobs And Economic Competitiveness. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ncaa Lacrosse Tournament Quarterfinals Tv Schedule Dates And Matchups

May 19, 2025

Ncaa Lacrosse Tournament Quarterfinals Tv Schedule Dates And Matchups

May 19, 2025 -

Trumps Eat The Tariffs Challenge To Walmart Impact On Consumers

May 19, 2025

Trumps Eat The Tariffs Challenge To Walmart Impact On Consumers

May 19, 2025 -

Tributes Pour In Following Death Of My 600 Lb Life Star Latonya Pottain At 40

May 19, 2025

Tributes Pour In Following Death Of My 600 Lb Life Star Latonya Pottain At 40

May 19, 2025 -

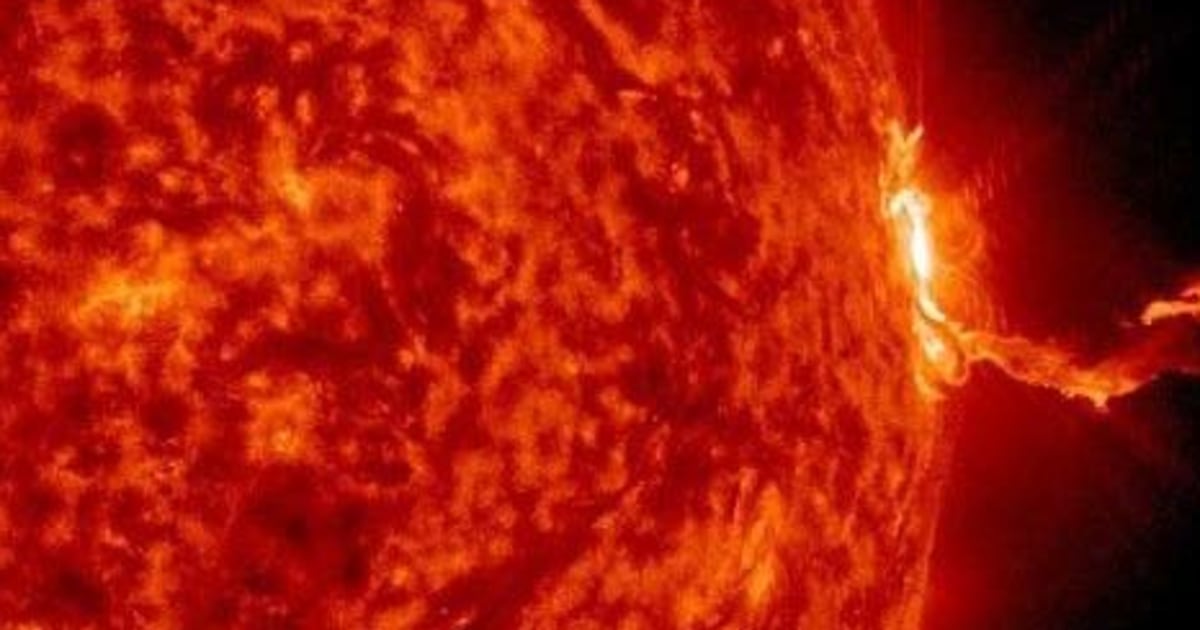

Solar Storm Blackouts Five Continents Affected By Geomagnetic Disturbance

May 19, 2025

Solar Storm Blackouts Five Continents Affected By Geomagnetic Disturbance

May 19, 2025 -

Lgbtq Rights Take Center Stage World Pride Meets Trumps Washington

May 19, 2025

Lgbtq Rights Take Center Stage World Pride Meets Trumps Washington

May 19, 2025