Bold Bets Drive $5B+ Investment In Bitcoin ETFs: The Future Of Crypto Investing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bold Bets Drive $5 Billion+ Investment in Bitcoin ETFs: The Future of Crypto Investing

The cryptocurrency market is buzzing. A recent surge in investment, exceeding $5 billion, into Bitcoin exchange-traded funds (ETFs) signals a monumental shift in how institutional and individual investors view Bitcoin and the future of crypto investing. This unprecedented influx of capital represents a significant vote of confidence in Bitcoin's long-term viability and its potential as a mainstream asset class. But what's driving this wave of investment, and what does it mean for the future?

The Catalyst: Regulatory Approvals and Institutional Adoption

The primary catalyst behind this massive investment is the recent approval of several Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC). This landmark decision, after years of deliberation, opened the floodgates for institutional investors – hedge funds, pension funds, and other large financial players – to access Bitcoin exposure through a regulated and familiar investment vehicle. This approval marks a significant milestone in the legitimization of cryptocurrencies within traditional finance. Previously, investing in Bitcoin directly involved navigating complex exchanges and dealing with inherent risks associated with self-custody. ETFs offer a significantly more streamlined and secure entry point.

Beyond the SEC Approval: Factors Fueling the Bitcoin ETF Boom

Several factors, in addition to SEC approvals, are contributing to this extraordinary growth:

- Increased Institutional Interest: Major financial institutions are increasingly recognizing Bitcoin's potential as a hedge against inflation and a diversifying asset. The availability of ETFs makes it easier for them to allocate capital to Bitcoin without the operational complexities of direct investment.

- Growing Retail Investor Participation: ETFs offer accessibility to a wider range of investors, including those who may be intimidated by the technical aspects of direct cryptocurrency trading. This broadened accessibility fuels increased demand.

- Regulatory Clarity (In Select Jurisdictions): While regulatory frameworks for cryptocurrencies are still evolving globally, the increasing clarity in certain key markets, like the U.S., fosters investor confidence.

- Bitcoin's Perceived Value Proposition: Bitcoin's position as the leading cryptocurrency, coupled with its limited supply, continues to drive its perceived value and attract long-term investors.

The Future of Crypto Investing: A Paradigm Shift?

The surge in Bitcoin ETF investment suggests a fundamental shift in the landscape of crypto investing. The involvement of institutional investors lends credibility to the asset class and signals a move towards mainstream adoption. This trend is likely to further accelerate the integration of cryptocurrencies into traditional financial markets.

What Lies Ahead?

While the future remains uncertain, several key trends are likely to shape the crypto investment landscape:

- More ETF Approvals: We can expect further applications and approvals for Bitcoin ETFs and potentially ETFs tracking other cryptocurrencies.

- Increased Competition: The growing popularity of Bitcoin ETFs is likely to attract more competition amongst ETF providers.

- Innovation in Crypto Investment Products: We may see further innovation in investment products, such as actively managed crypto ETFs and other specialized investment vehicles.

Conclusion:

The $5 billion+ investment in Bitcoin ETFs represents a watershed moment for the cryptocurrency market. It reflects a growing acceptance of Bitcoin as a legitimate asset class, driven by regulatory approvals, institutional interest, and increased accessibility for retail investors. While risks remain, the future of crypto investing appears increasingly bright, with ETFs playing a central role in its evolution. It will be fascinating to observe how this trend unfolds and shapes the broader financial landscape in the coming years. Stay tuned for further developments!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bold Bets Drive $5B+ Investment In Bitcoin ETFs: The Future Of Crypto Investing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Official New Peaky Blinders Series Announced With Significant Shift

