Chinese EV Maker NIO: Q1 2024 Earnings And The Tariff Question

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chinese EV Maker NIO: Q1 2024 Earnings and the Tariff Question – A Storm Brewing?

NIO, the prominent Chinese electric vehicle (EV) manufacturer, recently released its Q1 2024 earnings, sending ripples through the already volatile EV market. While the numbers themselves presented a mixed bag, the looming shadow of potential US tariffs casts a significant pall over the company's future prospects. This article delves into NIO's Q1 performance, analyzes the key takeaways, and explores the implications of the ongoing tariff debate.

NIO Q1 2024 Earnings: A Closer Look

NIO reported [insert actual Q1 2024 figures here, including vehicle deliveries, revenue, net income/loss, and any other key financial metrics]. While [mention positive aspects of the earnings report, e.g., increased vehicle deliveries compared to the previous quarter or year], several challenges remain. [Highlight negative aspects, such as lower-than-expected revenue or persistent losses]. These figures are crucial for understanding the company's current financial health and its ability to compete in the increasingly competitive global EV market. Analysts [cite analyst opinions and predictions, linking to relevant financial news sources].

The Tariff Tightrope: A Major Headwind

The elephant in the room, however, is the ongoing uncertainty surrounding potential US tariffs on Chinese EVs. The current administration is considering [explain the current status of the tariff discussions and the potential impact on NIO]. This uncertainty creates significant challenges for NIO, which has ambitions of expanding its market share in North America. Increased tariffs would dramatically increase the price of NIO vehicles in the US, making them less competitive against established players like Tesla and other emerging EV brands.

What does this mean for NIO's future?

The combination of a mixed Q1 earnings report and the looming tariff threat presents a complex scenario for NIO. The company needs to:

- Strategically navigate the US market: This could involve lobbying efforts to mitigate the impact of potential tariffs, focusing on building strong partnerships, or adjusting its pricing strategy.

- Strengthen its domestic market position: A robust Chinese market presence will be crucial to offset any potential setbacks in the US.

- Continue innovation: Investing in R&D to develop cutting-edge technologies and improve battery technology is vital for maintaining a competitive edge.

The Broader EV Landscape

NIO's challenges are not unique. The global EV market is experiencing significant shifts, with intense competition, supply chain disruptions, and fluctuating raw material prices all impacting profitability. Other Chinese EV manufacturers, such as [mention competitors like XPeng or Li Auto], are facing similar headwinds. [Link to articles discussing the broader EV market trends].

Conclusion: Navigating Uncertainty

NIO's Q1 2024 earnings and the looming tariff question highlight the complexities facing Chinese EV makers attempting to penetrate the global market. The company's ability to navigate these challenges, adapt its strategies, and capitalize on emerging opportunities will be crucial in determining its long-term success. Only time will tell whether NIO can weather this storm and emerge as a major player in the global EV race. Stay tuned for further updates and analysis.

Keywords: NIO, Chinese EV, electric vehicle, Q1 2024 earnings, US tariffs, EV market, Tesla, XPeng, Li Auto, Chinese EV makers, EV competition, NIO stock, NIO future, global EV market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chinese EV Maker NIO: Q1 2024 Earnings And The Tariff Question. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraine Accuses Russia New Underwater Drone Attack On Crimean Bridge

Jun 03, 2025

Ukraine Accuses Russia New Underwater Drone Attack On Crimean Bridge

Jun 03, 2025 -

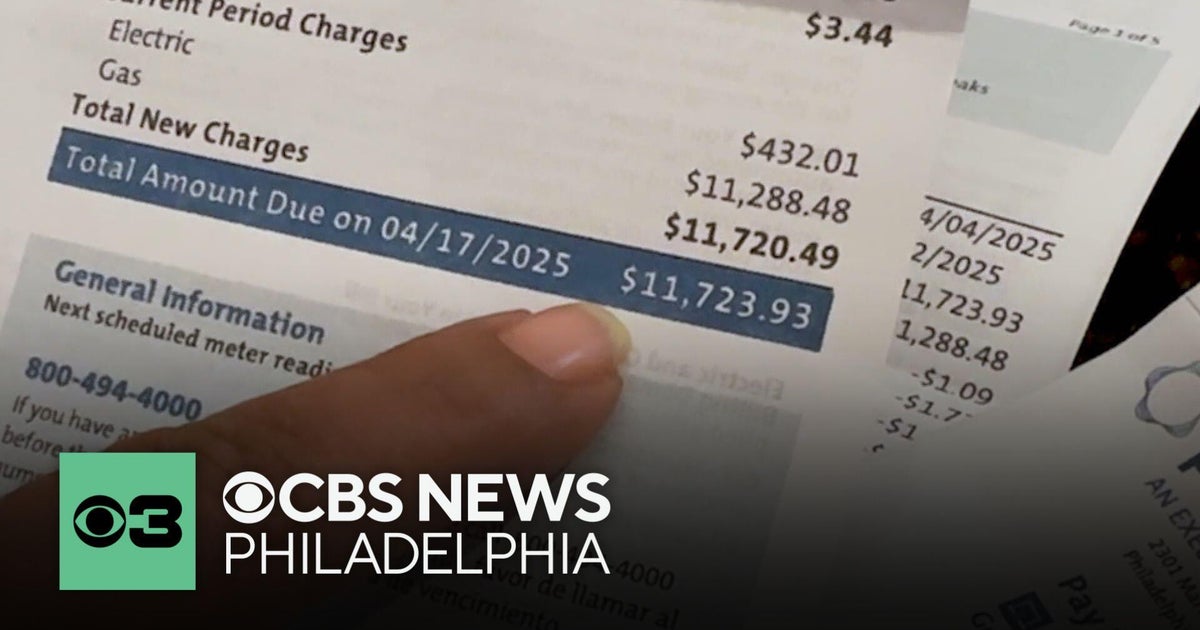

Peco Billing Glitch Results In 12 000 Bill For Pennsylvania Resident

Jun 03, 2025

Peco Billing Glitch Results In 12 000 Bill For Pennsylvania Resident

Jun 03, 2025 -

Tractor Accident Slows But Doesnt Stop Roseanne Barrs Texas Life

Jun 03, 2025

Tractor Accident Slows But Doesnt Stop Roseanne Barrs Texas Life

Jun 03, 2025 -

Miley Cyrus On Growing Up A Shifting Perspective On Family

Jun 03, 2025

Miley Cyrus On Growing Up A Shifting Perspective On Family

Jun 03, 2025 -

Patti Lu Pone Faces Backlash Hundreds Of Broadway Artists Speak Out Against Racialized Disrespect

Jun 03, 2025

Patti Lu Pone Faces Backlash Hundreds Of Broadway Artists Speak Out Against Racialized Disrespect

Jun 03, 2025