Bristol-Myers Squibb Q2 Earnings Beat Expectations, Driving Share Price Higher

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bristol-Myers Squibb Q2 Earnings Beat Expectations, Driving Share Price Higher

Bristol-Myers Squibb (BMY) surged in after-hours trading on Wednesday following the release of its second-quarter 2024 earnings report, which significantly exceeded analysts' expectations. The pharmaceutical giant announced strong financial results, driven by robust sales of its key oncology and immunology drugs. This positive performance fueled a significant increase in the company's share price, making it a compelling topic for investors and industry analysts alike.

<h3>Strong Q2 Performance Fuels Share Price Growth</h3>

Bristol-Myers Squibb reported adjusted earnings per share (EPS) of $1.98, comfortably surpassing the consensus estimate of $1.80. This impressive beat reflects the company's continued success in its core therapeutic areas. Revenue also came in above expectations, reaching $12.2 billion compared to the projected $11.8 billion. The exceeding performance underscores the efficacy of Bristol-Myers Squibb's strategic focus and robust product portfolio.

<h3>Key Growth Drivers: Oncology and Immunology</h3>

Several key factors contributed to Bristol-Myers Squibb's strong Q2 performance. The company's oncology franchise continued to be a major driver of growth, with strong sales of its flagship cancer therapies, including:

- Opdivo (nivolumab): This immunotherapy drug remains a key revenue generator for BMY, showing consistent growth across various cancer indications.

- Reblozyl (luspatercept): This treatment for anemia associated with myelodysplastic syndromes and beta-thalassemia continues to demonstrate strong market penetration.

- Yervoy (ipilimumab): While facing increased competition, Yervoy continues to contribute significantly to the company's oncology portfolio.

Furthermore, the company's immunology portfolio also performed well, further contributing to the overall strong financial results. This segment’s success highlights the growing demand for effective treatments in autoimmune diseases.

<h3>Future Outlook and Investment Implications</h3>

Bristol-Myers Squibb's management expressed confidence in the company's future prospects, reaffirming its full-year guidance. This positive outlook, coupled with the strong Q2 results, suggests a promising trajectory for the pharmaceutical giant. The exceeding earnings and positive forecast have bolstered investor confidence, leading to the significant increase in the company's share price. For investors, this positive news presents a potential opportunity, although thorough due diligence is always recommended.

<h3>Analyzing the Market Reaction</h3>

The market reacted favorably to the news, with BMY shares experiencing a substantial post-market surge. This indicates a strong vote of confidence from investors in the company's long-term growth potential and ability to deliver consistent financial results. The increased share price reflects the market's belief in Bristol-Myers Squibb's ability to navigate the competitive pharmaceutical landscape and maintain its position as a leading innovator. This positive response underscores the significance of exceeding expectations in the highly competitive pharmaceutical sector.

<h3>Conclusion: A Strong Quarter for Bristol-Myers Squibb</h3>

Bristol-Myers Squibb's Q2 2024 earnings report significantly exceeded expectations, driving a substantial increase in its share price. This success was driven by robust performance in its oncology and immunology segments, demonstrating the efficacy of its strategic focus and the strength of its product portfolio. While investing in the stock market always involves risk, the company's strong performance suggests a positive outlook for the future. Further analysis of the company’s financial reports and market trends is crucial for any investor considering adding BMY to their portfolio. Stay tuned for further updates and analysis of the pharmaceutical industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bristol-Myers Squibb Q2 Earnings Beat Expectations, Driving Share Price Higher. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Historic Russian Quake Tsunami Risk And Recent Events

