BuzzFeed Secures $40 Million Loan To Fuel Future Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BuzzFeed Secures $40 Million Loan to Fuel Future Growth Amidst Digital Media Challenges

Facing headwinds in the digital media landscape, BuzzFeed has announced a significant financial boost. The company has secured a $40 million loan, providing a much-needed lifeline as it navigates the evolving media industry and strives to achieve profitability. This strategic move underscores BuzzFeed's commitment to long-term growth and innovation, despite recent challenges that have impacted many digital publishers.

The loan, details of which remain undisclosed regarding the lender and specific terms, will reportedly be used to bolster BuzzFeed's operational capabilities and fund strategic initiatives. This financial injection comes at a crucial juncture for the company, which has been actively restructuring its operations to adapt to the changing digital media landscape and increasing competition.

Navigating the Shifting Sands of Digital Media

The digital media sector is notoriously volatile, with fluctuating advertising revenue and increasing pressure from social media platforms. BuzzFeed, like many of its peers, has felt the impact of these challenges. Recent years have seen a focus on cost-cutting measures and strategic pivots, including a shift towards branded content and a greater emphasis on video production. [Link to article about BuzzFeed's previous restructuring efforts].

The $40 million loan signifies a vote of confidence in BuzzFeed's future prospects. While the company hasn't explicitly detailed its plans for the funds, it's likely to be invested in several key areas:

- Content Creation and Innovation: Investing in high-quality content remains paramount for attracting and retaining audiences. This likely includes investment in new formats, technologies, and potentially even new talent acquisitions.

- Technology and Infrastructure: Improving its technological infrastructure will be crucial for BuzzFeed's efficiency and ability to deliver engaging content to a global audience. This could involve upgrades to its content management system, analytics tools, and other vital backend systems.

- Strategic Acquisitions: While not confirmed, the loan could also facilitate strategic acquisitions of smaller companies or promising technologies that complement BuzzFeed's existing offerings.

A Sign of Resilience in a Challenging Market?

The securing of this loan marks a significant development for BuzzFeed and the broader digital media industry. It demonstrates that even amidst considerable challenges, companies with strong brands and innovative approaches can still attract investment and navigate difficult economic conditions. This injection of capital provides BuzzFeed with a crucial opportunity to refine its strategy, invest in growth areas, and potentially emerge as a stronger competitor in the years to come.

While the long-term outlook for the digital media industry remains uncertain, BuzzFeed's proactive approach suggests a commitment to adapting and thriving in this ever-evolving environment. The company's ability to secure this significant loan provides a glimpse of hope for other digital media companies facing similar challenges.

What's Next for BuzzFeed?

The coming months will be critical for BuzzFeed as it implements its strategy fueled by this new funding. The company’s next steps will be closely watched by industry analysts and investors alike. The success of its initiatives will determine whether this loan represents a turning point or a temporary reprieve in its ongoing journey towards sustainable profitability. We will continue to monitor the situation and provide updates as they become available.

Call to Action: What are your thoughts on BuzzFeed's latest move? Share your opinions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BuzzFeed Secures $40 Million Loan To Fuel Future Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Metropolitan Notes Analyzing The Penguins Coaching Decisions With Roest And Kuokkanen

May 29, 2025

Metropolitan Notes Analyzing The Penguins Coaching Decisions With Roest And Kuokkanen

