Can The Ethereum Bulls Halt The Price Drop? A Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can the Ethereum Bulls Halt the Price Drop? A Market Analysis

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has recently experienced a significant price decline, leaving investors wondering if the bulls can stage a comeback. This market analysis delves into the factors contributing to the price drop and explores the potential for a bullish reversal. The question on everyone's mind: can the downward trend be stopped?

The Bearish Pressure Mounts: Understanding the Recent Dip

Ethereum's price has been under considerable pressure in recent weeks, primarily due to a confluence of factors. The overall cryptocurrency market downturn, fueled by macroeconomic anxieties and regulatory uncertainty, has undoubtedly played a significant role. Concerns about inflation, rising interest rates, and potential recessionary pressures have led to a risk-off sentiment across financial markets, impacting even established cryptocurrencies like Ethereum.

Furthermore, the ongoing debate surrounding Ethereum's upcoming Shanghai upgrade, while ultimately positive for the network, has introduced a degree of market uncertainty in the short term. The unlocking of staked ETH could potentially lead to increased selling pressure, at least initially. This, coupled with lower trading volumes, has exacerbated the bearish sentiment.

Analyzing the Technical Indicators: Signs of Hope or Further Decline?

Technical analysis offers some clues about the potential trajectory of ETH's price. While the current price action is undeniably bearish, several indicators suggest potential support levels. For instance, the recent bounce off of a key support level could indicate a temporary bottoming-out process. However, it’s crucial to note that these are merely indicators and not guarantees of future price movements.

- Support Levels: Identifying key support levels through chart analysis is vital for predicting potential price rebounds. Monitoring these levels closely is crucial for both short-term and long-term investors.

- Resistance Levels: Conversely, understanding resistance levels helps determine potential price ceilings. Breaking through these levels often signifies a significant shift in market sentiment.

- Trading Volume: Lower trading volume often accompanies periods of consolidation, making it difficult to definitively predict the next major price movement. Increased volume, however, can signal a potential breakout, either bullish or bearish.

The Bullish Case: Reasons for Optimism

Despite the current bearish pressure, several factors could contribute to a bullish reversal for Ethereum. The impending Shanghai upgrade, while initially creating uncertainty, will ultimately unlock staked ETH, increasing liquidity and potentially boosting the price in the longer term. Furthermore, the continued development and adoption of decentralized applications (dApps) on the Ethereum network bolster its long-term prospects. The robust and ever-evolving Ethereum ecosystem remains a significant draw for developers and investors alike.

Moreover, the overall cryptocurrency market tends to experience cyclical price fluctuations. History suggests that periods of bearish sentiment are often followed by periods of significant growth. While timing the market is notoriously difficult, the long-term fundamentals for Ethereum remain relatively strong.

Conclusion: Navigating the Uncertainty

Whether the Ethereum bulls can successfully halt the current price drop remains uncertain. The confluence of macroeconomic factors, regulatory concerns, and short-term market anxieties presents a challenging environment. However, analyzing technical indicators, understanding support and resistance levels, and assessing the long-term fundamentals offer valuable insights into potential future price movements. Investors should approach the market with caution, diversifying their portfolios and carefully considering their risk tolerance. The long-term potential of Ethereum remains promising, but navigating the short-term volatility requires careful observation and strategic decision-making. Stay informed and consult with financial advisors before making any significant investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can The Ethereum Bulls Halt The Price Drop? A Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Yvr And Air Canada Expand Service With New Fort Mc Murray Route

Sep 23, 2025

Yvr And Air Canada Expand Service With New Fort Mc Murray Route

Sep 23, 2025 -

Sec Postpones Ruling On Black Rock Ethereum Etf And Franklin Templetons Crypto Funds

Sep 23, 2025

Sec Postpones Ruling On Black Rock Ethereum Etf And Franklin Templetons Crypto Funds

Sep 23, 2025 -

L A County Blocks Release Of Crucial Skyscraper Seismic Report

Sep 23, 2025

L A County Blocks Release Of Crucial Skyscraper Seismic Report

Sep 23, 2025 -

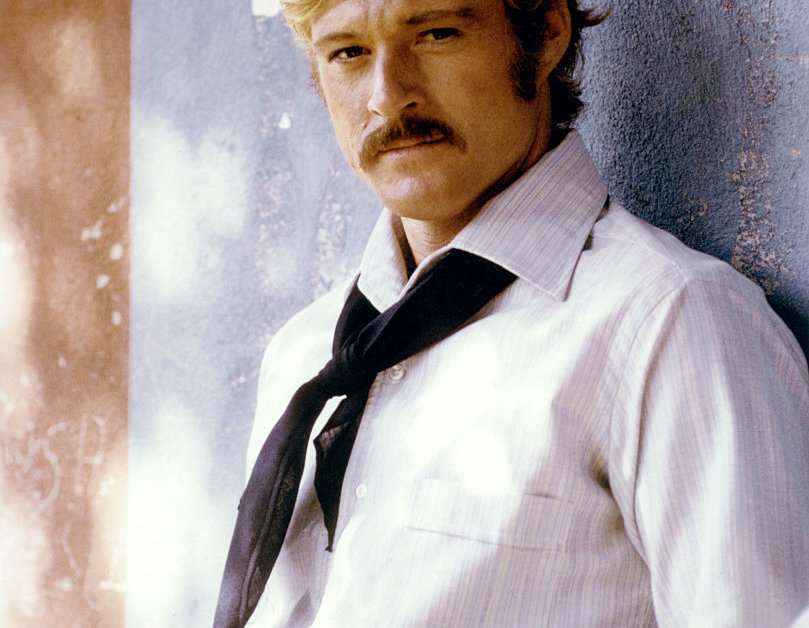

Decoding Robert Redfords Face An Actors Legacy

Sep 23, 2025

Decoding Robert Redfords Face An Actors Legacy

Sep 23, 2025 -

Air Canada New Flights To 3 Us Cities Announced

Sep 23, 2025

Air Canada New Flights To 3 Us Cities Announced

Sep 23, 2025