Brokerage Firms Set Lucid Group (LCID) Price Target At $25.94

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Brokerage Firms Set Lucid Group (LCID) Price Target at $25.94: Is This Electric Vehicle Maker Poised for a Surge?

The electric vehicle (EV) market is buzzing, and one name consistently generating headlines is Lucid Group (LCID). Recently, several prominent brokerage firms have collectively set a price target for LCID stock at $25.94, sparking significant interest and debate among investors. But what does this mean for the future of Lucid, and should you be considering adding this volatile stock to your portfolio?

This article dives deep into the recent price target estimations, examining the factors driving this bullish sentiment and exploring the potential risks and rewards for investors.

Why the Optimism? Analyzing the $25.94 Price Target

The $25.94 price target isn't a prediction from a single source; it represents a consensus among multiple brokerage firms who have recently updated their LCID stock assessments. This collective optimism stems from several key factors:

- Strong Product Performance: Lucid's Air Dream Edition has garnered significant critical acclaim for its luxury features, impressive range, and innovative technology. Positive reviews and strong initial sales are fueling confidence in the brand's potential.

- Expanding Production Capacity: Lucid is investing heavily in expanding its production capabilities, aiming to significantly increase the number of vehicles manufactured and delivered each year. Meeting production targets is crucial for the company's long-term financial health and stock valuation.

- Government Incentives and Growing EV Market: The increasing adoption of electric vehicles globally, coupled with government incentives and subsidies for EV purchases, presents a significant growth opportunity for Lucid and its competitors.

- Technological Innovation: Lucid is known for its cutting-edge battery technology and advanced electric motor designs. Maintaining its technological edge is vital for staying competitive in this rapidly evolving market.

However, Challenges Remain:

While the outlook for LCID appears positive, it's essential to acknowledge the challenges facing the company:

- Competition: The EV market is incredibly competitive, with established players like Tesla and numerous emerging competitors vying for market share. Lucid needs to effectively navigate this landscape to maintain its position.

- Supply Chain Issues: The ongoing global supply chain disruptions can impact production timelines and increase costs, potentially affecting profitability.

- Financial Performance: Lucid is still a relatively young company with a history of losses. Sustained profitability is crucial for long-term investor confidence.

What Should Investors Do?

The $25.94 price target represents a significant potential upside for LCID investors. However, it's crucial to remember that this is just a projection, and the actual stock price can fluctuate significantly based on various market factors. Before making any investment decisions, consider the following:

- Conduct Thorough Research: Understand the company's financials, business model, and competitive landscape.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification reduces overall portfolio risk.

- Consider Your Risk Tolerance: LCID stock is inherently volatile. Only invest an amount you're comfortable potentially losing.

- Consult a Financial Advisor: Seek professional advice before making any significant investment decisions.

Conclusion:

The consensus price target of $25.94 for Lucid Group (LCID) reflects a positive outlook for the company's future. However, investors should proceed with caution, carefully weighing the potential rewards against the inherent risks involved in investing in a volatile growth stock within a highly competitive industry. Thorough due diligence and a well-defined investment strategy are essential for navigating this exciting but unpredictable market.

Keywords: Lucid Group, LCID, stock price, price target, electric vehicle, EV, investment, brokerage firms, market analysis, stock market, Tesla, EV market, supply chain, investment strategy, risk tolerance, financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Brokerage Firms Set Lucid Group (LCID) Price Target At $25.94. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

