China Tariffs: Jamie Dimon's Direct Warning To The United States

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

China Tariffs: Jamie Dimon's Stark Warning to the United States

JP Morgan Chase CEO Jamie Dimon's recent comments on the potential economic fallout from continued US-China tariffs have sent shockwaves through financial markets. His direct warning highlights the significant risks these trade policies pose to the American economy, urging a more nuanced approach to trade relations with the world's second-largest economy.

Dimon's concerns aren't new; the ongoing trade war between the US and China has been a source of considerable uncertainty for businesses and investors globally. However, his prominent position and the weight of his words amplify the urgency of the situation. He's not just expressing concerns; he's issuing a stark warning about the potential for significant economic damage.

The Dire Consequences of Escalated Tariffs:

Dimon's warning centers on the ripple effects of sustained tariffs. He argues that these tariffs aren't simply a burden on specific industries; they have the potential to destabilize the entire US economy. His concerns are rooted in several key areas:

-

Inflationary Pressures: Tariffs increase the cost of imported goods, leading to higher prices for consumers. This can fuel inflation, potentially eroding purchasing power and slowing economic growth. This inflationary impact is particularly concerning given the current economic climate.

-

Supply Chain Disruptions: The complex global supply chains connecting the US and China are vulnerable to disruption from tariffs. Companies may relocate production to avoid tariffs, leading to job losses in the US and potentially impacting the competitiveness of American businesses.

-

Retaliatory Measures: China's retaliatory tariffs on American goods further exacerbate the problem, impacting US exports and potentially leading to a decline in American jobs. This tit-for-tat escalation could lead to a prolonged and damaging trade war.

-

Investor Uncertainty: The ongoing uncertainty surrounding US-China trade relations creates a climate of fear among investors, hindering investment and economic growth. This uncertainty makes it difficult for businesses to plan for the future, leading to hesitancy and potentially slowing down expansion and hiring.

A Call for a More Strategic Approach:

Dimon's message isn't simply a criticism of current policies; it's a call for a more strategic and nuanced approach to trade with China. He advocates for a more measured and less confrontational strategy that prioritizes long-term economic stability over short-term gains from protectionist measures. This might involve:

-

Targeted Tariffs: Instead of broad-based tariffs, a more strategic approach would involve targeting specific industries or products where there are genuine concerns about unfair trade practices.

-

Increased Dialogue: Open communication and diplomatic efforts are crucial to de-escalating tensions and finding mutually beneficial solutions.

-

Focus on Domestic Competitiveness: Rather than relying solely on protectionist measures, the US should invest in strengthening its domestic industries to enhance competitiveness in the global marketplace.

The Broader Implications:

Dimon's warning carries significant weight, not just for the US economy but for the global economy as a whole. The US-China relationship is crucial for global stability, and continued escalation of trade tensions poses a significant threat to international economic growth. This underscores the need for a more cooperative and less confrontational approach to resolving trade disputes.

Conclusion:

Jamie Dimon's direct warning serves as a powerful reminder of the significant risks associated with escalating US-China trade tensions. His call for a more strategic and less confrontational approach highlights the need for a reassessment of current policies and a renewed commitment to finding mutually beneficial solutions. The long-term economic health of the United States, and indeed the global economy, depends on it. The question remains: will policymakers heed this urgent warning?

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on China Tariffs: Jamie Dimon's Direct Warning To The United States. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dimon Highlights Key Priority For Trump Administration In Turbulent Times

Jun 02, 2025

Dimon Highlights Key Priority For Trump Administration In Turbulent Times

Jun 02, 2025 -

Spanish Grand Prix Front Row Lockout For Mc Laren Verstappen Lurks

Jun 02, 2025

Spanish Grand Prix Front Row Lockout For Mc Laren Verstappen Lurks

Jun 02, 2025 -

Tensions Rise Rep Nadlers Aide Arrested At New York Federal Building

Jun 02, 2025

Tensions Rise Rep Nadlers Aide Arrested At New York Federal Building

Jun 02, 2025 -

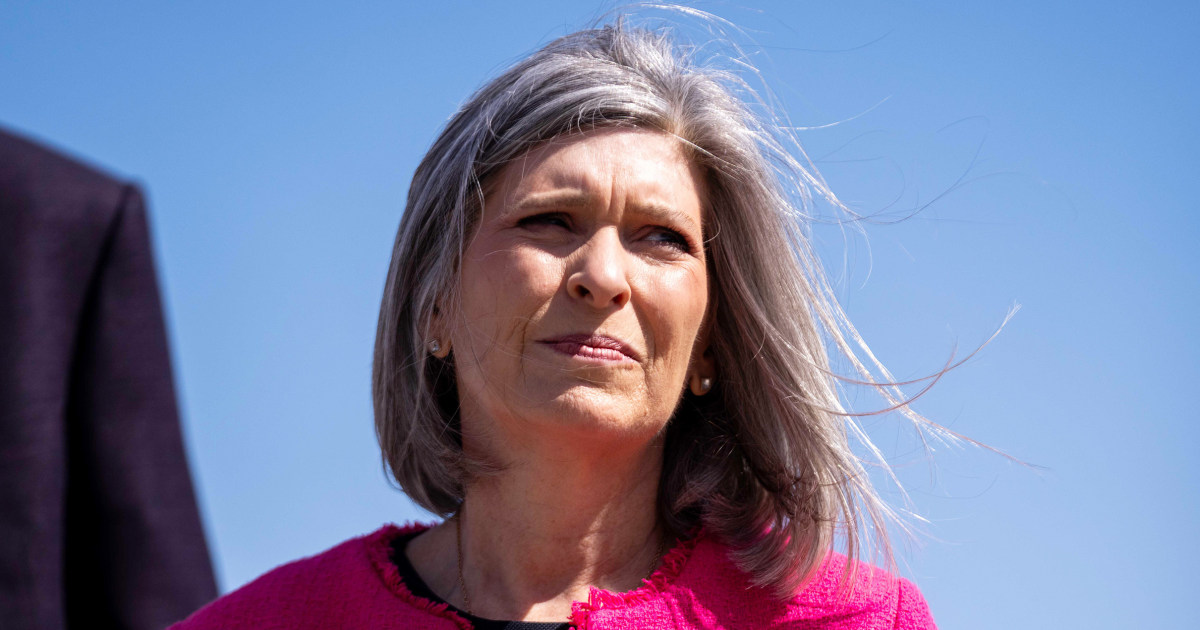

Ernsts We All Die Comment A Closer Look At The Proposed Medicaid Cuts

Jun 02, 2025

Ernsts We All Die Comment A Closer Look At The Proposed Medicaid Cuts

Jun 02, 2025 -

Dte Energy Facing Scrutiny From Detroit Official Over Rising Costs And Outages

Jun 02, 2025

Dte Energy Facing Scrutiny From Detroit Official Over Rising Costs And Outages

Jun 02, 2025