Chinese EV Maker NIO's Q1 2024 Earnings Preview: A Deep Dive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chinese EV Maker NIO's Q1 2024 Earnings Preview: A Deep Dive

NIO, the innovative Chinese electric vehicle (EV) manufacturer, is gearing up to release its Q1 2024 earnings report, a moment eagerly awaited by investors and industry analysts alike. This preview delves into the key factors that will shape NIO's performance and what we can expect to see in the upcoming announcement. The report will offer crucial insights into the company's progress amidst a rapidly evolving global EV market and intense competition.

Key Expectations for NIO's Q1 2024 Earnings:

Several factors will significantly influence NIO's Q1 2024 results. Analysts are keenly focused on:

-

Vehicle Deliveries: The number of EVs delivered will be a primary indicator of NIO's performance. Strong delivery figures will signal healthy demand and successful market penetration, while a slowdown could raise concerns. Recent industry reports suggest a mixed bag for Chinese EV makers in Q1, making NIO's numbers particularly important. Expect detailed breakdowns by model to reveal consumer preferences and market trends.

-

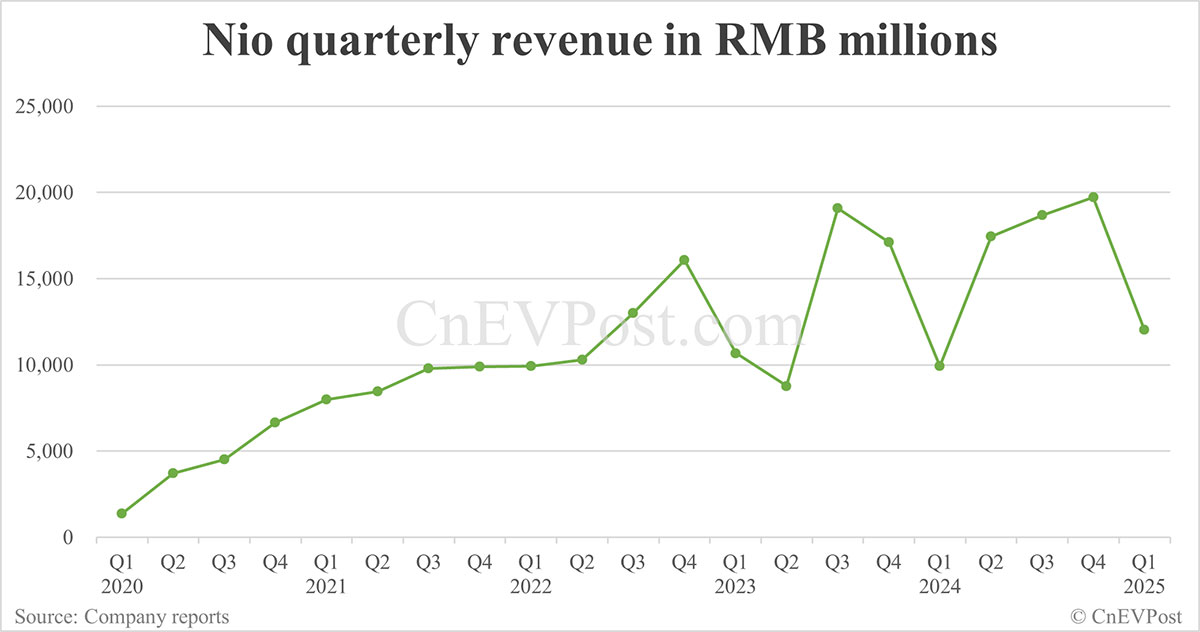

Revenue Growth: Sustained revenue growth is crucial for NIO's long-term viability. Analysts will scrutinize the revenue figures to assess the effectiveness of the company's pricing strategies and overall sales performance. Growth in this area will be vital to demonstrate NIO's continued strength in the competitive Chinese EV market.

-

Gross Margin: Maintaining healthy gross margins is essential for profitability. Factors such as raw material costs, production efficiency, and pricing strategies will significantly impact this metric. A strong gross margin will demonstrate NIO's ability to manage costs effectively and maintain its competitiveness.

-

New Model Launches & Market Expansion: Any updates on the rollout of new models or expansion into new markets will be closely watched. NIO's ability to innovate and expand its reach is critical for future growth. Announcements of new technologies or strategic partnerships will also influence investor sentiment.

-

Battery Swap Program Performance: NIO's innovative battery swap program is a key differentiator. The performance of this program, in terms of adoption and utilization rates, will be closely monitored. Strong performance here will underscore the program's effectiveness and its contribution to NIO's overall success.

Challenges and Opportunities for NIO:

NIO faces several challenges, including:

-

Intense Competition: The Chinese EV market is fiercely competitive, with both domestic and international players vying for market share. NIO needs to differentiate itself through innovation, superior technology, and a strong brand image.

-

Supply Chain Disruptions: Global supply chain issues can impact production and delivery timelines, posing a risk to NIO's operational efficiency.

-

Economic Slowdown: The global economic climate and potential slowdowns in China could affect consumer spending and demand for EVs.

However, NIO also enjoys several opportunities:

-

Growing EV Market: The overall demand for electric vehicles continues to grow rapidly, presenting a significant opportunity for expansion.

-

Technological Innovation: NIO's commitment to technological innovation, particularly in areas like battery technology and autonomous driving, positions it favorably for future growth.

-

Government Support: The Chinese government's support for the development of the domestic EV industry provides a favorable regulatory environment for NIO.

What to Watch For:

Investors should pay close attention to the company's guidance for the remainder of 2024. This will provide insight into NIO's future expectations and strategic direction. Any updates on research and development initiatives, particularly in the area of autonomous driving, will also be closely scrutinized.

NIO's Q1 2024 earnings report will be a pivotal moment for the company. The results will offer a clear picture of its performance and provide valuable insights into its prospects for the rest of the year. Stay tuned for further updates following the official release. You can typically find the latest financial information on NIO's .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chinese EV Maker NIO's Q1 2024 Earnings Preview: A Deep Dive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Warehouse Lease Secured Mayor Spencer Addresses St Louis Donation Logistics

Jun 04, 2025

Warehouse Lease Secured Mayor Spencer Addresses St Louis Donation Logistics

Jun 04, 2025 -

Explosion On Crimea Bridge A Deep Dive Into The Event And Its Fallout

Jun 04, 2025

Explosion On Crimea Bridge A Deep Dive Into The Event And Its Fallout

Jun 04, 2025 -

Steelers Practice Fallout Beanie Bishop Defaces Pitt Logo

Jun 04, 2025

Steelers Practice Fallout Beanie Bishop Defaces Pitt Logo

Jun 04, 2025 -

Strong Q1 2024 For Nio Revenue Up 21 Year Over Year

Jun 04, 2025

Strong Q1 2024 For Nio Revenue Up 21 Year Over Year

Jun 04, 2025 -

Successions Mountainhead Unmasking The Real Life Tech Billionaires

Jun 04, 2025

Successions Mountainhead Unmasking The Real Life Tech Billionaires

Jun 04, 2025