Citizens JMP Weighs In: A Cautious Outlook For CoreWeave (CRWV)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Citizens JMP Weighs In: A Cautious Outlook for CoreWeave (CRWV)

CoreWeave (CRWV), the rapidly growing cloud computing company specializing in high-performance computing (HPC) solutions, recently faced a cautious assessment from analysts at Citizens JMP Securities. This news sent ripples through the market, prompting investors to re-evaluate their positions. Let's delve into the details of this analyst report and its potential implications for CoreWeave's future.

Citizens JMP's Concerns: A Deeper Dive

The analyst report from Citizens JMP expressed concerns about CoreWeave's substantial capital expenditures and its aggressive growth strategy. While acknowledging the company's strong position in the burgeoning HPC market fueled by the rise of AI and machine learning, the analysts highlighted the inherent risks associated with such rapid expansion. Specifically, they pointed to:

- High Capital Expenditures: CoreWeave's significant investments in infrastructure to meet growing demand raise concerns about profitability in the short term. The report suggests that these costs might outweigh revenue gains for a considerable period.

- Competitive Landscape: The HPC market is becoming increasingly competitive, with established players and new entrants vying for market share. Citizens JMP emphasizes the need for CoreWeave to maintain its innovative edge and differentiate itself effectively.

- Potential for Slowdown: The analysts caution that the current rate of growth might not be sustainable in the long run, hinting at the possibility of a slowdown in revenue growth.

Market Reaction and Investor Sentiment

The release of the Citizens JMP report resulted in a notable dip in CoreWeave's stock price. Investor sentiment appears to be shifting from bullish optimism to a more cautious approach, reflecting the analysts' concerns about the company's financial trajectory. Many investors are now carefully weighing the long-term potential against the short-term risks associated with CoreWeave.

CoreWeave's Response and Future Outlook

CoreWeave has yet to issue an official response to the Citizens JMP report. However, the company’s continued investments in research and development and expansion into new markets suggest a commitment to long-term growth. The success of their strategy will depend on their ability to manage costs effectively, secure significant contracts, and maintain a competitive advantage in the rapidly evolving HPC landscape.

Analyzing the Long-Term Potential

Despite the cautious outlook, the long-term prospects for CoreWeave remain promising. The increasing demand for HPC resources driven by AI and machine learning presents a significant opportunity for growth. CoreWeave’s unique approach and focus on sustainability could also give them a competitive edge. The key will be navigating the challenges highlighted by Citizens JMP and demonstrating sustained profitability.

Conclusion: A Time for Cautious Optimism?

The Citizens JMP report serves as a timely reminder that even rapidly growing companies face challenges. While the long-term potential for CoreWeave (CRWV) in the HPC market remains substantial, investors should approach the stock with a degree of caution, carefully considering the risks associated with its aggressive growth strategy and high capital expenditures. Further analysis and monitoring of the company's financial performance are crucial for informed investment decisions. This situation underscores the importance of due diligence and a nuanced understanding of the market before committing capital. Staying informed about future developments and analyst reports will be key for navigating this evolving situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Citizens JMP Weighs In: A Cautious Outlook For CoreWeave (CRWV). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Outperforming Palantir 3 Promising Ai Stocks To Consider

May 28, 2025

Outperforming Palantir 3 Promising Ai Stocks To Consider

May 28, 2025 -

French Presidents Plane Incident What Really Happened Between The Macrons

May 28, 2025

French Presidents Plane Incident What Really Happened Between The Macrons

May 28, 2025 -

Is Rain In The Forecast Central Florida Memorial Day Weather Outlook

May 28, 2025

Is Rain In The Forecast Central Florida Memorial Day Weather Outlook

May 28, 2025 -

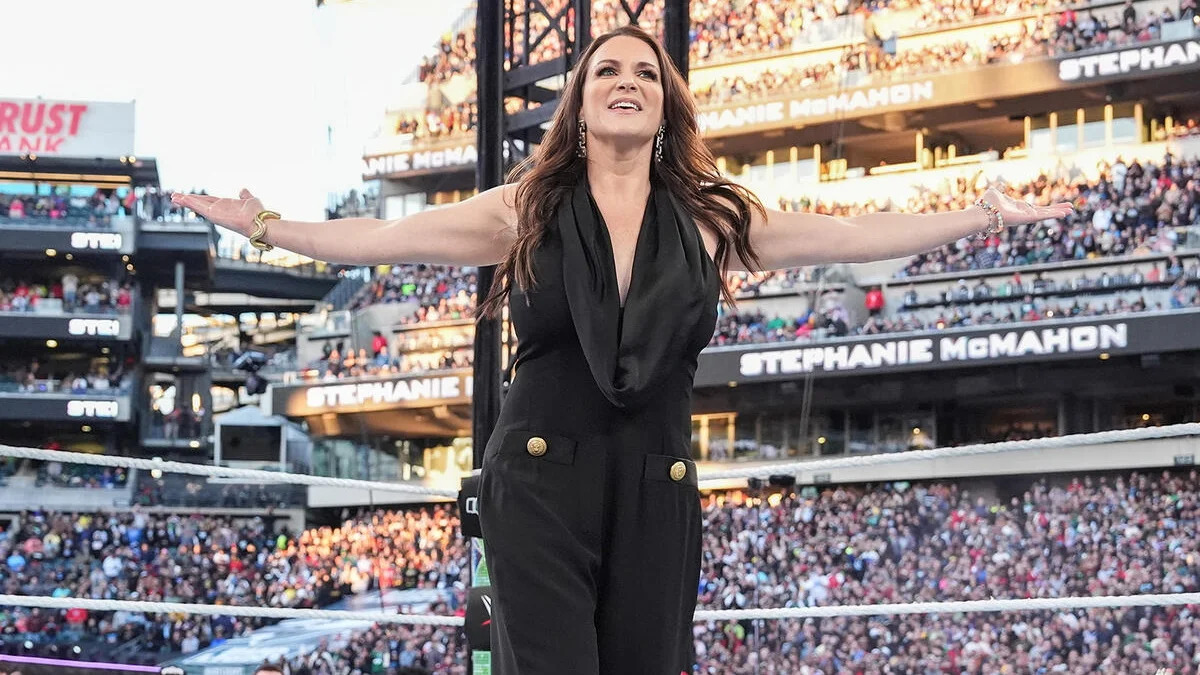

Stephanie Mc Mahon Reveals Her Biggest Tattoo Regret A Wwe Insiders Perspective

May 28, 2025

Stephanie Mc Mahon Reveals Her Biggest Tattoo Regret A Wwe Insiders Perspective

May 28, 2025 -

The Tattoo Stephanie Mc Mahon Almost Got And Why Shes Relieved She Didnt

May 28, 2025

The Tattoo Stephanie Mc Mahon Almost Got And Why Shes Relieved She Didnt

May 28, 2025