Aug 01, 2025

Historic Russian Quake Tsunami Risk And Recent Events

Aug 01, 2025 -

Vikings Mc Carthy On Rough Patches Lessons Learned Growth Ahead

Aug 01, 2025

Vikings Mc Carthy On Rough Patches Lessons Learned Growth Ahead

Aug 01, 2025 -

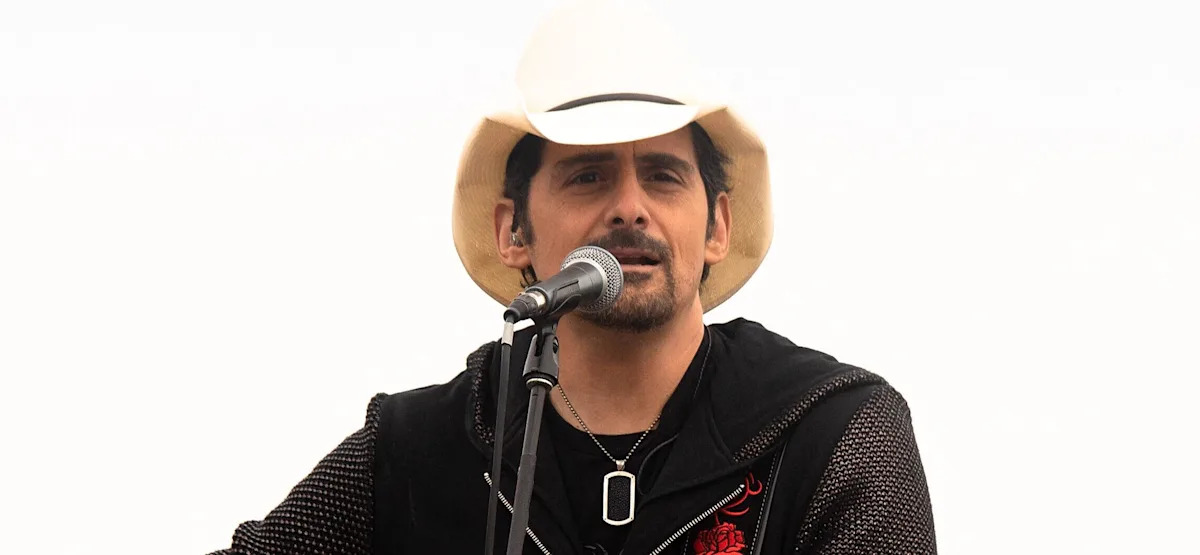

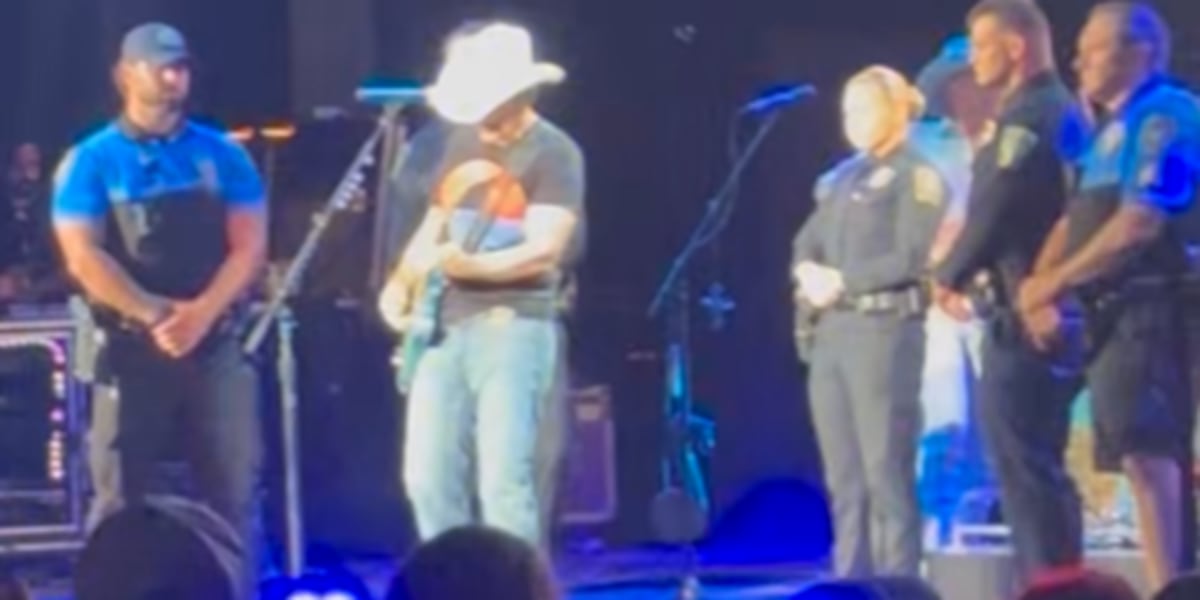

Police Custody For Brad Paisley Mid Show Arrest Rocks Country Music World

Aug 01, 2025

Police Custody For Brad Paisley Mid Show Arrest Rocks Country Music World

Aug 01, 2025 -

Brad Paisley Invites Wilmington Police Officers Onstage During Concert

Aug 01, 2025

Brad Paisley Invites Wilmington Police Officers Onstage During Concert

Aug 01, 2025 -

J J Mc Carthys Vikings Camp Struggles Learning From Mistakes

Aug 01, 2025

J J Mc Carthys Vikings Camp Struggles Learning From Mistakes

Aug 01, 2025