Business And Finance Strategies For A Changing Climate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Business and Finance Strategies for a Changing Climate: Navigating the New Normal

The climate is changing, and its impact on businesses and finances is undeniable. From extreme weather events disrupting supply chains to shifting consumer preferences demanding sustainable practices, companies must adapt to survive and thrive in this new reality. Ignoring the climate crisis is no longer an option; it's a significant financial risk. This article explores key strategies businesses and financial institutions can employ to navigate these challenges and capitalize on emerging opportunities.

H2: Assessing Climate-Related Financial Risks

Before implementing any strategies, businesses need a thorough understanding of their exposure to climate-related risks. This involves a comprehensive assessment covering:

- Physical risks: These include direct damage from extreme weather events (floods, wildfires, hurricanes), sea-level rise, and changes in temperature and precipitation patterns. The impact can range from property damage and business interruption to supply chain disruptions and decreased productivity. Understanding your vulnerability is crucial. Consider using climate risk modeling tools to assess potential future scenarios.

- Transition risks: These arise from the shift towards a low-carbon economy. Regulations like carbon pricing, changing consumer preferences for sustainable products, and technological advancements can make existing assets and business models obsolete. Businesses reliant on fossil fuels, for instance, face significant transition risks.

- Opportunities: The transition to a low-carbon economy also presents substantial opportunities. Investing in renewable energy, developing sustainable products and services, and improving energy efficiency can lead to cost savings, increased competitiveness, and new revenue streams. The green economy is booming, creating a wealth of opportunities for innovative businesses.

H2: Implementing Climate-Resilient Strategies

Adapting to a changing climate requires a multifaceted approach. Key strategies include:

- Integrating climate risk into financial planning: Climate-related risks should be integrated into all aspects of financial planning, including investment decisions, risk management, and financial reporting. This ensures that the long-term impacts of climate change are considered. The Task Force on Climate-related Financial Disclosures (TCFD) provides valuable guidance on this front. [Link to TCFD website]

- Investing in climate resilience: Companies can invest in measures to enhance their resilience to climate-related impacts. This might involve strengthening infrastructure, diversifying supply chains, and developing early warning systems for extreme weather events.

- Embracing sustainable business practices: Adopting sustainable practices, such as reducing carbon emissions, improving energy efficiency, and sourcing sustainable materials, can reduce operational costs, enhance brand reputation, and attract environmentally conscious investors.

- Developing climate-related metrics and targets: Setting measurable targets for reducing emissions, improving resource efficiency, and increasing renewable energy use is crucial for tracking progress and demonstrating commitment to climate action. Using frameworks like the Science Based Targets initiative (SBTi) can provide valuable guidance. [Link to SBTi website]

- Engaging with stakeholders: Open communication and engagement with stakeholders, including investors, customers, employees, and communities, are crucial for building trust and fostering collaboration in addressing climate change.

H2: The Role of Finance in the Climate Transition

Financial institutions have a critical role to play in supporting the transition to a low-carbon economy. This includes:

- Green financing: Increasing investment in green technologies and projects is essential. This includes providing loans, bonds, and other financial products to support renewable energy development, energy efficiency improvements, and sustainable infrastructure projects.

- Divestment from fossil fuels: Many investors are shifting their portfolios away from fossil fuels and towards cleaner energy sources. This reflects growing awareness of the financial risks associated with fossil fuel investments.

- ESG investing: Environmental, Social, and Governance (ESG) investing is gaining popularity as investors increasingly consider ESG factors in their investment decisions. This reflects a growing demand for transparent and sustainable investments.

H2: Conclusion: A Necessary Transformation

Addressing climate change is not just an environmental imperative; it's a critical business and financial necessity. By proactively assessing risks, implementing resilient strategies, and embracing sustainable practices, businesses and financial institutions can navigate the challenges of a changing climate and unlock significant opportunities. The transition requires collaboration, innovation, and a long-term perspective. The future of business depends on it.

