BuzzFeed (BZFD)'s $40 Million Loan: Implications For Financial Health

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BuzzFeed's $40 Million Loan: A Lifeline or a Warning Sign? Implications for the Digital Media Giant's Financial Health

BuzzFeed (BZFD), the once-dominant digital media powerhouse, recently secured a $40 million loan, sparking considerable debate about the company's financial stability and future prospects. While the loan provides a short-term reprieve, it also raises serious questions about the long-term viability of its business model in a fiercely competitive digital landscape. This article delves into the implications of this loan, analyzing its significance and potential consequences for BuzzFeed's financial health.

The Loan's Details and Immediate Impact:

The $40 million loan, secured from a private credit fund, offers BuzzFeed some breathing room. It provides vital capital to navigate immediate financial challenges, potentially including covering operational costs and potentially debt repayment. The short-term impact is positive – avoiding immediate bankruptcy and allowing the company to continue operations. However, the terms of the loan, including interest rates and repayment schedules, remain undisclosed, leaving room for speculation regarding its long-term burden. The lack of transparency also raises concerns for investors.

Underlying Challenges Facing BuzzFeed:

BuzzFeed’s financial struggles are not a sudden phenomenon. The company has faced persistent headwinds, primarily stemming from:

- Declining Advertising Revenue: The digital advertising market is increasingly saturated, making it difficult for BuzzFeed to compete effectively with larger tech giants like Google and Meta, who dominate ad revenue.

- Shifting Consumer Preferences: The ever-evolving digital media landscape and changing consumer habits pose a significant challenge. Younger audiences, BuzzFeed's core demographic, are increasingly turning to platforms like TikTok and Instagram for their content consumption.

- Competition from Other Digital Media Outlets: The digital media industry is incredibly competitive. BuzzFeed faces intense pressure from established players and emerging startups vying for the same audience and advertising dollars.

- Profitability Concerns: BuzzFeed has consistently struggled to achieve profitability, a major concern for investors and a key factor contributing to its current financial situation.

Long-Term Implications and Potential Outcomes:

The $40 million loan is a temporary solution, not a long-term fix. BuzzFeed needs a sustainable strategy to address its underlying financial issues. Potential outcomes include:

- Successful Restructuring: BuzzFeed may successfully restructure its operations, streamline costs, and diversify its revenue streams, potentially through a greater focus on subscription models or other revenue-generating initiatives.

- Acquisition or Merger: A potential acquisition or merger with a larger media company could provide the resources and stability BuzzFeed needs to thrive. This remains a viable, although uncertain, possibility.

- Further Financial Distress: If BuzzFeed fails to implement effective changes and generate sufficient revenue, it could face further financial difficulties, potentially leading to bankruptcy or liquidation.

The Future of BuzzFeed:

The $40 million loan provides a crucial lifeline for BuzzFeed, buying time for the company to implement strategic changes and navigate its challenges. However, the long-term success of the company hinges on its ability to adapt to the evolving digital media landscape, diversify its revenue streams, and improve its profitability. The coming months will be critical in determining whether BuzzFeed can successfully overcome these hurdles and secure a sustainable future. Investors and industry analysts will be closely watching BuzzFeed's performance and strategic decisions. The story of BuzzFeed's financial health is far from over.

Keywords: BuzzFeed, BZFD, $40 million loan, financial health, digital media, advertising revenue, bankruptcy, acquisition, merger, restructuring, financial distress, competition, profitability, digital landscape, investment

Related Articles: (You would insert links to relevant articles here, e.g., articles on the state of the digital media industry, previous BuzzFeed financial reports, etc.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BuzzFeed (BZFD)'s $40 Million Loan: Implications For Financial Health. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

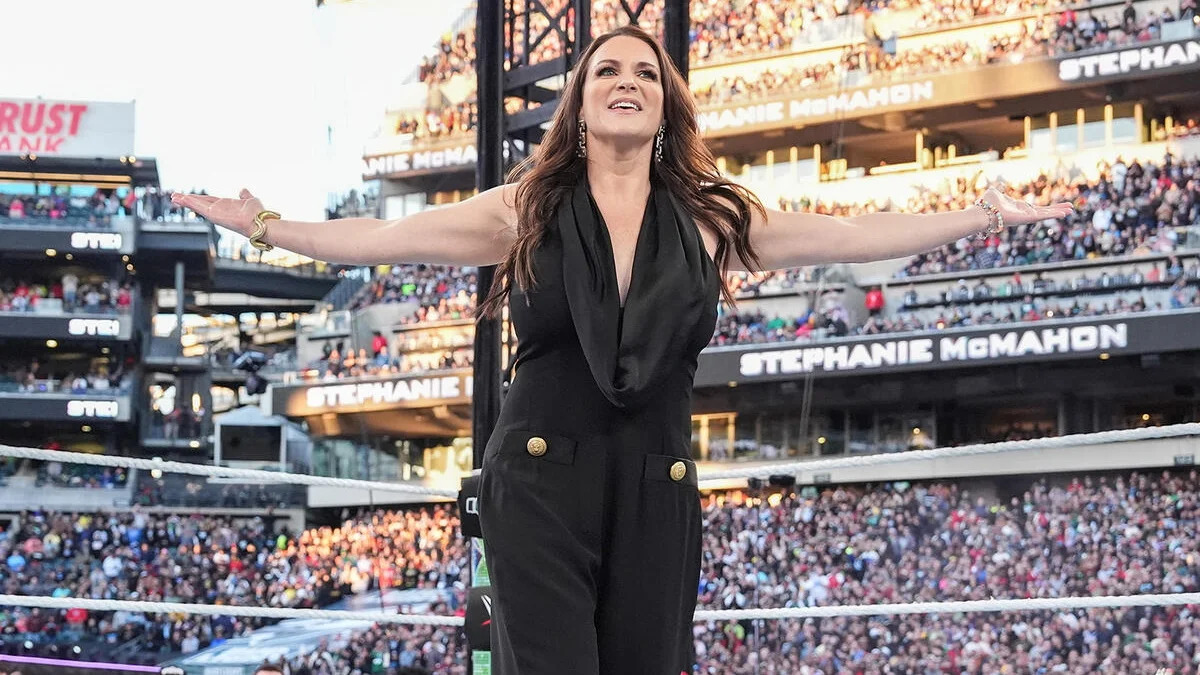

Wwes Stephanie Mc Mahon Shares Why Shes Glad She Skipped A Tattoo

May 28, 2025

Wwes Stephanie Mc Mahon Shares Why Shes Glad She Skipped A Tattoo

May 28, 2025 -

24 Analyst Projections Predicting Ubers Future Trajectory

May 28, 2025

24 Analyst Projections Predicting Ubers Future Trajectory

May 28, 2025 -

Is Oklos Smr Nne Technology The Key To Its Market Breakout Nyse Oklo

May 28, 2025

Is Oklos Smr Nne Technology The Key To Its Market Breakout Nyse Oklo

May 28, 2025 -

Analyzing The Responses Of China North Korea And Russia To Trumps Golden Dome Initiative

May 28, 2025

Analyzing The Responses Of China North Korea And Russia To Trumps Golden Dome Initiative

May 28, 2025 -

Severe Weather 165 000 Experience Power Loss

May 28, 2025

Severe Weather 165 000 Experience Power Loss

May 28, 2025