Business And Finance Sector's Response To Climate Change

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Business and Finance Sector's Response to Climate Change: A Turning Tide?

The global climate crisis is no longer a distant threat; its impacts are being felt acutely across the world. This reality is forcing a significant shift in the business and finance sector, prompting a reassessment of risk, opportunity, and responsibility. While the response is still evolving, a growing number of companies and financial institutions are taking concrete steps to address climate change, driven by a combination of regulatory pressure, investor demand, and a growing awareness of the long-term implications.

The Growing Pressure: Regulations and Investor Activism

Governments worldwide are implementing stricter environmental regulations, pushing businesses to reduce their carbon footprint and embrace sustainable practices. The EU's Taxonomy Regulation, for example, provides a framework for classifying environmentally sustainable economic activities, influencing investment decisions and corporate strategies. This regulatory push is complemented by increasing pressure from investors, who are increasingly incorporating Environmental, Social, and Governance (ESG) factors into their investment strategies. [Link to EU Taxonomy Regulation]. This means companies with poor climate performance face higher financing costs and diminished investor appeal. Activist investors are also becoming more vocal, demanding greater transparency and accountability from companies on their climate-related risks and opportunities.

Strategies for Climate Action: Beyond Greenwashing

The response from the business and finance sector is multifaceted, moving beyond superficial "greenwashing" efforts to encompass more substantial changes. Key strategies include:

- Carbon Reduction Targets: Many companies are setting ambitious targets to reduce their greenhouse gas emissions, often aiming for net-zero emissions by mid-century. These targets are increasingly backed by science-based methodologies, ensuring their credibility and effectiveness.

- Investing in Renewable Energy: A significant shift is occurring towards renewable energy sources, with businesses investing in solar, wind, and other clean technologies to power their operations and reduce their reliance on fossil fuels.

- Sustainable Supply Chains: Companies are examining their entire supply chains to identify and reduce emissions at every stage, from raw material sourcing to product distribution. This requires collaboration with suppliers and a commitment to sustainable procurement practices.

- Climate-Related Financial Disclosures: The Task Force on Climate-related Financial Disclosures (TCFD) framework is gaining widespread adoption, requiring companies to disclose their climate-related risks and opportunities, improving transparency and informing investment decisions. [Link to TCFD website]

- Developing Climate-Resilient Strategies: Businesses are preparing for the physical impacts of climate change, such as extreme weather events and sea-level rise, by developing strategies to mitigate risks and build resilience into their operations.

The Role of Finance in Driving Change

The financial sector plays a crucial role in accelerating the transition to a low-carbon economy. This includes:

- Green Finance Initiatives: Banks and investment firms are increasingly developing green finance products and services, such as green bonds and sustainable investment funds, to channel capital towards environmentally friendly projects.

- ESG Integration: Many financial institutions are integrating ESG factors into their investment and lending decisions, using them to assess risk and identify investment opportunities.

- Divestment from Fossil Fuels: Some financial institutions are divesting from fossil fuel companies, signalling a shift away from high-carbon assets and towards a more sustainable investment portfolio.

Challenges and Opportunities

Despite the progress, significant challenges remain. These include the need for standardized metrics and reporting, the complexities of measuring and managing climate-related risks, and the need for greater collaboration across sectors. However, the transition to a low-carbon economy also presents significant opportunities for innovation, job creation, and economic growth. Businesses that embrace sustainability are likely to gain a competitive advantage, attracting investors, customers, and talent.

Conclusion:

The response of the business and finance sector to climate change is a dynamic and evolving process. While challenges persist, the growing pressure from regulators, investors, and consumers is driving substantial changes. Companies and financial institutions that proactively address climate change will not only contribute to a more sustainable future but also position themselves for long-term success in a rapidly changing world. The future depends on continued innovation, collaboration, and a commitment to genuine, impactful climate action.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Business And Finance Sector's Response To Climate Change. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Six Goal Thriller Barcelona Real Madrid El Clasico Live Updates

May 11, 2025

Six Goal Thriller Barcelona Real Madrid El Clasico Live Updates

May 11, 2025 -

Rome Masters Jabeur Vs Kvitova Live Streaming Preview And Odds Comparison

May 11, 2025

Rome Masters Jabeur Vs Kvitova Live Streaming Preview And Odds Comparison

May 11, 2025 -

Deep Sea Exploration Unveiling The 99 We Havent Seen

May 11, 2025

Deep Sea Exploration Unveiling The 99 We Havent Seen

May 11, 2025 -

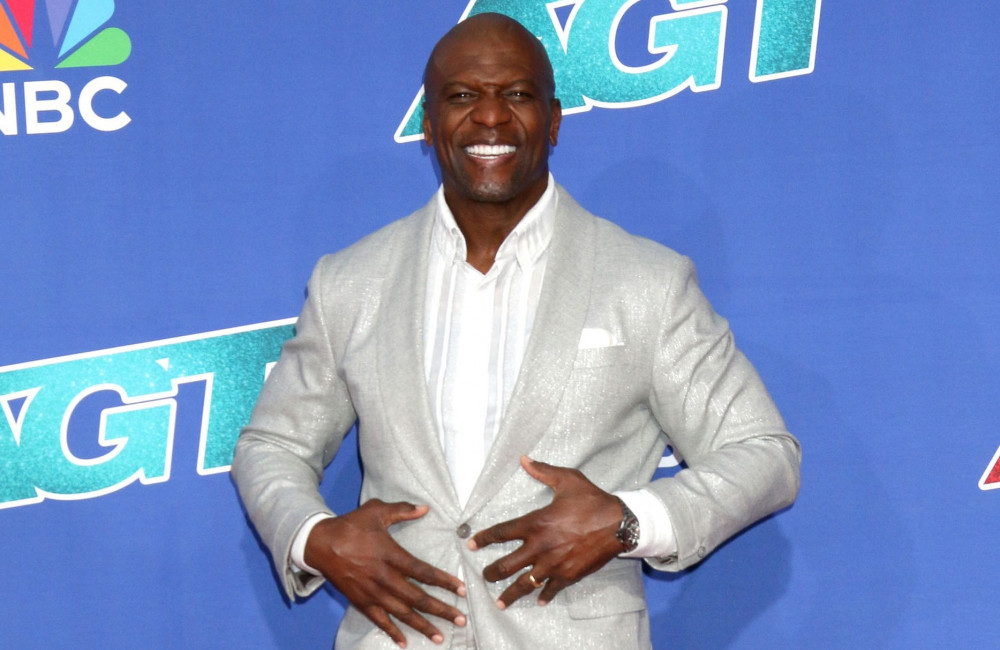

Terry Crews Wants Everybody Hates Chris To Join Animations Elite A Realistic Goal

May 11, 2025

Terry Crews Wants Everybody Hates Chris To Join Animations Elite A Realistic Goal

May 11, 2025 -

Oceans Deep The Vast Unknown And The Challenges Of Deep Sea Research

May 11, 2025

Oceans Deep The Vast Unknown And The Challenges Of Deep Sea Research

May 11, 2025