BuzzFeed's $40 Million Loan: A Key Investment In Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BuzzFeed's $40 Million Loan: A Gamble on Growth or a Sign of Trouble?

BuzzFeed, the digital media giant known for its viral quizzes and listicle-style content, recently secured a substantial $40 million loan. While the company frames this as a key investment fueling future growth, the news has sparked debate among industry analysts, raising questions about the platform's long-term financial stability. This significant capital injection warrants a closer look at BuzzFeed's current situation and its ambitious plans for the future.

A Lifeline or a Band-Aid?

The $40 million loan, reportedly secured from Sixth Street Partners, provides BuzzFeed with much-needed financial breathing room. The company has faced persistent challenges in recent years, struggling to consistently translate its massive online reach into substantial profits. This loan, therefore, could be interpreted in two ways: a strategic move to bolster growth initiatives or a sign that the company's existing revenue streams are insufficient.

The company's official statement emphasizes the loan's role in supporting its ongoing expansion into new areas, including the burgeoning creator economy and the development of its own original video content. This focus on diversification suggests a proactive approach to navigating the ever-changing digital media landscape. However, critics point to BuzzFeed's history of financial instability as a cause for concern. The company has undergone several rounds of layoffs and restructuring in recent years, indicating a persistent struggle to find a sustainable business model.

Diversification: A Path to Profitability?

BuzzFeed's strategy hinges on diversification. They are investing heavily in:

- Creator Partnerships: Collaborating with creators to expand their content offerings and reach wider audiences. This strategy mirrors the success of platforms like YouTube and TikTok.

- Original Video Content: Producing high-quality video content for various platforms, aiming to capture a larger share of the lucrative video advertising market.

- News and Investigative Journalism: Expanding its news coverage, moving beyond its traditionally lighter fare to attract a more engaged, and potentially more lucrative, audience segment.

These initiatives represent a significant shift from BuzzFeed's early reliance on viral content. The success of this strategy remains to be seen, but it demonstrates a willingness to adapt and evolve in a rapidly changing media environment.

Challenges Remain

Despite the optimism surrounding this new investment, significant challenges remain for BuzzFeed. The highly competitive digital media market, saturated with content creators and platforms, presents a constant battle for audience attention and advertising revenue. Maintaining audience engagement and innovating to stay ahead of the curve will be crucial for the company's long-term success.

Moreover, the loan itself introduces financial obligations that BuzzFeed must meet. The terms of the loan, including interest rates and repayment schedules, will significantly impact the company's future financial performance. Transparency regarding these terms is essential for investors and stakeholders to accurately assess the risk involved.

The Future of BuzzFeed: A Waiting Game

Whether this $40 million loan represents a turning point for BuzzFeed or simply delays the inevitable remains to be seen. The company's ambitious diversification strategy is a bold gamble, and its success will depend on its ability to execute effectively and adapt to the ever-evolving digital landscape. The coming years will be critical in determining whether this investment leads to sustainable growth or exacerbates existing financial woes. Only time will tell if this loan is a key investment in BuzzFeed's future or a last-ditch effort to stay afloat. We'll be watching closely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BuzzFeed's $40 Million Loan: A Key Investment In Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Public Scrutiny Analyzing The Changes In Lauren Sanchezs Look

