Can Intel Deliver In 2025? A Look At The Investment Risks And Rewards.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can Intel Deliver in 2025? A Look at the Investment Risks and Rewards

Intel, a name synonymous with computing for decades, finds itself at a crucial juncture. The company, once the undisputed king of the microprocessor market, has faced significant challenges in recent years, losing ground to competitors like TSMC and AMD. But with ambitious plans and substantial investments in its manufacturing capabilities, Intel is aiming for a major comeback by 2025. This article delves into the potential risks and rewards for investors considering a stake in the tech giant's resurgence.

Intel's Ambitious 2025 Goals:

Intel's strategy hinges on several key pillars: a massive investment in its manufacturing facilities (IDM 2.0), a renewed focus on innovation across its product portfolio, and a push into new and expanding markets. They're aiming for leadership in several key areas, including:

- Advanced Process Node Technology: Intel is aggressively pursuing advancements in its process technology, aiming to compete with TSMC's leading-edge nodes. Success here is crucial to regaining market share in high-performance computing (HPC) and data center processors.

- Data Center Dominance: The data center market is a lucrative battlefield, and Intel is striving to reclaim its position as the leading supplier of CPUs and other essential components. Their Xeon processors remain a key player, but competition remains fierce.

- Expansion into New Markets: Intel is expanding into new areas like automotive and AI chips, diversifying its revenue streams and reducing reliance on the traditional PC market. This diversification strategy is viewed as vital for long-term growth.

The Investment Risks:

While Intel's plans are ambitious, several significant risks could hinder its progress:

- Execution Risk: Successfully transitioning to new manufacturing processes and scaling production is a monumental task. Any delays or setbacks could significantly impact profitability and market share. [Link to an article about Intel's past production challenges]

- Competition: The semiconductor industry is incredibly competitive. TSMC, Samsung, and AMD are formidable rivals with significant resources and technological expertise. Maintaining a competitive edge will be a constant struggle.

- Geopolitical Factors: The global chip shortage and increasing geopolitical tensions, particularly concerning US-China relations, add uncertainty to the supply chain and could impact Intel's operations and investment returns. [Link to an article about geopolitical impacts on the semiconductor industry]

- High Capital Expenditure: Intel's massive investments in new fabs represent a significant financial commitment. The return on these investments is not guaranteed and could significantly impact profitability in the short term.

The Investment Rewards:

Despite the risks, the potential rewards for investors are considerable:

- Market Share Recovery: If Intel successfully executes its strategy, it could reclaim significant market share in key segments, leading to substantial revenue growth and increased profitability.

- Technological Leadership: Becoming a leader in advanced process nodes would position Intel as a key supplier for the next generation of computing technologies.

- Diversified Revenue Streams: Expansion into new markets like automotive and AI will provide resilience against fluctuations in the traditional PC market.

- Potential for Significant Stock Appreciation: Successful execution of Intel's plans could lead to a significant increase in the company's stock price, generating substantial returns for investors.

Conclusion:

Investing in Intel in 2024 presents a high-risk, high-reward proposition. While the company faces significant challenges, its ambitious plans and substantial investments offer the potential for a remarkable turnaround. Investors should carefully weigh the risks and rewards, considering Intel's track record, the competitive landscape, and the broader macroeconomic environment before making any investment decisions. Conduct thorough due diligence and consider consulting with a financial advisor before committing capital. The coming years will be crucial in determining whether Intel can truly deliver on its promises and reclaim its position as a technology leader.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can Intel Deliver In 2025? A Look At The Investment Risks And Rewards.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Years Greatest Sports Comeback Alcaraz At The French Open

Jun 11, 2025

The Years Greatest Sports Comeback Alcaraz At The French Open

Jun 11, 2025 -

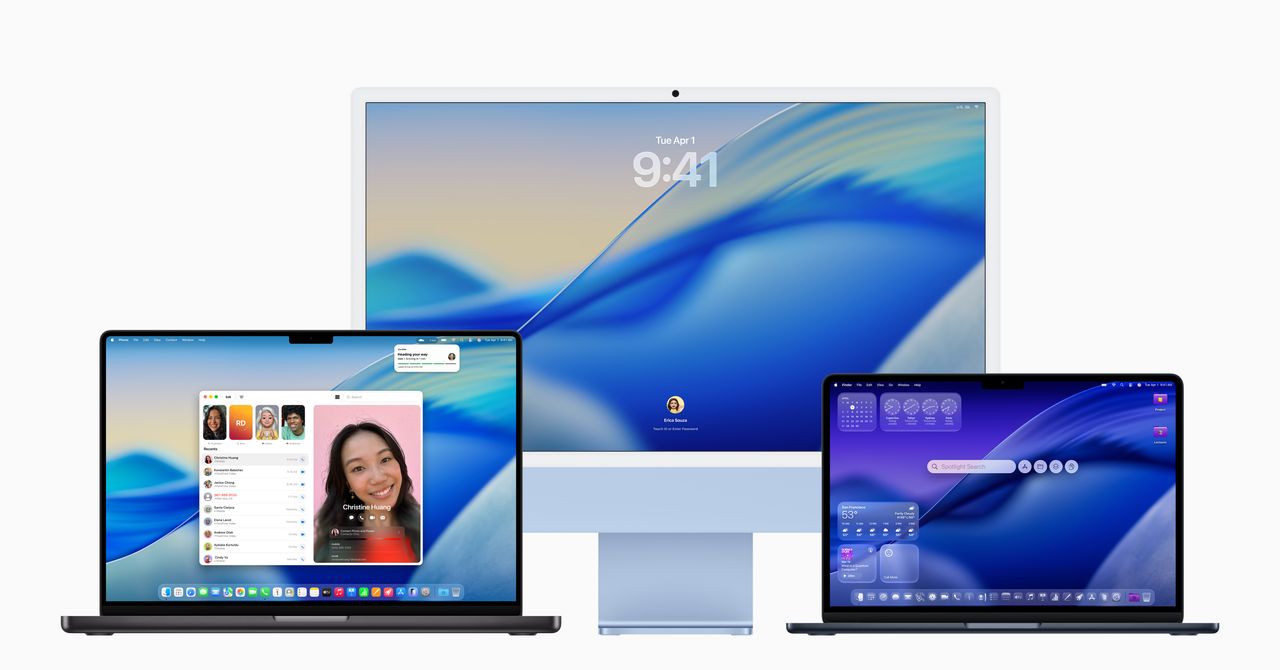

Apples Upcoming Mac Book Pro Lineup A Farewell To Classic Designs

Jun 11, 2025

Apples Upcoming Mac Book Pro Lineup A Farewell To Classic Designs

Jun 11, 2025 -

The 2025 Tony Awards A Look Back At The Nights Biggest Wins

Jun 11, 2025

The 2025 Tony Awards A Look Back At The Nights Biggest Wins

Jun 11, 2025 -

Transition Complete Apples Mac Ecosystem Now Fully Apple Silicon

Jun 11, 2025

Transition Complete Apples Mac Ecosystem Now Fully Apple Silicon

Jun 11, 2025 -

Filipino Tennis Star Alex Eala Takes On Cabrera At Wta Ilkley Open

Jun 11, 2025

Filipino Tennis Star Alex Eala Takes On Cabrera At Wta Ilkley Open

Jun 11, 2025