Chinese EV Maker NIO's Q1 2024 Earnings Preview

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO's Q1 2024 Earnings Preview: Can the Chinese EV Giant Maintain Momentum?

Chinese electric vehicle (EV) maker NIO is gearing up to release its Q1 2024 earnings, and investors are eagerly awaiting the results. The company, known for its premium EVs and battery-as-a-service (BaaS) model, has faced a challenging market landscape in recent months, marked by intense competition and fluctuating consumer demand. This preview delves into the key factors that will shape NIO's performance and what investors should watch for.

NIO's Recent Performance: A Mixed Bag

NIO's 2023 performance was a mixed bag. While the company delivered impressive sales figures in certain quarters, it also struggled with supply chain disruptions and increased competition from established players like BYD and newer entrants. The overall market sentiment surrounding Chinese EVs has also been impacted by macroeconomic factors and evolving government policies. This makes NIO's Q1 2024 earnings all the more crucial.

Key Metrics to Watch in NIO's Q1 2024 Earnings Report:

-

Vehicle Deliveries: The number of vehicles delivered will be a key indicator of NIO's market share and overall growth. Analysts will be closely scrutinizing this figure to gauge the effectiveness of NIO's sales strategies and product appeal. Any significant deviation from expectations will likely trigger market reactions.

-

Revenue Growth: Sustained revenue growth is critical for NIO's long-term sustainability. Investors will be looking for evidence that the company is effectively managing costs while increasing sales volume. A strong revenue performance will signal robust demand and efficient operations.

-

Gross Margin: NIO's gross margin will reflect its pricing strategy and manufacturing efficiency. Maintaining a healthy gross margin is vital for profitability, particularly in a competitive market. Any significant compression of the margin will raise concerns about pricing pressure and operational challenges.

-

Battery-as-a-Service (BaaS) Performance: NIO's BaaS model is a key differentiator. Its performance – including subscription numbers and revenue generated – will provide insights into the model's viability and market acceptance. Strong BaaS growth would signal a successful long-term strategy.

-

Guidance for Q2 2024 and Beyond: NIO's future outlook, including delivery guidance for the upcoming quarter, will be crucial for investors. Positive guidance will likely boost investor confidence, while cautious or negative guidance could lead to market sell-offs.

Challenges and Opportunities for NIO in 2024:

NIO faces several challenges in 2024, including:

- Intense Competition: The Chinese EV market is fiercely competitive, with numerous established and emerging players vying for market share.

- Economic Uncertainty: Macroeconomic factors and global economic slowdown could impact consumer spending on luxury EVs.

- Supply Chain Issues: Persisting supply chain disruptions could affect production and delivery timelines.

However, NIO also has significant opportunities:

- New Product Launches: The launch of new models and upgrades to existing vehicles could drive sales growth.

- Expansion into New Markets: Exploring new international markets could unlock significant growth potential.

- Technological Innovation: Continued investment in R&D and technological advancements will be crucial for maintaining a competitive edge.

Conclusion: A Crucial Quarter for NIO

NIO's Q1 2024 earnings will be a significant event for the company and its investors. The results will provide crucial insights into its performance amidst a dynamic and challenging market. While the company faces headwinds, its innovative approach and strong brand recognition could help it navigate the complexities of the Chinese EV market. Keep an eye out for the official release and subsequent analyst commentary for a comprehensive understanding of NIO's future trajectory. Stay tuned for further updates as the earnings announcement draws closer. For more information on the Chinese EV market, explore resources like [link to relevant news source or industry report].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chinese EV Maker NIO's Q1 2024 Earnings Preview. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Miley Cyrus Relationship With Billy Cyrus Flourishing A Source Weighs In

Jun 03, 2025

Is Miley Cyrus Relationship With Billy Cyrus Flourishing A Source Weighs In

Jun 03, 2025 -

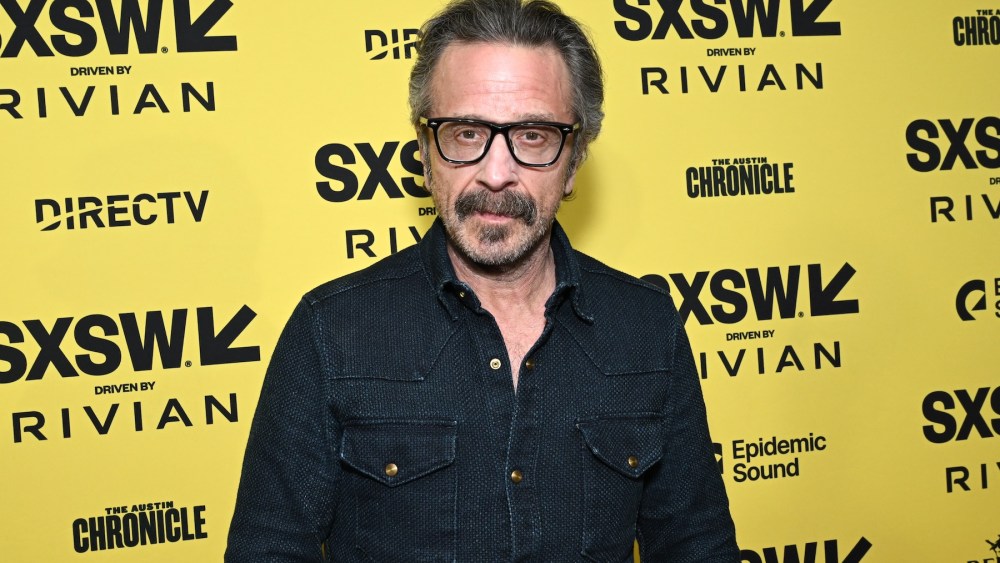

The End Of An Era Marc Marons Wtf Podcast Signs Off After 16 Years

Jun 03, 2025

The End Of An Era Marc Marons Wtf Podcast Signs Off After 16 Years

Jun 03, 2025 -

Popular Podcast Wtf With Marc Maron Set To Conclude Its Run

Jun 03, 2025

Popular Podcast Wtf With Marc Maron Set To Conclude Its Run

Jun 03, 2025 -

Hims And Hers Health Hims Stock Performance A Comprehensive Overview

Jun 03, 2025

Hims And Hers Health Hims Stock Performance A Comprehensive Overview

Jun 03, 2025 -

Double Trouble Trumps Tariff Increase Sparks Economic Warnings

Jun 03, 2025

Double Trouble Trumps Tariff Increase Sparks Economic Warnings

Jun 03, 2025