Check Today's Mortgage Refinance Rates (May 19, 2025)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Check Today's Mortgage Refinance Rates (May 19, 2025): Is Refinancing Right for You?

Are you paying more for your mortgage than you need to? With interest rates constantly fluctuating, today, May 19th, 2025, could be the perfect time to explore mortgage refinance rates and potentially save thousands of dollars over the life of your loan. This article will break down current rates, the benefits of refinancing, and what you need to consider before making a decision.

Current Mortgage Refinance Rates (May 19, 2025): A Snapshot

Unfortunately, providing precise, real-time mortgage refinance rates on a specific date like May 19th, 2025, in this article is impossible. Mortgage rates are incredibly dynamic and change constantly based on numerous economic factors. To get the most up-to-date information, you'll need to consult several reputable sources.

Here's where you can find current rates:

- Major Financial Institutions: Check the websites of large banks and mortgage lenders like Bank of America, Wells Fargo, Chase, and Rocket Mortgage. They often display their current rates prominently.

- Mortgage Brokers: Independent mortgage brokers can compare rates from multiple lenders, saving you the time and effort of doing it yourself. They often have access to rates not publicly advertised.

- Online Mortgage Rate Calculators: Numerous websites offer mortgage rate calculators that provide estimates based on your specific financial situation. Be cautious, though; these are estimates, not guarantees.

Is Refinancing Right for You? Key Factors to Consider:

Before you jump into refinancing, carefully weigh the pros and cons. Here are some crucial points:

- Current Interest Rate vs. Your Current Rate: The most significant factor is whether current rates are significantly lower than your existing mortgage rate. A substantial difference justifies the closing costs.

- Closing Costs: Remember that refinancing involves fees, including appraisal fees, lender fees, and title insurance. These costs can eat into your savings. Make sure the potential savings outweigh these expenses.

- Loan Term: Consider shortening your loan term to pay off your mortgage faster, despite potentially higher monthly payments. Or, choose a longer term for lower monthly payments.

- Your Credit Score: A higher credit score typically qualifies you for better rates. Check your credit report before applying to ensure accuracy and identify areas for improvement. .

- Your Equity: You'll generally need a certain amount of equity in your home to refinance successfully.

Types of Mortgage Refinancing:

Several refinancing options exist, each with its own advantages and disadvantages:

- Rate-and-Term Refinance: This lowers your interest rate and/or shortens your loan term.

- Cash-Out Refinance: This allows you to borrow against your home's equity, providing you with cash for home improvements, debt consolidation, or other expenses. Proceed with caution as you are increasing your overall debt.

- No-Cash-Out Refinance: This allows you to lower your interest rate without borrowing additional funds.

The Bottom Line:

Checking today's mortgage refinance rates is a smart financial move, especially in a fluctuating market. However, careful consideration of your individual financial situation, including your credit score, current interest rate, and equity, is paramount. Don't hesitate to consult with a financial advisor or mortgage professional before making a decision. Remember, the information provided here is for general guidance only and shouldn't be considered financial advice.

Call to Action: Explore your refinancing options today by contacting a reputable lender or mortgage broker. Your future financial well-being might depend on it!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Check Today's Mortgage Refinance Rates (May 19, 2025). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

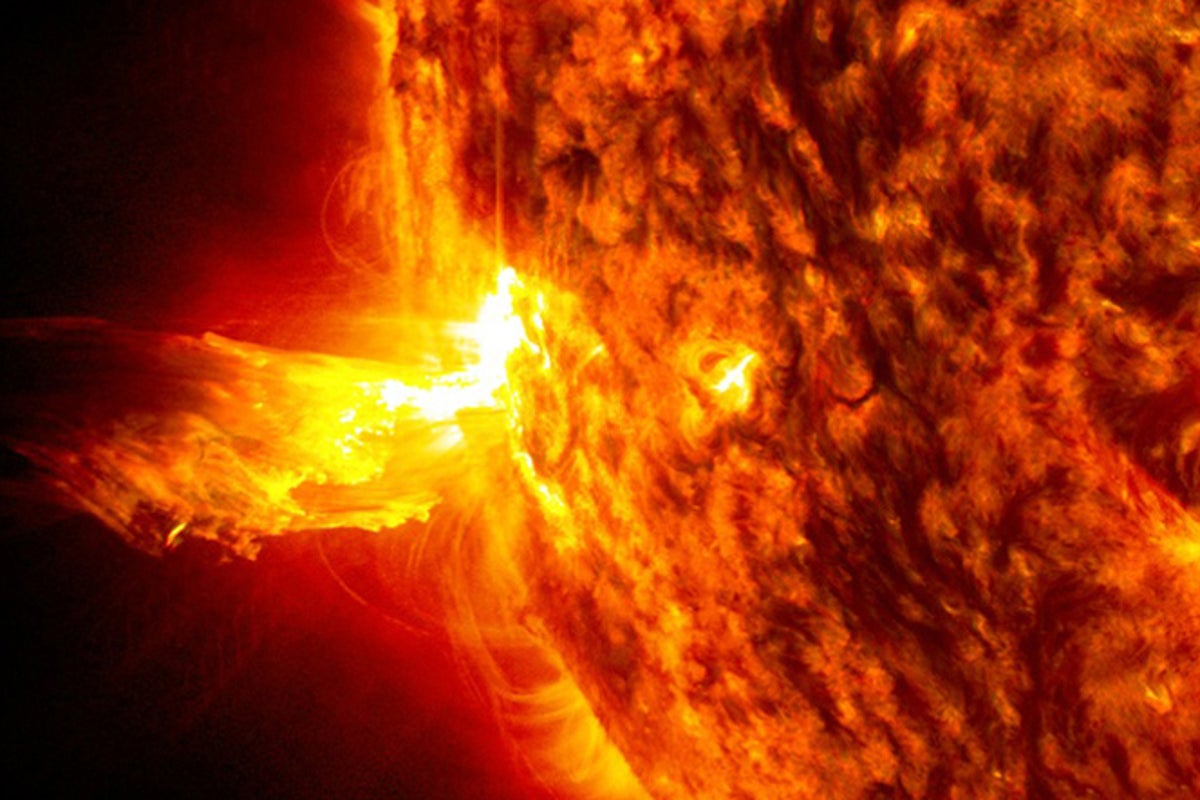

Massive Solar Flares Nasa Predicts Potential Power Grid Failures

May 19, 2025

Massive Solar Flares Nasa Predicts Potential Power Grid Failures

May 19, 2025 -

An Open Letter From Vladimir Coufal To The West Ham Family

May 19, 2025

An Open Letter From Vladimir Coufal To The West Ham Family

May 19, 2025 -

Sudden Death Of Runner Casts Shadow Over Brooklyn Half Marathon

May 19, 2025

Sudden Death Of Runner Casts Shadow Over Brooklyn Half Marathon

May 19, 2025 -

Lgbtq Rights Take Center Stage As World Pride Meets Trumps Washington

May 19, 2025

Lgbtq Rights Take Center Stage As World Pride Meets Trumps Washington

May 19, 2025 -

Pga Opening Leading Players Struggle With Unforeseen Challenges

May 19, 2025

Pga Opening Leading Players Struggle With Unforeseen Challenges

May 19, 2025