May 20, 2025

Official New Peaky Blinders Series Announced With Significant Shift

May 20, 2025 -

Earth Faces Blackout Risk Nasa Issues Urgent Solar Flare Warning

May 20, 2025

Earth Faces Blackout Risk Nasa Issues Urgent Solar Flare Warning

May 20, 2025 -

Bidens Cancer Diagnosis Political Figures Offer Messages Of Hope

May 20, 2025

Bidens Cancer Diagnosis Political Figures Offer Messages Of Hope

May 20, 2025 -

Eagles Super Bowl Success Secures Siriannis Future Multi Year Contract Details

May 20, 2025

Eagles Super Bowl Success Secures Siriannis Future Multi Year Contract Details

May 20, 2025 -

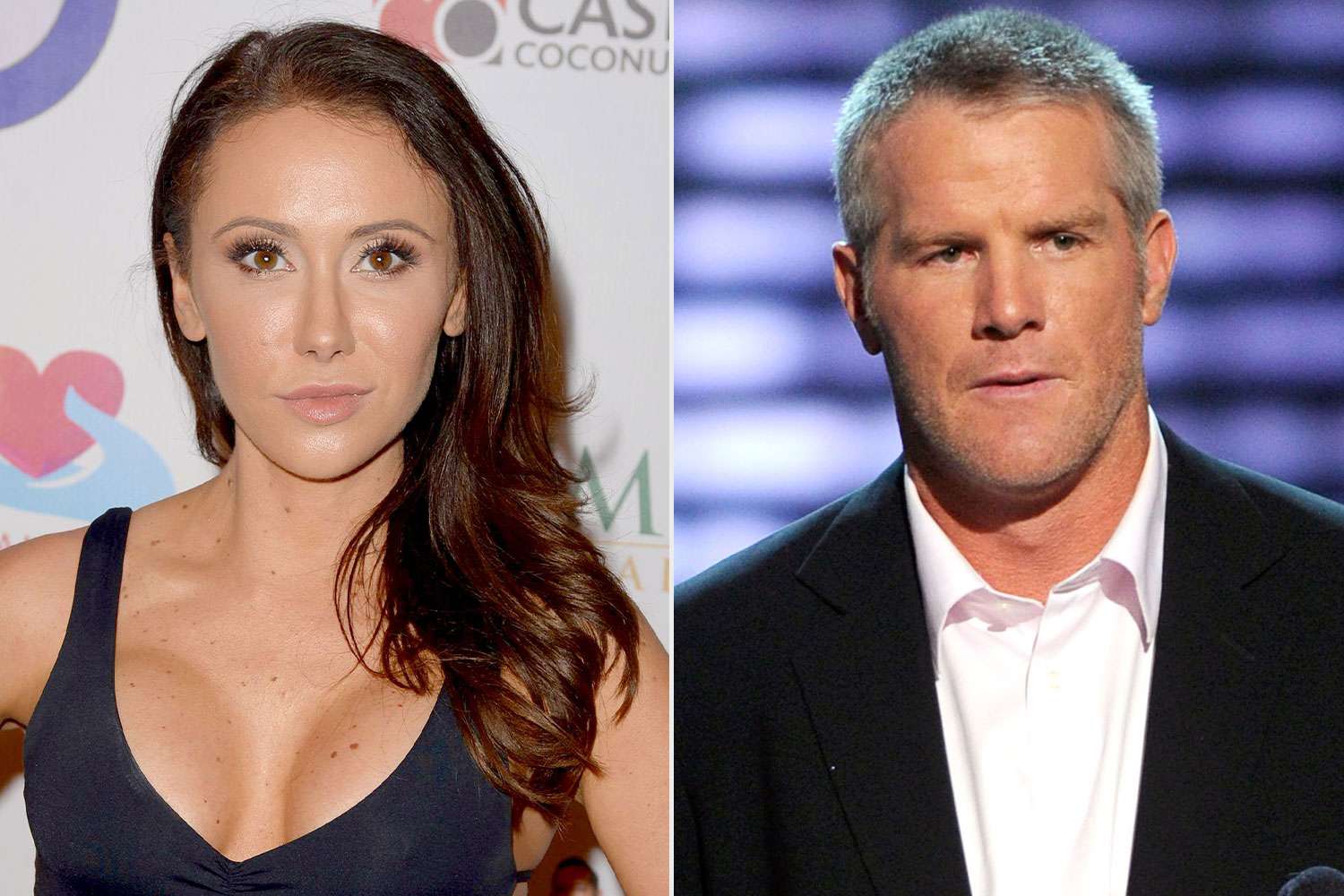

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Mistreatment

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Mistreatment

May 20, 2025