Call to Action: Learn more about climate-related financial risks and opportunities by exploring resources from reputable organizations like the UNEP FI and the World Bank. [Link to UNEP FI and World Bank websites (or relevant pages)]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Business And Finance Strategies For A Changing Climate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Expert Analysis Espn Names Tetairoa Mc Millan As Prime Nfl Draft Target For Carolina Panthers

May 13, 2025

Expert Analysis Espn Names Tetairoa Mc Millan As Prime Nfl Draft Target For Carolina Panthers

May 13, 2025 -

Enfrentamiento Wta Italian Open 2025 Elina Svitolina Vs Danielle Collins Previa Y Pronostico

May 13, 2025

Enfrentamiento Wta Italian Open 2025 Elina Svitolina Vs Danielle Collins Previa Y Pronostico

May 13, 2025 -

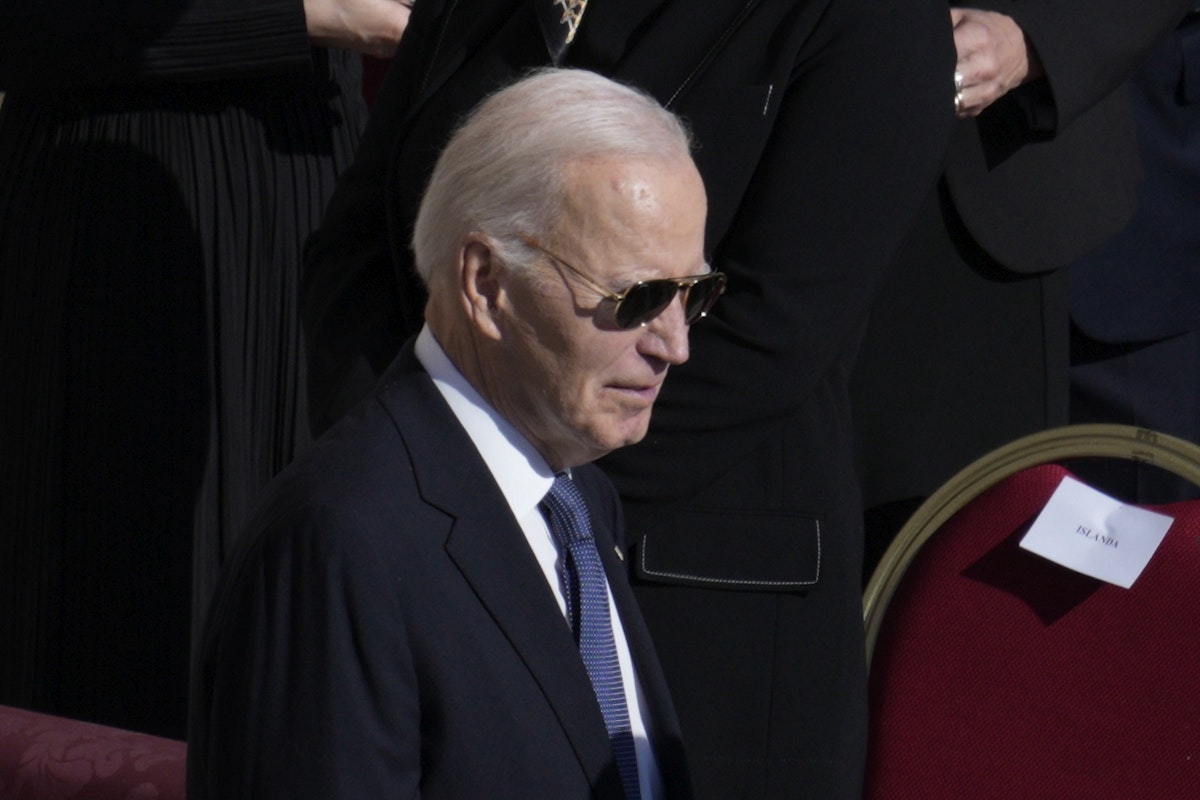

Inside The White House Staff Observations On Bidens Health

May 13, 2025

Inside The White House Staff Observations On Bidens Health

May 13, 2025 -

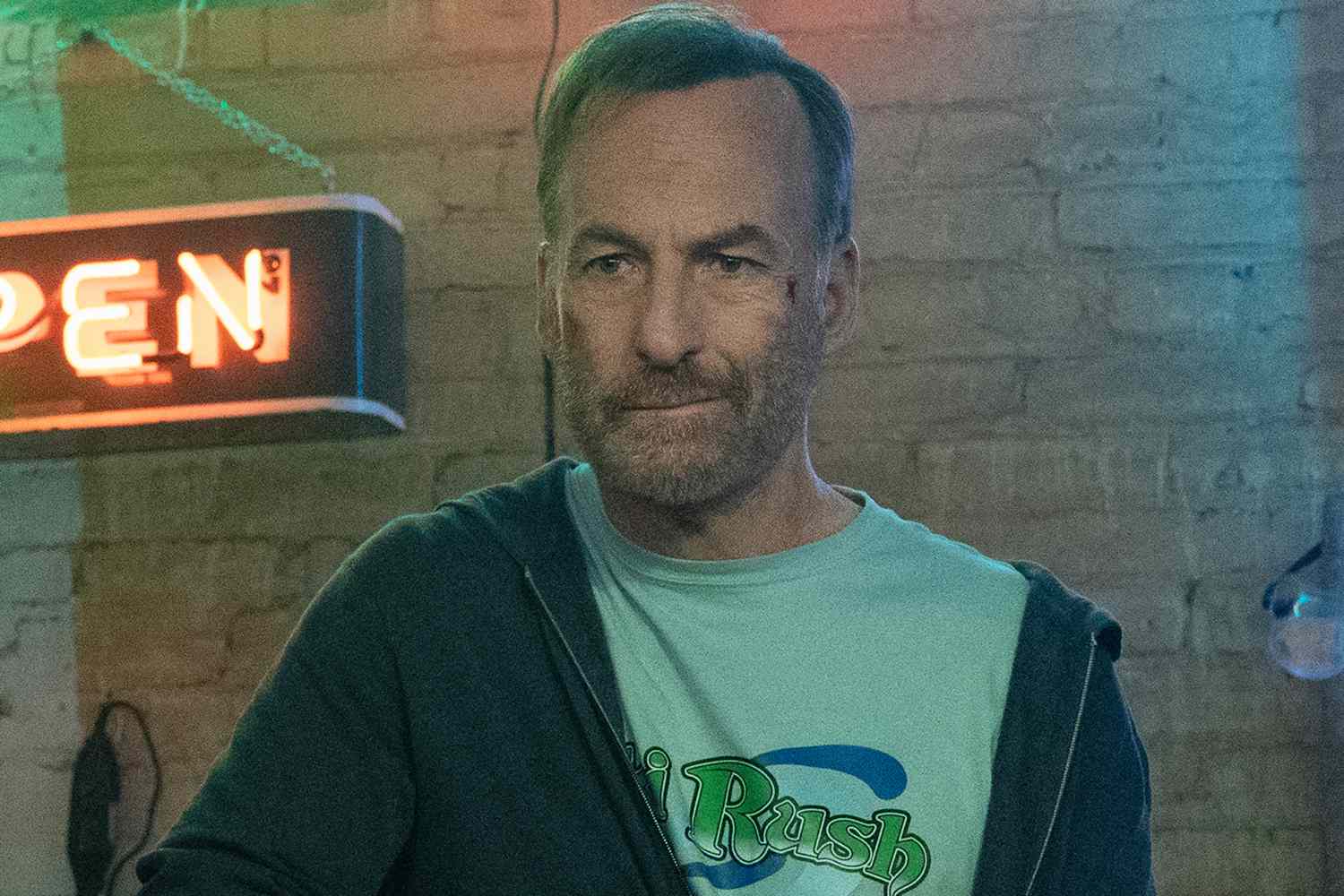

Bob Odenkirks Nobody 2 Trailer A Bloody Family Getaway

May 13, 2025

Bob Odenkirks Nobody 2 Trailer A Bloody Family Getaway

May 13, 2025 -

Nbc Universals Nba Coverage Boosted By Michael Jordans Expertise

May 13, 2025

Nbc Universals Nba Coverage Boosted By Michael Jordans Expertise

May 13, 2025