BuzzFeed Receives $40 Million Loan: Implications For The Media Company

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BuzzFeed Receives $40 Million Loan: A Lifeline or a Sign of Deeper Trouble?

BuzzFeed, the digital media giant known for its viral quizzes and listicle-style content, has secured a $40 million loan from its existing lender, Sixth Street Partners. While the company portrays this as a strategic move to bolster its operational efficiency, the news raises questions about the long-term financial health and future trajectory of the once-dominant internet powerhouse. This injection of capital offers a temporary reprieve, but the underlying challenges facing BuzzFeed remain significant.

A Much-Needed Financial Infusion:

The $40 million loan, announced [insert date of announcement], provides BuzzFeed with much-needed working capital. This funding is intended to help the company navigate the current economic downturn and invest in its core businesses, including strengthening its proprietary content creation and improving its advertising revenue streams. The loan agreement, however, doesn't disclose the specific terms, interest rates, or repayment schedule, leaving room for speculation.

Challenges Facing BuzzFeed:

Despite its early success and innovative approach to online content, BuzzFeed has struggled to translate its massive online audience into sustainable profitability. Several factors contribute to this:

- Intense Competition: The digital media landscape is fiercely competitive. BuzzFeed faces pressure from established players like Google and Facebook, as well as a rising tide of independent creators and smaller, niche media outlets.

- Advertising Revenue Decline: The advertising market has become increasingly volatile, with many companies cutting back on their marketing budgets. This has directly impacted BuzzFeed's revenue streams, forcing them to seek alternative funding sources.

- Shifting Consumption Patterns: The way people consume news and entertainment online is constantly evolving. BuzzFeed needs to adapt to these changes and find new ways to engage its audience and generate revenue.

- Focus on Profitability: The company's recent emphasis on profitability might lead to changes in content strategy, potentially impacting its creative output and unique brand identity. Balancing financial sustainability with maintaining its distinctive voice is a critical challenge.

What the Loan Means for the Future:

The $40 million loan provides a short-term solution, allowing BuzzFeed to continue operating and potentially implement restructuring initiatives. However, it doesn't address the fundamental issues impacting the company's long-term viability. The loan can be interpreted as a vote of confidence from Sixth Street Partners, but it also underscores the financial pressures facing BuzzFeed. The company needs a comprehensive long-term strategy that addresses its core challenges to ensure its continued success.

The Path Forward:

BuzzFeed’s future hinges on its ability to innovate and diversify its revenue streams. Exploring new avenues like subscription models, strategic partnerships, and potentially even acquisitions could prove crucial. The success of these strategies will determine whether this loan serves as a bridge to a brighter future or merely delays the inevitable. Only time will tell if this financial lifeline is enough to steer BuzzFeed towards sustainable profitability in the increasingly challenging digital media environment.

Keywords: BuzzFeed, loan, $40 million, Sixth Street Partners, digital media, financial challenges, online advertising, media industry, profitability, future of media, content creation, revenue diversification.

Related Articles: (Include links to relevant articles on BuzzFeed's past performance, the digital media industry, and similar financial news.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BuzzFeed Receives $40 Million Loan: Implications For The Media Company. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sporting Cp Responds To Arsenals Viktor Gyokeres Transfer Pursuit

May 29, 2025

Sporting Cp Responds To Arsenals Viktor Gyokeres Transfer Pursuit

May 29, 2025 -

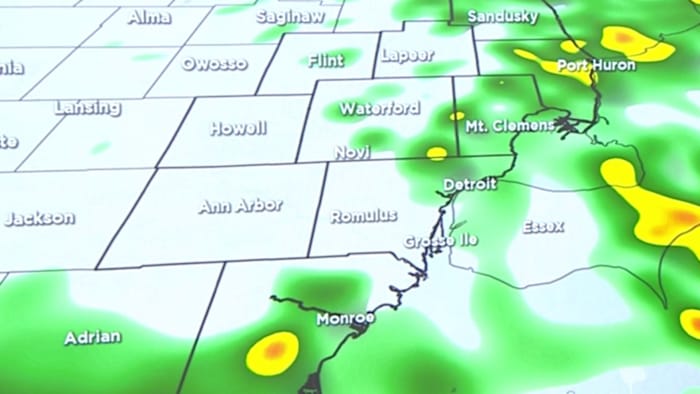

This Weeks Metro Detroit Forecast Expect Scattered Showers And Cooler Temps

May 29, 2025

This Weeks Metro Detroit Forecast Expect Scattered Showers And Cooler Temps

May 29, 2025 -

Buzz Feed Bzfd Receives 40 Million Loan To Improve Financial Position

May 29, 2025

Buzz Feed Bzfd Receives 40 Million Loan To Improve Financial Position

May 29, 2025 -

Humanitarian Crisis In Gaza Thousands Swarm Food Distribution Center Amidst Hunger

May 29, 2025

Humanitarian Crisis In Gaza Thousands Swarm Food Distribution Center Amidst Hunger

May 29, 2025 -

Twin Power Lower Moreland High School Wins State Tennis Title

May 29, 2025

Twin Power Lower Moreland High School Wins State Tennis Title

May 29, 2025