Chinese EV Maker NIO's Q1 2024 Earnings Preview: What To Expect

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chinese EV Maker NIO's Q1 2024 Earnings Preview: What to Expect

Chinese electric vehicle (EV) manufacturer NIO is poised to release its first-quarter 2024 earnings report, a crucial moment for investors watching the company's performance in a fiercely competitive market. The announcement will provide vital insights into NIO's progress, its strategies for navigating challenges, and its future outlook. This preview examines key areas investors will be scrutinizing.

NIO's Q1 2024: A Battleground of Expectations

The first quarter of 2024 is significant for NIO, as it reflects the company's performance following a period of intense competition and market fluctuations. Analysts and investors will be keenly interested in several key performance indicators (KPIs):

-

Vehicle Deliveries: The number of vehicles delivered will be a primary focus. Any significant deviation from analysts' predictions will heavily influence market sentiment. Strong delivery numbers will signal robust demand and effective marketing strategies. Conversely, a shortfall could indicate challenges in production, supply chains, or market competition.

-

Revenue Growth: Sustained revenue growth is crucial for NIO's long-term viability. Investors will assess whether the company is successfully translating vehicle deliveries into increased revenue, considering factors like pricing strategies and sales mix. A substantial increase would demonstrate strong market position and financial health.

-

Gross Margin: Maintaining a healthy gross margin is essential for profitability. This metric reflects the efficiency of NIO's operations and its ability to manage costs amidst fluctuating raw material prices and competitive pressures. A shrinking gross margin could spark concern among investors.

-

Operating Expenses: Controlling operating expenses is paramount for NIO's profitability. Investors will analyze whether the company is efficiently managing research and development (R&D) spending, marketing costs, and general administrative expenses. This will be particularly crucial given the ongoing investments in new technologies and market expansion.

-

New Model Launches and Market Expansion: NIO's strategic approach to launching new EV models and expanding into new markets will be under the microscope. Any updates on new product launches or international expansion plans will significantly impact investor confidence.

Challenges Facing NIO in Q1 2024

NIO faces several key challenges in the current market environment:

-

Intense Competition: The Chinese EV market is incredibly competitive, with established players like BYD and new entrants constantly vying for market share. NIO needs to demonstrate its competitive edge in terms of technology, design, and customer experience.

-

Supply Chain Disruptions: Global supply chain challenges continue to affect the automotive industry. NIO's ability to manage potential disruptions and ensure a stable supply of components will be a crucial factor influencing its Q1 performance.

-

Economic Uncertainty: Global economic uncertainty can influence consumer spending on luxury goods like EVs. NIO's ability to navigate this economic climate and maintain strong demand for its vehicles will be critical.

What to Expect from NIO's Q1 2024 Earnings Report:

While predicting the exact figures is impossible, analysts generally expect a mixed bag. While delivery numbers might show some growth, margins could be under pressure due to competition and economic factors. The key will be NIO's guidance for the rest of 2024, showcasing its long-term strategy and confidence in overcoming current market hurdles. Investors will also be looking for clear indications of NIO's commitment to innovation and its plans for maintaining a leading position in the increasingly crowded Chinese EV market. The report will undoubtedly offer crucial insights into the company's trajectory and its future potential.

Call to Action: Stay tuned for our comprehensive coverage of NIO's Q1 2024 earnings release and analysis. Follow us for the latest updates on the Chinese EV market and its key players. [Link to your website/social media]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chinese EV Maker NIO's Q1 2024 Earnings Preview: What To Expect. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Look New Game Marquez Discusses Changes Before India Thailand Match

Jun 04, 2025

New Look New Game Marquez Discusses Changes Before India Thailand Match

Jun 04, 2025 -

Nio Q1 2024 Revenue Up 21 A Detailed Look At The Numbers

Jun 04, 2025

Nio Q1 2024 Revenue Up 21 A Detailed Look At The Numbers

Jun 04, 2025 -

650 Million Soccer Stadium Planned For The 78 A Chicago Fire Development

Jun 04, 2025

650 Million Soccer Stadium Planned For The 78 A Chicago Fire Development

Jun 04, 2025 -

Amy Jones And Tammy Beaumonts Hundreds Lead England To Victory Against West Indies

Jun 04, 2025

Amy Jones And Tammy Beaumonts Hundreds Lead England To Victory Against West Indies

Jun 04, 2025 -

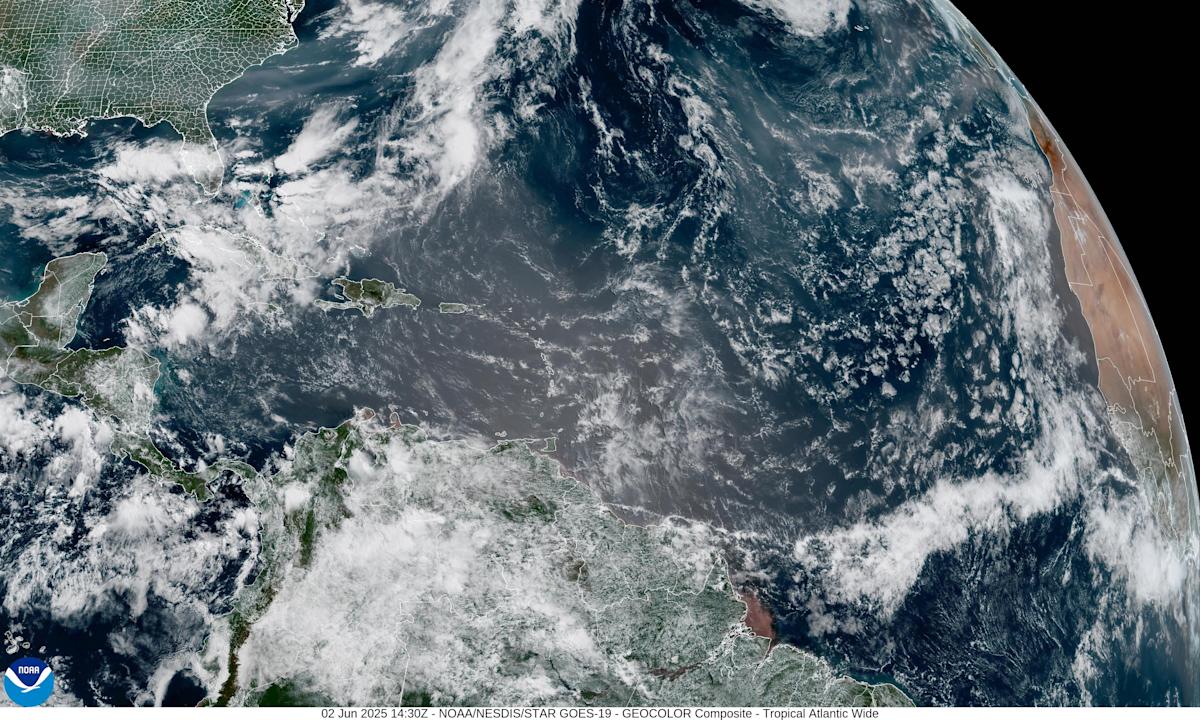

Floridas Air Quality Crisis The Impact Of Saharan Dust And Canadian Wildfires

Jun 04, 2025

Floridas Air Quality Crisis The Impact Of Saharan Dust And Canadian Wildfires

Jun 04, 2025