CEO Addresses Robinhood's Recent Trading Halt And Customer Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood CEO Addresses Trading Halt, Calming Customer Concerns

Robinhood's recent trading halt sparked outrage and uncertainty among its users. Now, CEO Vlad Tenev has addressed the situation directly, attempting to quell growing concerns and restore faith in the popular trading app.

The unexpected trading restrictions imposed by Robinhood on January 28th, 2021, during the GameStop trading frenzy, sent shockwaves through the financial world and left many users feeling betrayed. The company's decision to temporarily halt trading in certain stocks, including GameStop, AMC Entertainment, and others, drew intense criticism, accusations of market manipulation, and calls for increased regulatory oversight. The move prompted investigations by several regulatory bodies and sparked a national conversation about the democratization of investing and the power of retail traders.

Tenev's Response and Explanations

In a recent blog post and subsequent interviews, CEO Vlad Tenev acknowledged the significant impact of the trading halt on Robinhood's users. He explained the decision was driven by a need to meet the requirements of the clearinghouses that handle the financial transactions processed by Robinhood. These clearinghouses demanded that Robinhood increase its collateral – essentially, a cash reserve – to cover potential losses arising from the volatile trading activity surrounding the "meme stocks."

Tenev stated that the unprecedented demand and volatility overwhelmed the system, forcing Robinhood to take swift action to ensure its financial stability. He emphasized that the decision was made to protect the company and its users from potential bankruptcy, highlighting the significant financial risks involved.

Addressing Customer Concerns: Transparency and Future Improvements

The CEO's statement focused heavily on regaining the trust of Robinhood's user base. He addressed several key customer concerns:

- Lack of Transparency: Tenev admitted the communication surrounding the trading halt could have been significantly improved, acknowledging the frustration caused by the lack of immediate explanation. He pledged to enhance communication protocols in future events.

- Fairness and Equity: The CEO directly addressed the perception of unfairness, emphasizing that the trading restrictions were applied equally across all affected users, regardless of their account size or trading history. He also reiterated Robinhood's commitment to promoting fair and equitable access to the markets for all its users.

- System Improvements: Robinhood announced significant investments in infrastructure upgrades to prevent similar events in the future. This includes bolstering its capital reserves and improving its risk management systems to better handle periods of extreme volatility.

The Broader Implications and Future of Retail Investing

The Robinhood trading halt highlighted crucial issues within the current financial system, including:

- The Role of Clearinghouses: The incident brought increased scrutiny to the role and power of clearinghouses in regulating market activity.

- Regulatory Oversight: The events sparked renewed debate about the need for stronger regulatory oversight of online brokerage platforms and the potential for conflicts of interest.

- The Power of Retail Investors: The "meme stock" phenomenon demonstrated the growing influence of retail investors and the potential for collective action to impact market dynamics.

The Robinhood situation serves as a stark reminder of the complexities of modern finance and the challenges faced by both established institutions and new entrants in the rapidly evolving world of online trading. While Tenev's attempts at damage control are underway, the long-term impact of the trading halt on Robinhood's reputation and the broader landscape of retail investing remains to be seen. Further investigations and regulatory actions are expected to shape the future of the industry.

What are your thoughts on Robinhood's handling of the situation? Share your opinion in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CEO Addresses Robinhood's Recent Trading Halt And Customer Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Netanyahu Announces Evacuation Plan As Israeli Strikes Kill 25 In Gaza

