Business And Finance's Evolving Climate Change Discourse

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Business and Finance's Evolving Climate Change Discourse: From Risk to Opportunity

The conversation surrounding climate change within the business and finance sectors is rapidly evolving. No longer a niche concern relegated to environmental, social, and governance (ESG) reports, climate change is now firmly entrenched as a central factor impacting investment strategies, risk assessments, and long-term business viability. This shift reflects a growing awareness of both the substantial financial risks posed by a changing climate and the immense opportunities presented by the transition to a low-carbon economy.

From Denial to Integration: A Paradigm Shift

For years, the narrative surrounding climate change in the business world was often marked by skepticism or a delayed response. However, a confluence of factors – including increasingly frequent and severe extreme weather events, stricter government regulations, and growing investor pressure – has forced a dramatic reassessment. The sheer financial cost of inaction is becoming undeniable. Insurers are already facing record payouts due to climate-related disasters, and businesses across various sectors are experiencing supply chain disruptions and operational challenges. This has led to a significant increase in climate risk disclosures and the integration of climate-related scenarios into financial planning.

The Rise of Sustainable Finance and ESG Investing

The shift in perspective has fueled the explosive growth of sustainable finance and ESG investing. Investors are increasingly demanding transparency and accountability from companies regarding their climate impact. This has led to a surge in demand for green bonds, sustainable investment funds, and other financial instruments that align with climate goals. Major financial institutions are actively developing climate-related financial products and services, recognizing the significant market opportunity.

Identifying and Managing Climate-Related Financial Risks

Understanding and managing climate-related financial risks is paramount for businesses and investors alike. These risks can be broadly categorized as:

- Physical risks: Direct damage from extreme weather events (floods, droughts, wildfires) impacting operations, assets, and supply chains.

- Transition risks: Risks associated with the shift towards a low-carbon economy, such as policy changes, technological advancements, and changes in consumer preferences. This includes the potential for stranded assets – investments that become worthless as the world transitions away from fossil fuels.

- Liability risks: Legal risks stemming from climate-related damages and failures to comply with environmental regulations.

Harnessing the Opportunities of the Green Transition

While the risks are undeniable, the transition to a low-carbon economy also presents substantial opportunities. The growth of renewable energy, energy efficiency technologies, sustainable agriculture, and green building materials represents a massive economic shift, creating new markets and investment opportunities. Businesses that proactively embrace sustainable practices and innovate in green technologies are well-positioned to capture a significant share of this growing market.

The Future of Climate Change Discourse in Business and Finance

The integration of climate considerations into business and finance is still evolving, but the trajectory is clear. Increased transparency, robust regulatory frameworks, and continued investor pressure will likely drive even greater integration of climate-related factors into decision-making processes. Companies that fail to adapt risk being left behind, while those that embrace sustainability stand to benefit significantly.

Call to Action: Stay informed about the latest developments in climate-related finance and ESG investing. Explore resources from organizations like the and the to better understand the implications for your business or investment strategy. The future of business is inextricably linked to the future of our planet.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Business And Finance's Evolving Climate Change Discourse. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Limited Edition Travis Scott Fc Barcelona Collection Released

May 11, 2025

Limited Edition Travis Scott Fc Barcelona Collection Released

May 11, 2025 -

Lamine Yamal Proves Himself Barcelonas Key Player

May 11, 2025

Lamine Yamal Proves Himself Barcelonas Key Player

May 11, 2025 -

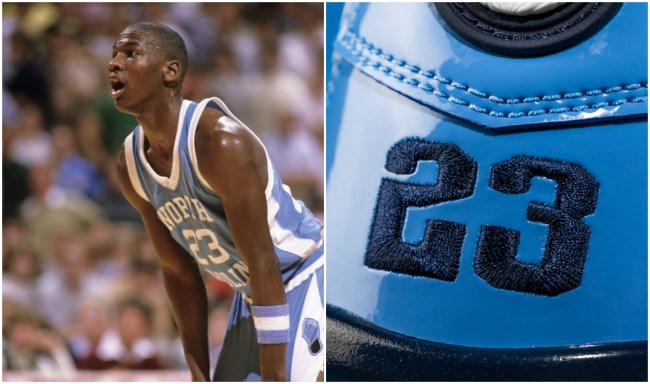

Unveiling The Rare Air Jordan A Gift To Michael Jordans University

May 11, 2025

Unveiling The Rare Air Jordan A Gift To Michael Jordans University

May 11, 2025 -

Discover The New Seeds In The Grow A Garden Night Collection

May 11, 2025

Discover The New Seeds In The Grow A Garden Night Collection

May 11, 2025 -

Will Clean Energy Power Brazil To Become An Ai Superpower

May 11, 2025

Will Clean Energy Power Brazil To Become An Ai Superpower

May 11, 2025