China Trade Talks: Jim Cramer's Analysis And 10 Stocks To Consider

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

China Trade Talks: Jim Cramer's Analysis and 10 Stocks to Consider

The ongoing saga of US-China trade relations continues to send shockwaves through global markets. Investors are anxiously watching for any sign of progress or escalation, leaving many wondering how to navigate this complex landscape. Famed CNBC host Jim Cramer has weighed in, offering his insights and suggesting specific stocks to consider amidst the uncertainty. Let's delve into his analysis and explore ten stocks that might warrant a closer look.

Cramer's Cautious Optimism:

Jim Cramer, known for his outspoken opinions and market analysis, has expressed a degree of cautious optimism regarding the latest round of China trade talks. He acknowledges the inherent volatility and risks involved but believes that a resolution, while not guaranteed, remains a possibility. His analysis centers on the potential benefits of a de-escalation, highlighting the positive impact it could have on certain sectors and individual companies. However, he also stresses the need for investors to remain vigilant and diversify their portfolios to mitigate potential downsides. [Link to a relevant CNBC article featuring Cramer's comments].

Sectors to Watch:

Cramer's assessment points to several sectors that stand to benefit significantly from a positive resolution in the trade dispute. These include:

- Technology: Companies heavily reliant on the Chinese market, particularly those involved in semiconductors and software, could experience a significant boost in revenue and profitability.

- Agriculture: The agricultural sector, which has been heavily impacted by tariffs, could see a significant rebound if trade tensions ease.

- Retail: Retailers that source goods from China or sell goods in China could see improved supply chains and increased sales.

10 Stocks to Consider (Based on Cramer's Insights and Market Trends):

While Cramer hasn't explicitly endorsed a specific list of 10 stocks, considering his analysis and broader market trends, here are ten companies representing diverse sectors that may be worth investigating. Remember, this is not financial advice, and thorough due diligence is crucial before making any investment decisions.

- Apple (AAPL): Heavily reliant on Chinese manufacturing and sales.

- Nike (NKE): Significant manufacturing and sales presence in China.

- Intel (INTC): Key player in the semiconductor industry.

- Qualcomm (QCOM): Another significant player in the semiconductor industry with exposure to China.

- ** Deere & Company (DE):** Major agricultural equipment manufacturer.

- Caterpillar (CAT): Heavy machinery manufacturer with global operations, including in China.

- Walmart (WMT): Significant sourcing and sales in China.

- Starbucks (SBUX): Large presence in the Chinese market.

- Coca-Cola (KO): Global beverage giant with substantial operations in China.

- LVMH Moët Hennessy Louis Vuitton SE (LVMUY): Luxury goods company with significant presence in the Chinese market.

Disclaimer: This list is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions.

Navigating the Uncertainty:

The ongoing US-China trade talks remain a source of significant market volatility. While Cramer's analysis offers a valuable perspective, investors must approach the situation with caution. Diversification, risk management, and thorough due diligence are crucial when making investment decisions in this uncertain environment. Staying informed about the latest developments and engaging in thoughtful analysis are key to navigating this dynamic landscape successfully.

What are your thoughts on the US-China trade situation? Share your insights in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on China Trade Talks: Jim Cramer's Analysis And 10 Stocks To Consider. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hilaria Baldwins Accusation A List Actresss Nasty And Untrue Lies

May 10, 2025

Hilaria Baldwins Accusation A List Actresss Nasty And Untrue Lies

May 10, 2025 -

Report Bill Belichicks Girlfriend Jordon Hudson Prohibited From Unc Football Games

May 10, 2025

Report Bill Belichicks Girlfriend Jordon Hudson Prohibited From Unc Football Games

