Business And Finance's Evolving Climate Change Narrative

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Business and Finance's Evolving Climate Change Narrative: From Risk to Opportunity

The narrative surrounding climate change in the business and finance worlds is rapidly shifting. No longer viewed solely as a distant threat, climate change is increasingly recognized as a present-day risk with significant financial implications, but also as a source of unprecedented opportunity. This evolution is driven by a confluence of factors, including heightened investor awareness, stricter regulatory frameworks, and the burgeoning green economy.

The Growing Recognition of Climate-Related Financial Risks:

For years, climate change was often relegated to the realm of environmental concerns, with its financial implications largely underestimated. However, recent extreme weather events, from devastating hurricanes to crippling droughts, have starkly revealed the significant financial liabilities associated with a changing climate. These include:

- Physical Risks: Direct damage to assets from extreme weather, rising sea levels, and other climate-related events. This can impact everything from real estate portfolios to infrastructure investments.

- Transition Risks: The costs associated with adapting to a low-carbon economy, including changes in technology, regulations, and consumer preferences. Companies reliant on fossil fuels, for instance, face significant transition risks.

- Liability Risks: Increasing legal action against companies for their contribution to climate change and the resulting damages.

These risks are now firmly on the radar of investors, lenders, and insurance companies, leading to a reassessment of investment strategies and risk management practices. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations, while voluntary, are significantly influencing corporate reporting and transparency regarding climate-related risks. [Link to TCFD website]

The Emergence of Climate-Related Investment Opportunities:

The shift in perspective is not solely about mitigating risks; it also recognizes the vast economic opportunities presented by the transition to a sustainable future. The green economy is experiencing explosive growth, with substantial investment flowing into renewable energy, energy efficiency technologies, sustainable agriculture, and green infrastructure.

This presents a wealth of opportunities for businesses and investors:

- Renewable Energy Sector: The solar and wind power industries are booming, attracting billions in investment and creating thousands of jobs.

- Green Technology: Innovation in areas such as electric vehicles, battery storage, and carbon capture is driving significant economic growth.

- Sustainable Finance: The growth of ESG (Environmental, Social, and Governance) investing is reshaping investment strategies, directing capital towards companies with strong sustainability profiles. [Link to article on ESG investing]

- Climate Adaptation & Resilience: Investment in infrastructure projects designed to withstand the impacts of climate change is becoming increasingly crucial.

The Role of Regulation and Policy:

Government policies and regulations are playing a crucial role in driving this transformation. Carbon pricing mechanisms, stricter emissions standards, and incentives for renewable energy are creating a more favorable environment for green investments while disincentivizing carbon-intensive activities. The increasing focus on climate-related disclosures is also enhancing transparency and accountability.

Conclusion:

The narrative surrounding climate change in the business and finance sector is evolving rapidly. While the challenges are significant, the opportunities are even greater. Companies and investors who proactively address climate-related risks and embrace the transition to a sustainable economy will be best positioned to thrive in the long term. Ignoring these trends is no longer an option; it's a strategic imperative for long-term success. The future belongs to those who embrace the evolving climate change narrative and see it not as a threat, but as a catalyst for innovation and sustainable growth.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Business And Finance's Evolving Climate Change Narrative. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Empathy In Formula 1 Driver Connects With Lewis Hamiltons Experiences

May 11, 2025

Empathy In Formula 1 Driver Connects With Lewis Hamiltons Experiences

May 11, 2025 -

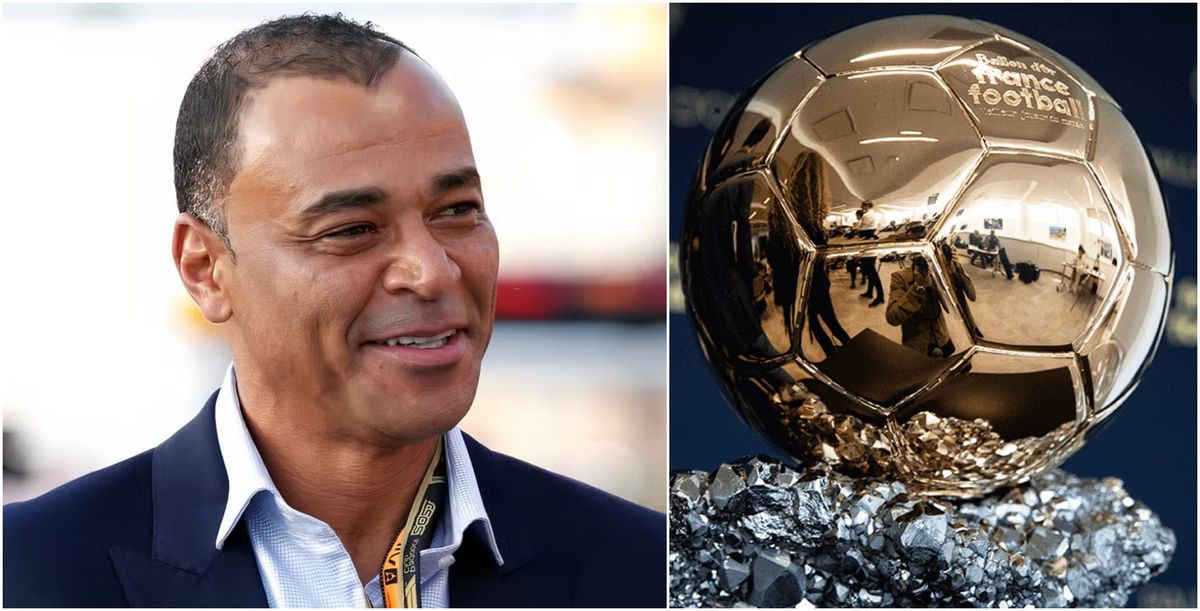

World Cup Winner Cafu Unveils His Ballon D Or 2025 Frontrunners

May 11, 2025

World Cup Winner Cafu Unveils His Ballon D Or 2025 Frontrunners

May 11, 2025 -

Hilaria Baldwin Accuses A Lister Of Spreading False Rumors

May 11, 2025

Hilaria Baldwin Accuses A Lister Of Spreading False Rumors

May 11, 2025 -

Fernando Alonso And Esteban Ocon Echoing Hamiltons Ferrari Challenges

May 11, 2025

Fernando Alonso And Esteban Ocon Echoing Hamiltons Ferrari Challenges

May 11, 2025 -

Barcelonas Yamal Emulating Messis Success A Realistic Possibility

May 11, 2025

Barcelonas Yamal Emulating Messis Success A Realistic Possibility

May 11, 2025