Aug 16, 2025

Netanyahu Announces Evacuation Plan As Israeli Strikes Kill 25 In Gaza

Aug 16, 2025 -

Increased Light Exposure Risks To Eye Health

Aug 16, 2025

Increased Light Exposure Risks To Eye Health

Aug 16, 2025 -

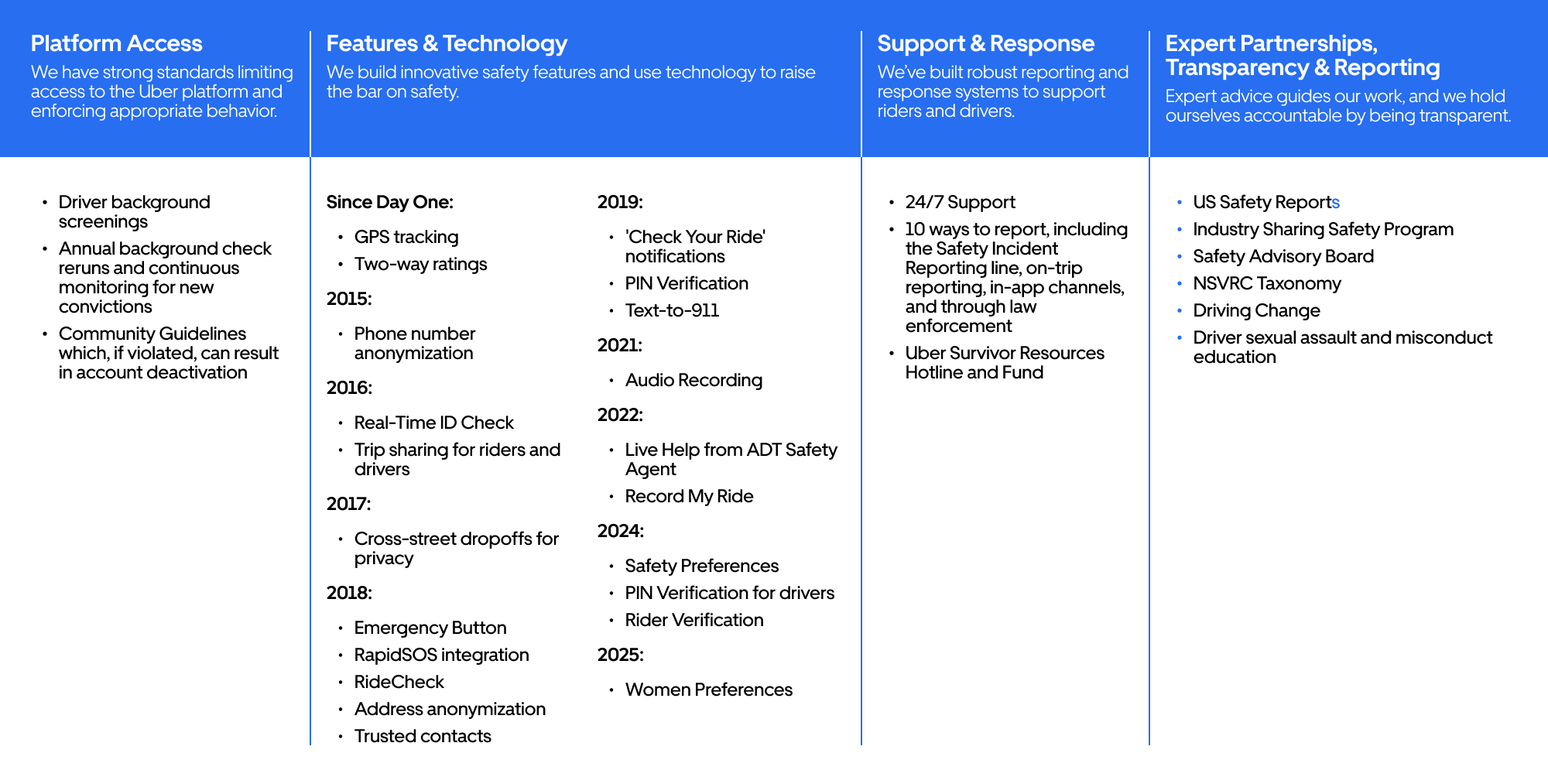

Is Uber Safe A Look At The Companys Safety Data

Aug 16, 2025

Is Uber Safe A Look At The Companys Safety Data

Aug 16, 2025 -

Can Trump Take Control Of Police Forces Beyond D C Legal Analysis And Implications

