Business And Finance's Evolving Conversation On Climate Change

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Business and Finance's Evolving Conversation on Climate Change: Beyond ESG, Towards Systemic Transformation

The conversation surrounding climate change within the business and finance sectors is rapidly evolving. No longer a niche concern relegated to sustainability reports, climate risk is now firmly entrenched in boardroom discussions, investment strategies, and regulatory frameworks. This shift reflects a growing awareness of the interconnectedness between environmental sustainability and long-term financial performance. But what exactly is driving this change, and where is the conversation headed?

From ESG to Holistic Climate Integration:

For years, Environmental, Social, and Governance (ESG) investing served as a primary lens through which businesses and investors considered climate-related factors. While ESG provided a valuable framework, its limitations are becoming increasingly apparent. Many critics argue that ESG's broad scope often dilutes the focus on climate-specific risks and opportunities. This critique has fueled a movement towards a more holistic approach, integrating climate considerations across all aspects of business operations and investment strategies.

The Growing Pressure: Regulation and Investor Demand:

Several factors are accelerating this shift. Firstly, increasingly stringent regulations, such as the EU's Sustainable Finance Disclosure Regulation (SFDR) and the SEC's proposed climate-related disclosure rules, are forcing companies to be more transparent about their climate-related risks and emissions. This regulatory pressure is pushing businesses to not just talk about sustainability but actively manage their environmental impact.

Secondly, investor demand is playing a crucial role. Institutional investors, pension funds, and asset managers are increasingly incorporating climate-related factors into their investment decisions. They are demanding greater transparency and accountability from companies, leading to a significant increase in climate-related disclosures and sustainable investment strategies. This heightened scrutiny is forcing companies to adapt or risk losing investor confidence and capital.

Beyond Mitigation: Embracing Adaptation and Resilience:

The conversation is also moving beyond mitigation efforts – reducing greenhouse gas emissions – to encompass adaptation and resilience. Businesses are increasingly recognizing the need to prepare for the unavoidable impacts of climate change, such as extreme weather events and resource scarcity. This involves developing strategies to build resilience, ensuring business continuity, and protecting assets from climate-related risks.

The Role of Technology and Innovation:

Technological advancements are playing a pivotal role in driving this transformation. From renewable energy technologies and carbon capture solutions to advanced analytics and climate modeling, innovation is providing businesses with the tools they need to address climate change effectively. Investing in these technologies is not just ethically responsible but also presents significant financial opportunities.

Challenges Remain:

Despite significant progress, significant challenges remain. Accurate and consistent climate-related data remains a hurdle, making it difficult to assess and compare the climate performance of different companies. The complexities of measuring and managing Scope 3 emissions (emissions from a company's value chain) also pose a significant challenge. Finally, ensuring equitable and just transitions that avoid disproportionate impacts on vulnerable communities remains a critical priority.

Looking Ahead:

The evolving conversation on climate change in business and finance is a journey, not a destination. The future will likely involve even greater integration of climate considerations into all aspects of business decision-making, a further strengthening of regulatory frameworks, and continued innovation in climate-related technologies. By embracing this change, businesses and investors can not only contribute to a more sustainable future but also unlock significant long-term economic opportunities. The future of finance is inextricably linked to the future of our planet, and ignoring this reality is no longer an option. Understanding and adapting to this evolving landscape is crucial for success in the years to come. This demands proactive engagement, transparency, and a long-term strategic vision that considers both environmental and financial sustainability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Business And Finance's Evolving Conversation On Climate Change. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

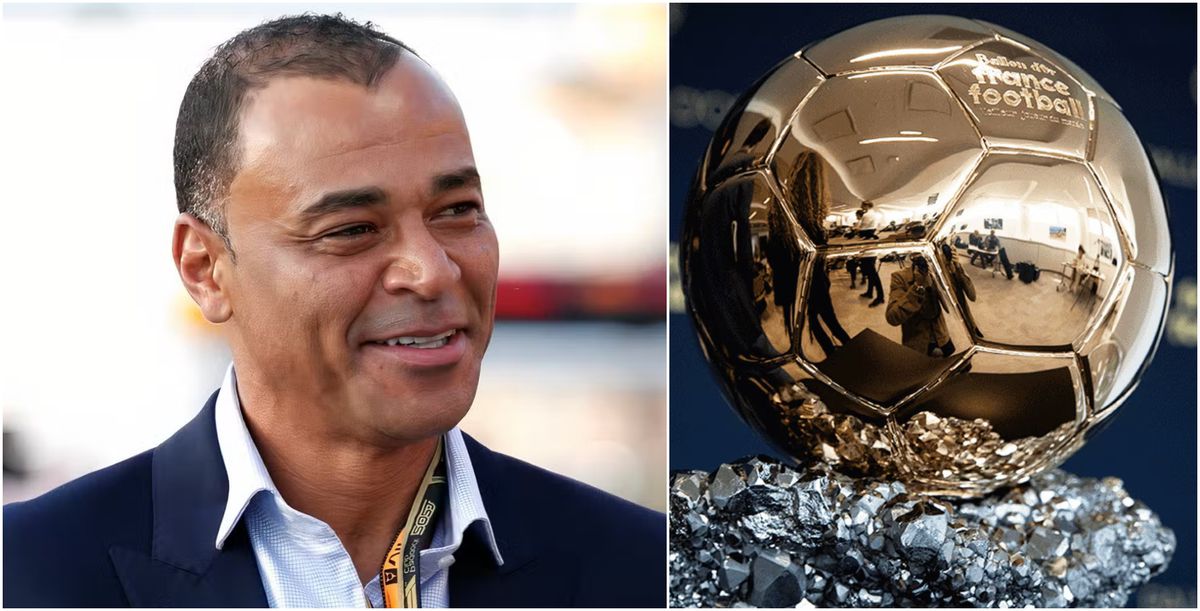

Cafu Predicts Ballon D Or 2025 Winners Leaving Yamal Out Of The Race

May 12, 2025

Cafu Predicts Ballon D Or 2025 Winners Leaving Yamal Out Of The Race

May 12, 2025 -

Climate Risk And Opportunity A Business And Finance Dialogue

May 12, 2025

Climate Risk And Opportunity A Business And Finance Dialogue

May 12, 2025 -

96 Goals 30 Games Is This Barcelonas Answer To Lamine Yamals Departure

May 12, 2025

96 Goals 30 Games Is This Barcelonas Answer To Lamine Yamals Departure

May 12, 2025 -

Victoria En El Clasico Un Analisis Del Control Del Partido

May 12, 2025

Victoria En El Clasico Un Analisis Del Control Del Partido

May 12, 2025 -

Sinner De Jong E Berrettini Ruud All Atp Roma Guida Tv Al Terzo Turno

May 12, 2025

Sinner De Jong E Berrettini Ruud All Atp Roma Guida Tv Al Terzo Turno

May 12, 2025