China Tariffs And The US Economy: Jamie Dimon's Direct Warning To American Businesses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

China Tariffs and the US Economy: Jamie Dimon's Stark Warning to American Businesses

Introduction: JPMorgan Chase CEO Jamie Dimon recently issued a stark warning regarding the lingering effects of China tariffs on the US economy, urging American businesses to prepare for continued uncertainty and potential long-term consequences. His comments, delivered during a time of escalating geopolitical tensions, highlight the ongoing debate surrounding the impact of trade policies on American prosperity. This article delves into Dimon's concerns, exploring the wider implications for businesses and the US economy.

Dimon's Dire Prediction: Dimon's warning wasn't subtle. He didn't mince words when discussing the lingering effects of the trade war with China. He emphasized that the tariffs, while initially intended to protect American industries, have had a ripple effect throughout the economy, impacting supply chains, increasing costs for consumers, and creating uncertainty for businesses planning for the future. His message: businesses need to adapt and plan for a prolonged period of economic instability related to US-China trade relations.

The Lingering Impact of Tariffs: The impact of tariffs extends far beyond simple import costs. Several key areas are significantly affected:

-

Supply Chain Disruptions: Tariffs forced many companies to diversify their supply chains, moving away from China and seeking alternative sources. This process is costly and time-consuming, impacting productivity and potentially harming long-term relationships with established suppliers.

-

Increased Inflation: Tariffs directly increase the cost of imported goods, contributing to inflation. This inflationary pressure impacts consumers' purchasing power and can lead to decreased consumer spending, slowing economic growth.

-

Reduced Competitiveness: American businesses facing higher input costs due to tariffs become less competitive in both domestic and international markets. This can lead to job losses and reduced economic output.

-

Geopolitical Uncertainty: The ongoing tension between the US and China creates significant geopolitical uncertainty. This uncertainty makes it difficult for businesses to make long-term investments and strategic decisions, hindering economic growth.

Beyond the Immediate Impact: Dimon's warning goes beyond the immediate economic impacts. He points to the potential for long-term damage to the US-China relationship, highlighting the risk of a decoupling of the two economies. Such a decoupling would have profound implications for global trade and could significantly reshape the global economic landscape. This scenario, while not inevitable, underscores the gravity of the situation.

What Businesses Can Do: In light of Dimon's warning, American businesses need to proactively address the challenges posed by the ongoing trade tensions:

-

Diversify Supply Chains: Companies should continue diversifying their supply chains to mitigate risks associated with relying heavily on a single source, particularly China.

-

Invest in Technology and Automation: Investing in automation and technology can help improve efficiency and offset rising labor and material costs.

-

Focus on Innovation: Developing innovative products and services can help businesses remain competitive in a challenging economic environment.

-

Engage in Strategic Planning: Businesses must develop robust strategic plans that account for various scenarios, including prolonged trade tensions.

Conclusion: Jamie Dimon's warning serves as a crucial wake-up call for American businesses. The lingering effects of China tariffs are not to be underestimated. Proactive adaptation and strategic planning are essential for navigating the complexities of the current geopolitical landscape and ensuring long-term success in a world marked by evolving US-China relations. Ignoring these warnings could have significant consequences for the future of American businesses and the broader US economy. Understanding these risks and preparing accordingly is paramount for survival and thriving in the years to come. Staying informed about developments in US-China trade relations is crucial for all businesses operating in the global market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on China Tariffs And The US Economy: Jamie Dimon's Direct Warning To American Businesses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is The Nio Stock Dip A Buying Opportunity Ahead Of Q1 Results