Aug 16, 2025

Can Trump Take Control Of Police Forces Beyond D C Legal Analysis And Implications

Aug 16, 2025 -

Trump Administration Considers Marijuana Reclassification What It Means For Indiana

Aug 16, 2025

Trump Administration Considers Marijuana Reclassification What It Means For Indiana

Aug 16, 2025

Latest Posts

-

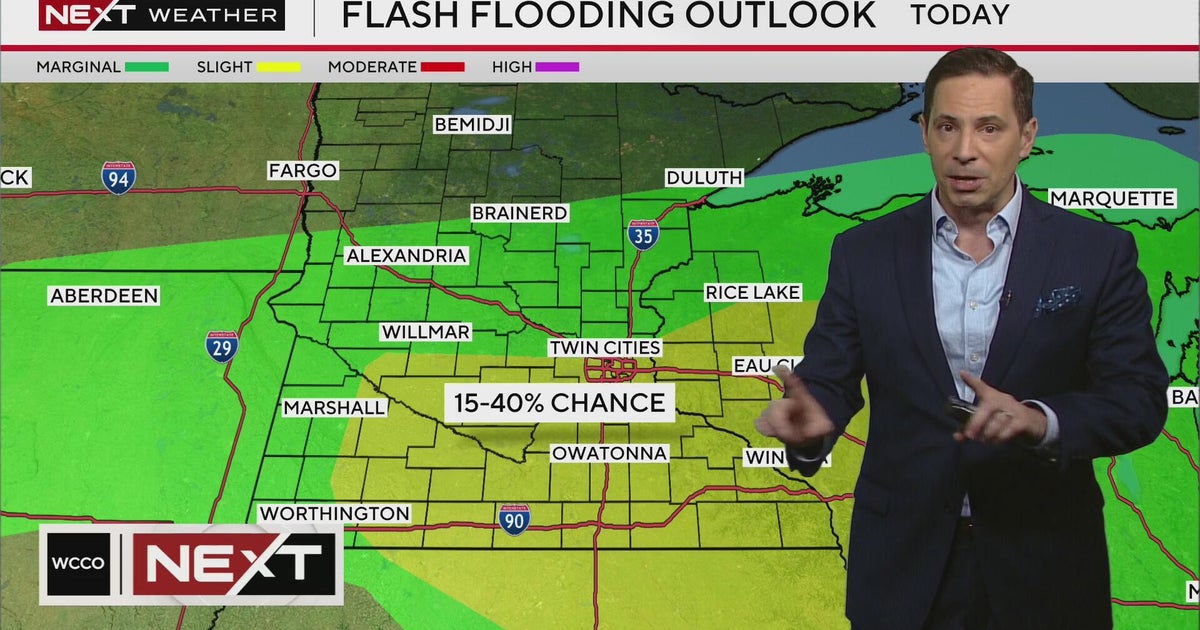

Next Weather 4 Pm Minnesota Forecast For August 15 2025

Aug 16, 2025

Next Weather 4 Pm Minnesota Forecast For August 15 2025

Aug 16, 2025 -

Unpacking The Perils A Critical Analysis Of The Trump Putin Meeting

Aug 16, 2025

Unpacking The Perils A Critical Analysis Of The Trump Putin Meeting

Aug 16, 2025 -

The Trump Putin Summit A Deeper Look At Potential Dangers

Aug 16, 2025

The Trump Putin Summit A Deeper Look At Potential Dangers

Aug 16, 2025 -

Advocacy Groups Israels New West Bank Settlements Will Lead To More Violence

Aug 16, 2025

Advocacy Groups Israels New West Bank Settlements Will Lead To More Violence

Aug 16, 2025 -

Expert Premier League Predictions Jones Knows Weekend Double

Aug 16, 2025

Expert Premier League Predictions Jones Knows Weekend Double

Aug 16, 2025