May 10, 2025 -

Pope Francis Successor Is Cardinal Luis Antonio Gokim Tagle The Favorite

May 10, 2025

Pope Francis Successor Is Cardinal Luis Antonio Gokim Tagle The Favorite

May 10, 2025 -

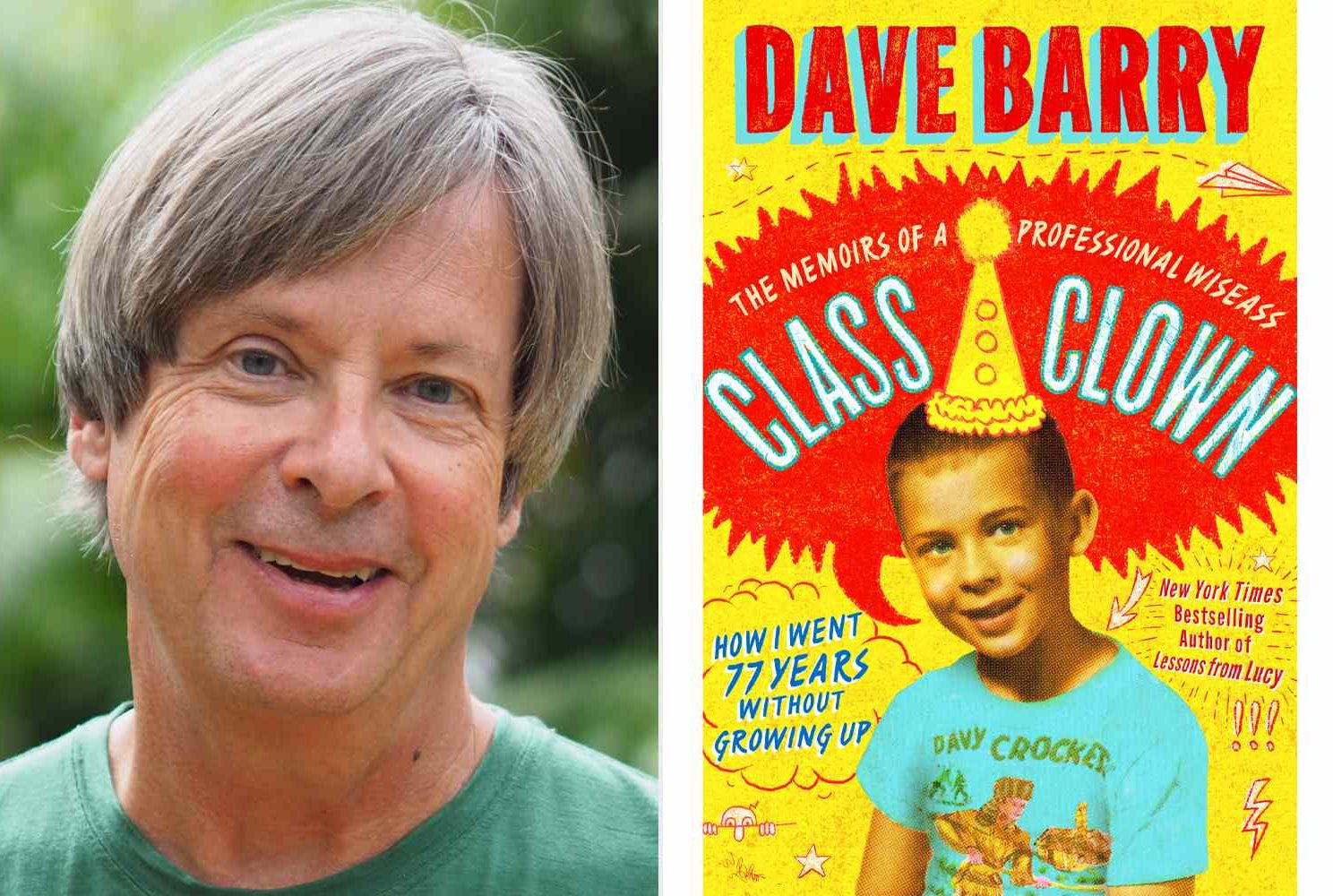

Dont Miss Dave Barry And Angie Corio At Keplers May 12

May 10, 2025

Dont Miss Dave Barry And Angie Corio At Keplers May 12

May 10, 2025 -

Nyt Spelling Bee Solutions Game 431 May 8 2025

May 10, 2025

Nyt Spelling Bee Solutions Game 431 May 8 2025

May 10, 2025