Jun 03, 2025

Is The Nio Stock Dip A Buying Opportunity Ahead Of Q1 Results

Jun 03, 2025 -

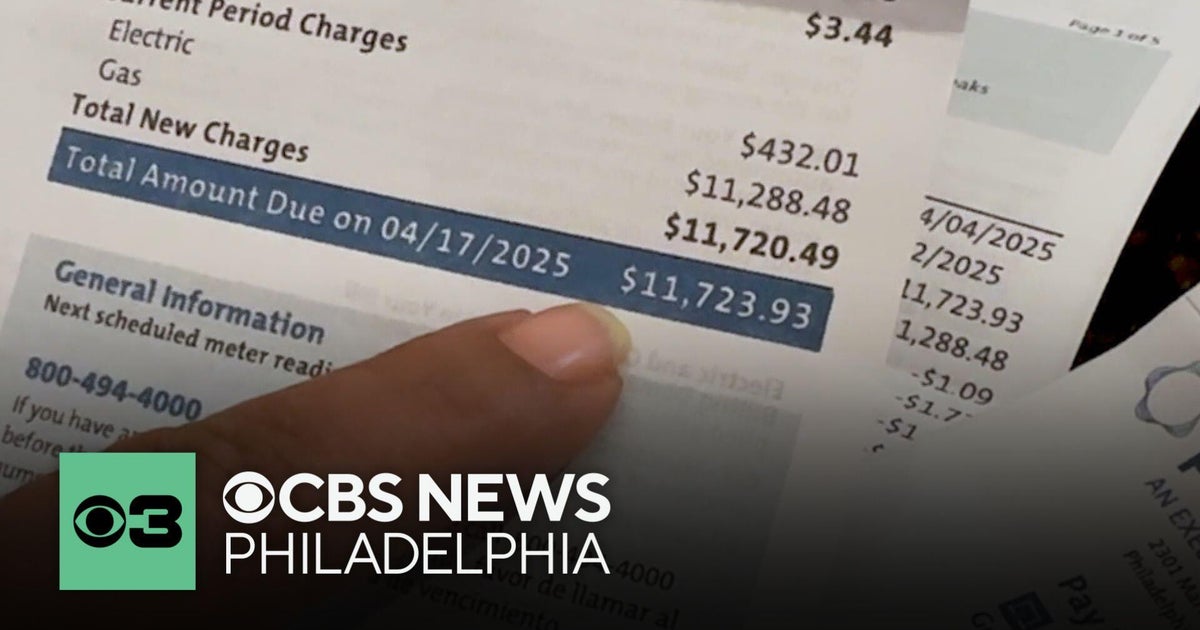

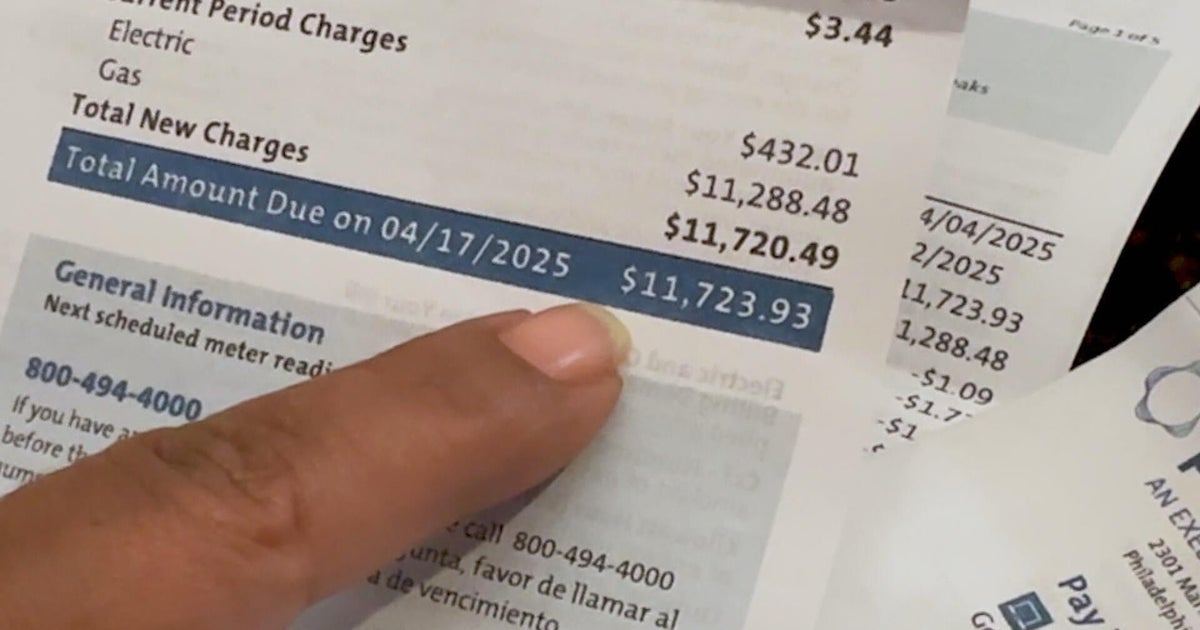

Massive Peco Bill Customer Faces 12 000 Charge After Months Of Omissions

Jun 03, 2025

Massive Peco Bill Customer Faces 12 000 Charge After Months Of Omissions

Jun 03, 2025 -

Should You Buy Nio Stock After Its Q1 Earnings Report

Jun 03, 2025

Should You Buy Nio Stock After Its Q1 Earnings Report

Jun 03, 2025 -

Nio Q1 Earnings Report Assessing Delivery Growth Amidst Rising Tariff Concerns

Jun 03, 2025

Nio Q1 Earnings Report Assessing Delivery Growth Amidst Rising Tariff Concerns

Jun 03, 2025 -

Philadelphia Residents Face Peco Billing Chaos Months Without Bills Then A 12 000 Surprise

Jun 03, 2025

Philadelphia Residents Face Peco Billing Chaos Months Without Bills Then A 12 000 Surprise

Jun 03, 2025