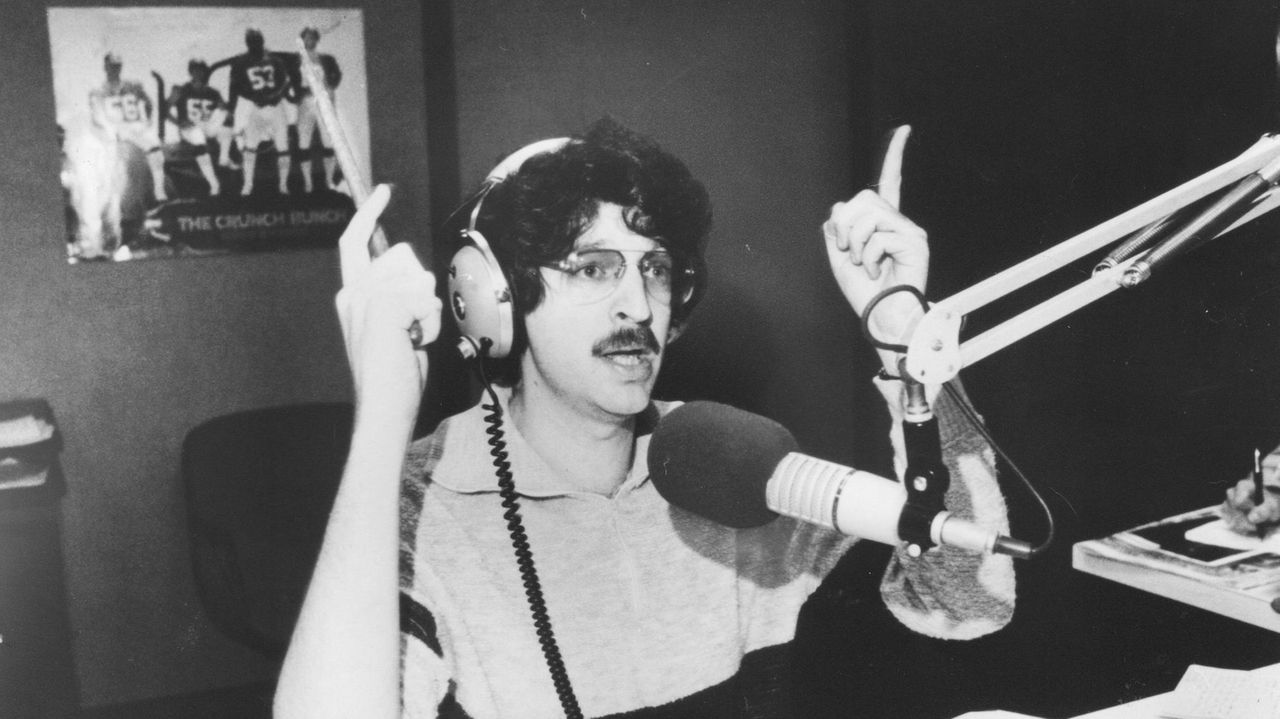

Howard Sterns Early Years Building An Empire On New York Radio Waves

Sep 03, 2025

Howard Sterns Early Years Building An Empire On New York Radio Waves

Sep 03, 2025 -

Twenty Years After Katrina A Review Of Disaster Preparedness And Recovery

Sep 03, 2025

Twenty Years After Katrina A Review Of Disaster Preparedness And Recovery

Sep 03, 2025 -

28 Years Later The Bone Temple Trailer Ralph Fiennes And Jack O Connell Face Unseen Horror

Sep 03, 2025

28 Years Later The Bone Temple Trailer Ralph Fiennes And Jack O Connell Face Unseen Horror

Sep 03, 2025 -

Dont Miss It Free Live Stream Of Dancing With The Stars Season 34 Cast Announcement

Sep 03, 2025

Dont Miss It Free Live Stream Of Dancing With The Stars Season 34 Cast Announcement

Sep 03, 2025 -

20 Years After Katrina What Improvements Have We Made

Sep 03, 2025

20 Years After Katrina What Improvements Have We Made

Sep 03, 2025

Latest Posts

-

Cyberpunk 2077 Hype Dies Down Tomorrows Announcement Underwhelms

Sep 07, 2025

Cyberpunk 2077 Hype Dies Down Tomorrows Announcement Underwhelms

Sep 07, 2025 -

Caps Back Chris Evanss Steve Rogers Esque Red Carpet Look

Sep 07, 2025

Caps Back Chris Evanss Steve Rogers Esque Red Carpet Look

Sep 07, 2025 -

Watch This Critically Acclaimed Superhero Series Free On Prime Video

Sep 07, 2025

Watch This Critically Acclaimed Superhero Series Free On Prime Video

Sep 07, 2025 -

Unprecedented View Of Star Birth Nasas Webb Telescope Delivers

Sep 07, 2025

Unprecedented View Of Star Birth Nasas Webb Telescope Delivers

Sep 07, 2025 -

The Hollywood Reporters Tiff Studio A Look At Interviews With Cillian Murphy Paul Mescal And Others

Sep 07, 2025

The Hollywood Reporters Tiff Studio A Look At Interviews With Cillian Murphy Paul Mescal And Others

Sep 07, 2025