China Tariffs: JPMorgan's Dimon Sounds Alarm On US Economic Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

China Tariffs: JPMorgan's Dimon Sounds Alarm on US Economic Strategy

JPMorgan Chase CEO Jamie Dimon has issued a stark warning about the long-term economic consequences of the ongoing US-China trade war, specifically highlighting the detrimental impact of tariffs. His comments, delivered during a recent earnings call, underscore growing concerns among business leaders about the sustainability of the current US economic strategy towards China. The impact, Dimon argues, extends far beyond simple trade deficits and touches upon broader geopolitical and economic stability.

Dimon's alarm isn't new; many economists have voiced similar concerns. However, coming from the head of one of the world's largest financial institutions, his words carry significant weight and amplify the existing debate surrounding US-China trade relations. The ongoing tariffs, originally implemented under the Trump administration and partially retained under the Biden administration, have been a major point of contention, impacting businesses and consumers alike.

The High Cost of Tariffs: More Than Just Prices

The immediate impact of tariffs is clear: increased prices for consumers. However, Dimon argues that the long-term costs are far more significant and less immediately apparent. These include:

- Reduced competitiveness: US companies face higher production costs, making them less competitive in both domestic and international markets. This can lead to job losses and decreased economic growth.

- Supply chain disruptions: The reliance on China for certain goods and components has made US supply chains vulnerable. Tariffs exacerbate these vulnerabilities, leading to shortages and increased uncertainty.

- Geopolitical tensions: The trade war has heightened tensions between the US and China, impacting overall global stability and investor confidence. This uncertainty makes long-term planning and investment more challenging.

- Retaliatory tariffs: China's retaliatory tariffs on US goods have further damaged US businesses and farmers. This tit-for-tat escalation only serves to deepen the economic harm.

Dimon's concerns highlight a broader issue: the need for a more nuanced and strategic approach to US-China relations. Simply slapping tariffs on imported goods is, he implies, a blunt instrument that inflicts collateral damage on the US economy.

Beyond Tariffs: A Need for a More Strategic Approach

The debate extends beyond the immediate impact of tariffs. Experts are calling for a more comprehensive strategy that addresses the underlying issues driving the trade imbalance, including intellectual property rights, technology transfer, and market access. This requires a more sophisticated approach than simply imposing tariffs.

Finding a solution will require:

- Open communication and diplomacy: Reducing tensions and fostering dialogue between the two economic giants is crucial.

- Targeted interventions: Addressing specific concerns through targeted negotiations rather than broad tariffs could prove more effective.

- Investment in domestic industries: Strengthening US manufacturing and technology sectors to reduce reliance on China is essential for long-term economic resilience.

- Diversification of supply chains: Reducing dependence on a single supplier, like China, is key to mitigating future disruptions.

Dimon’s statement serves as a significant call to action. It emphasizes the need for a reevaluation of the current US economic strategy towards China, urging policymakers to consider the far-reaching consequences of their actions. The long-term economic health of the US may depend on finding a more sustainable and less confrontational path forward. The question remains: will policymakers heed this warning? Only time will tell.

Keywords: China tariffs, US-China trade war, Jamie Dimon, JPMorgan Chase, economic consequences, supply chain disruptions, geopolitical tensions, trade relations, US economic strategy, retaliatory tariffs, global economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on China Tariffs: JPMorgan's Dimon Sounds Alarm On US Economic Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dte Energy Faces Scrutiny From Detroit Official Over High Prices And Outages

Jun 02, 2025

Dte Energy Faces Scrutiny From Detroit Official Over High Prices And Outages

Jun 02, 2025 -

Mc Larens Piastri Steals Pole From Norris At The 2025 Spanish Grand Prix

Jun 02, 2025

Mc Larens Piastri Steals Pole From Norris At The 2025 Spanish Grand Prix

Jun 02, 2025 -

Adulting 101 Miley Cyruss Take On Billy Ray Cyrus Dating Elizabeth Hurley

Jun 02, 2025

Adulting 101 Miley Cyruss Take On Billy Ray Cyrus Dating Elizabeth Hurley

Jun 02, 2025 -

Us China Trade War Jamie Dimons Warning On Tariffs And Economic Fallout

Jun 02, 2025

Us China Trade War Jamie Dimons Warning On Tariffs And Economic Fallout

Jun 02, 2025 -

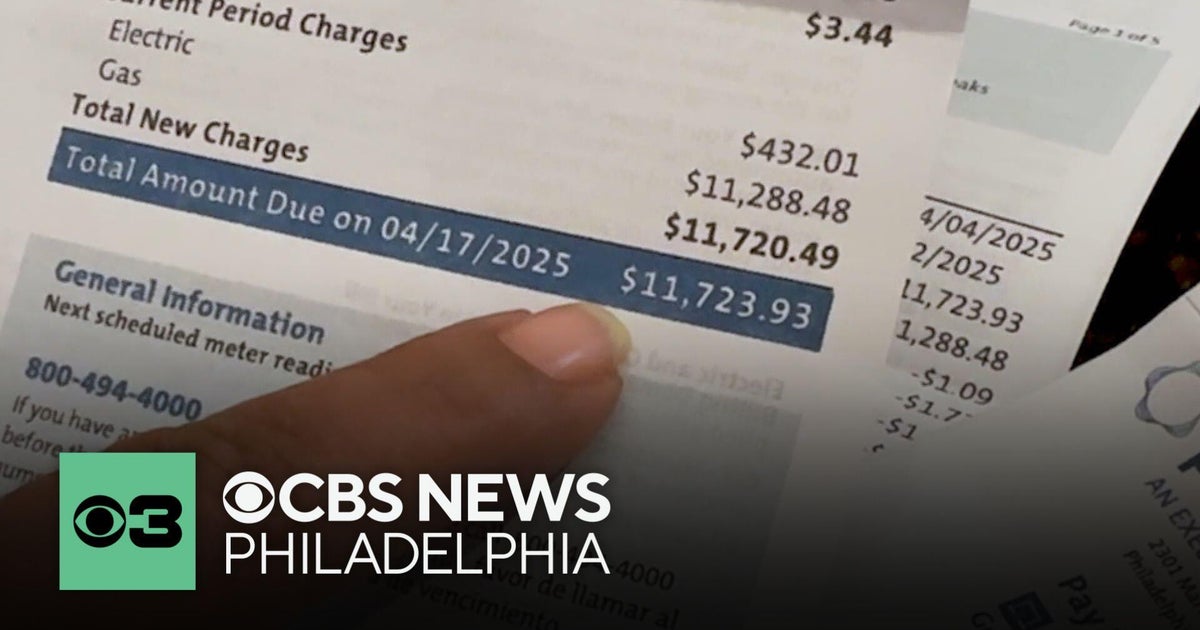

12 000 Peco Bill Customers Shock After Months Without A Statement

Jun 02, 2025

12 000 Peco Bill Customers Shock After Months Without A Statement

Jun 02, 2025