May 29, 2025 -

French Open Day 5 Expert Predictions For Mens Singles Matches

May 29, 2025

French Open Day 5 Expert Predictions For Mens Singles Matches

May 29, 2025 -

Roland Garros De Jongs Two Set Deficit Comeback Triumphs Over Passaro

May 29, 2025

Roland Garros De Jongs Two Set Deficit Comeback Triumphs Over Passaro

May 29, 2025 -

Fritz Blasts Performance After Disappointing Roland Garros Exit

May 29, 2025

Fritz Blasts Performance After Disappointing Roland Garros Exit

May 29, 2025 -

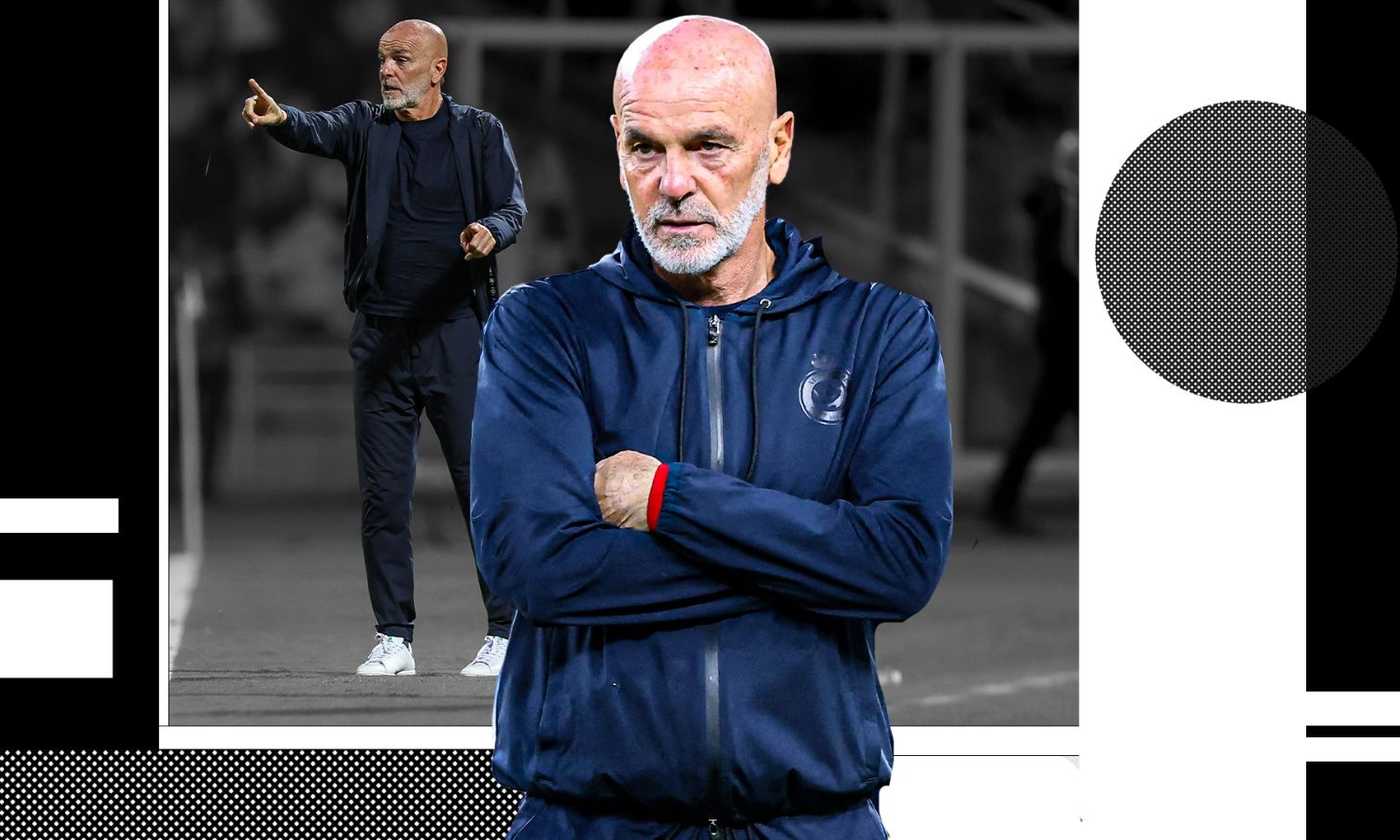

Dopo Gasperini Pioli All Atalanta Ecco Le Ultime Notizie

May 29, 2025

Dopo Gasperini Pioli All Atalanta Ecco Le Ultime Notizie

May 29, 2025