May 28, 2025

Public Scrutiny Analyzing The Changes In Lauren Sanchezs Look

May 28, 2025 -

Another Primetime Game In Baltimore Mike North Defends Joe Burrows Frustration

May 28, 2025

Another Primetime Game In Baltimore Mike North Defends Joe Burrows Frustration

May 28, 2025 -

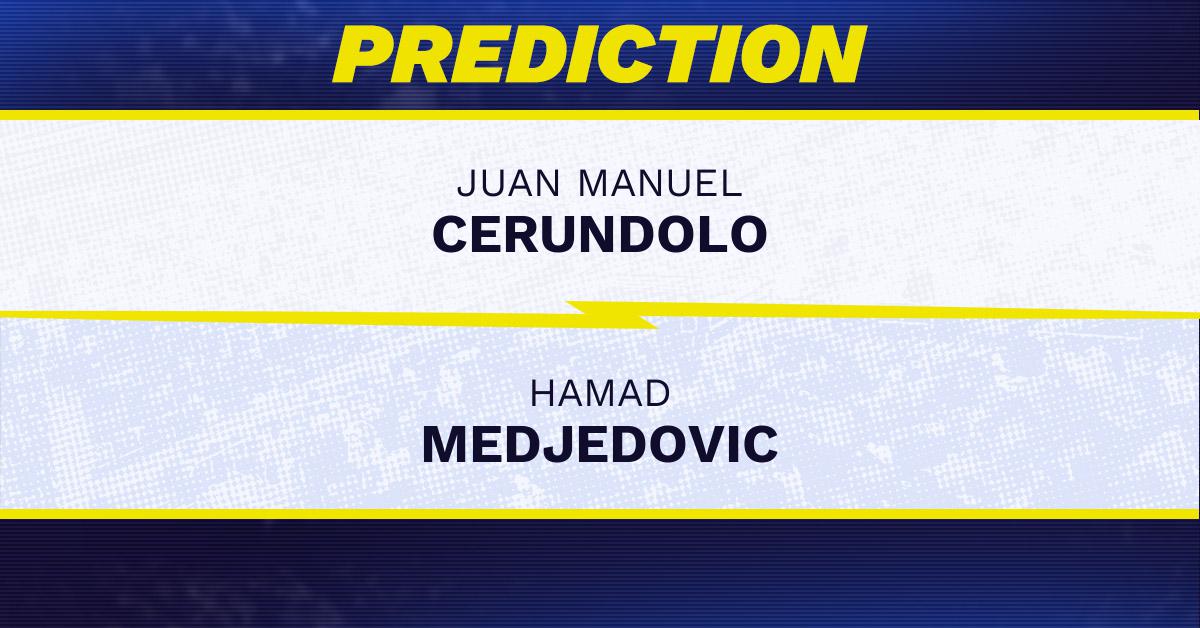

Juan Manuel Cerundolo Vs Hamad Medjedovic French Open 2025 Who Will Win

May 28, 2025

Juan Manuel Cerundolo Vs Hamad Medjedovic French Open 2025 Who Will Win

May 28, 2025 -

420 Million Lincoln National Expands Cash Tender Offer

May 28, 2025

420 Million Lincoln National Expands Cash Tender Offer

May 28, 2025 -

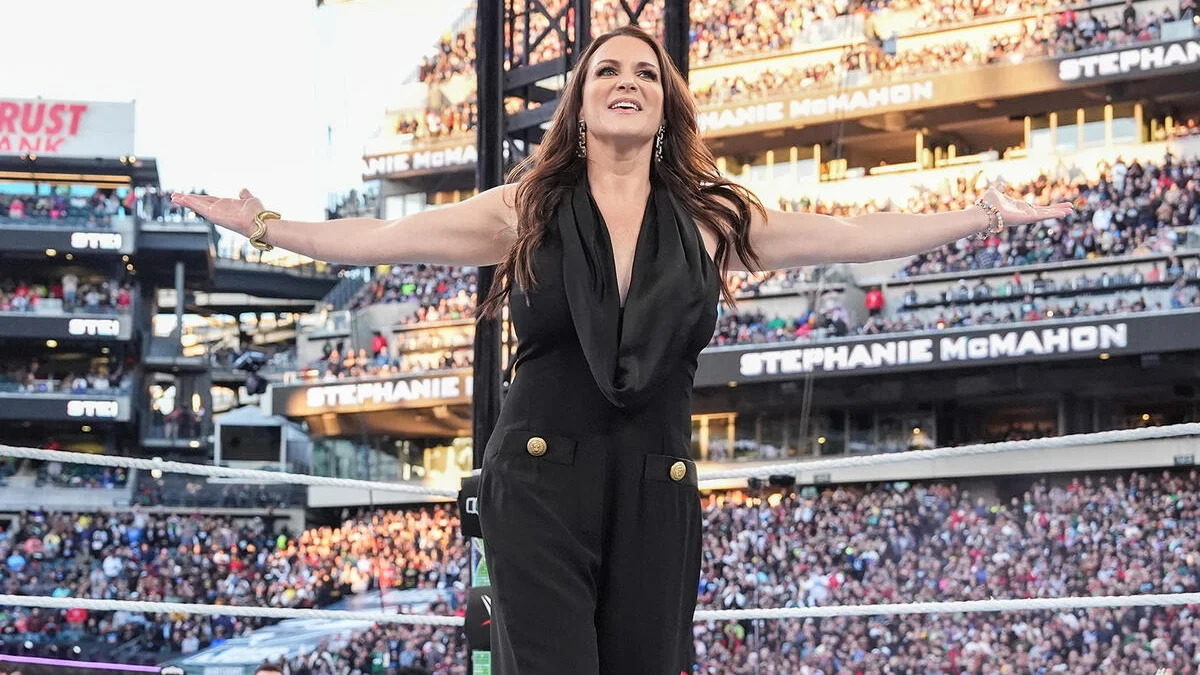

Wwes Stephanie Mc Mahon Shares Near Tattoo Regret The Story Behind It

May 28, 2025

Wwes Stephanie Mc Mahon Shares Near Tattoo Regret The Story Behind It

May 28, 2025