Business And Finance's Real Talk On Climate Change

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Business and Finance's Real Talk on Climate Change: Beyond the Rhetoric, Towards Action

The climate crisis isn't just an environmental issue; it's a massive economic one. For too long, the conversation around climate change has been framed as a battle between environmentalists and industry. But increasingly, the business and finance worlds are recognizing the undeniable reality: climate change poses significant risks and equally significant opportunities. This shift is not just about corporate social responsibility; it's about long-term financial stability and competitive advantage.

The Mounting Financial Risks of Inaction

The impacts of climate change – from extreme weather events to resource scarcity – are already costing businesses billions. Insurance claims are soaring, supply chains are disrupted, and asset values are threatened. The Financial Stability Board, a global body, has identified climate change as one of the most significant threats to the global financial system. This isn't just theoretical; we're seeing tangible consequences:

- Increased insurance premiums: Businesses in vulnerable areas face rapidly escalating insurance costs, making operations increasingly expensive.

- Supply chain disruptions: Extreme weather events can halt production, delaying deliveries and impacting profitability. [Link to article on supply chain disruptions due to climate change]

- Stranded assets: Investments in fossil fuel infrastructure are becoming increasingly risky as the world transitions to cleaner energy sources. This risk of "stranded assets" is a major concern for investors.

- Reputational damage: Companies perceived as lagging on climate action face boycotts and investor pressure, impacting their brand value and market share.

The Emerging Opportunities of a Green Transition

While the risks are undeniable, the opportunities presented by the transition to a low-carbon economy are equally compelling. The global shift towards renewable energy, sustainable technologies, and green finance is creating a massive new market:

- Growth in renewable energy: The solar and wind power sectors are experiencing explosive growth, creating jobs and attracting significant investment. [Link to renewable energy market statistics]

- Innovation in green technologies: From electric vehicles to carbon capture technologies, the demand for innovative solutions is driving rapid technological advancements.

- Green finance booming: The market for green bonds and sustainable investments is expanding rapidly, attracting billions in capital. [Link to article on growth of green finance]

- Enhanced corporate reputation: Companies demonstrating leadership on climate action attract investors, customers, and top talent.

What Businesses and Finance Professionals Need to Do

The conversation has moved beyond awareness; now is the time for decisive action. Businesses and financial institutions need to:

- Integrate climate risk into their strategies: Conduct thorough climate risk assessments and develop plans to mitigate potential impacts.

- Invest in sustainable technologies and practices: Embrace innovation and transition to cleaner energy sources and sustainable operations.

- Disclose climate-related financial information: Transparency is crucial for building trust with investors and stakeholders. [Link to relevant ESG reporting frameworks]

- Advocate for climate-friendly policies: Support policies that encourage the transition to a low-carbon economy.

Conclusion:

The integration of climate considerations into business and finance is no longer optional; it's essential for survival and success. The transition to a sustainable future presents challenges, but also immense opportunities for innovation, growth, and long-term prosperity. Ignoring the climate crisis is not only environmentally irresponsible but also financially reckless. The time for real talk is over; the time for action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Business And Finance's Real Talk On Climate Change. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

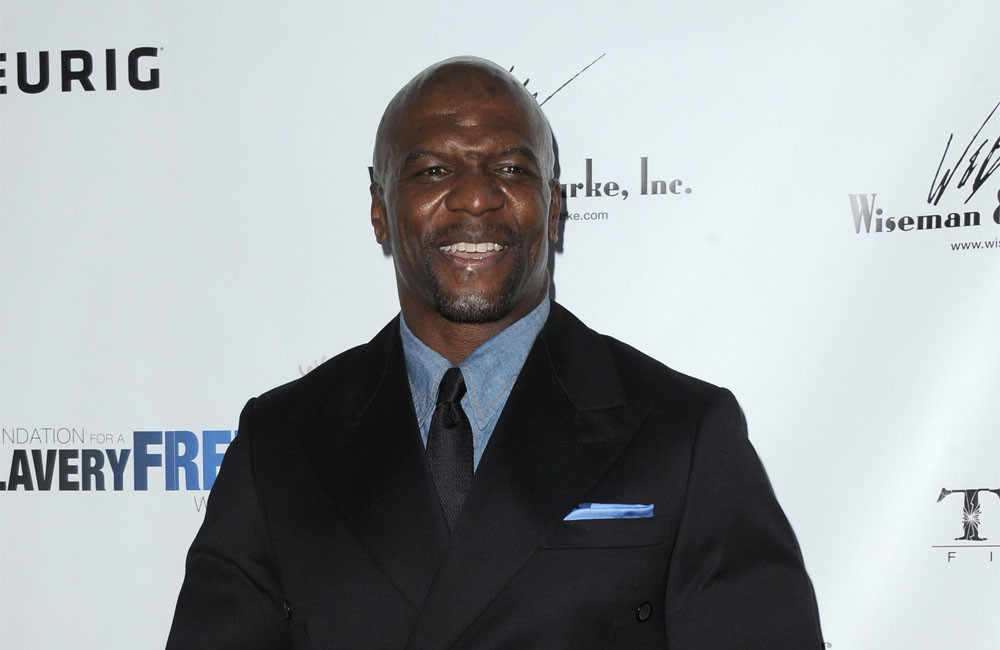

Inside Terry Crews Health Plan Fasting Till 2 Pm

May 12, 2025

Inside Terry Crews Health Plan Fasting Till 2 Pm

May 12, 2025 -

Confirmed Bellinghams Summer Surgery Following Euro 2024 With England

May 12, 2025

Confirmed Bellinghams Summer Surgery Following Euro 2024 With England

May 12, 2025 -

Lamine Yamal Early Career Compared To Messis A Detailed Assessment

May 12, 2025

Lamine Yamal Early Career Compared To Messis A Detailed Assessment

May 12, 2025 -

Panatta Sinner Ha Sbagliato Sette Palle Break Ecco Il Commento

May 12, 2025

Panatta Sinner Ha Sbagliato Sette Palle Break Ecco Il Commento

May 12, 2025 -

Will Pope Leo Xiv Maintain Pope Francis Commitment To Environmental Action

May 12, 2025

Will Pope Leo Xiv Maintain Pope Francis Commitment To Environmental Action

May 12, 2025