Bitcoin's Quiet Before The Storm? Low Volatility Hints At Breakout

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin's Quiet Before the Storm? Low Volatility Hints at a Potential Breakout

Bitcoin's price has been remarkably calm recently, exhibiting unusually low volatility. While this might seem boring to some, seasoned crypto investors know that periods of low volatility often precede significant price movements – a potential "quiet before the storm." Is Bitcoin primed for a dramatic breakout, or is this just another lull in the market? Let's delve into the potential scenarios.

The Current State of Bitcoin Volatility

For weeks, Bitcoin's price has traded within a relatively tight range. This low volatility, as measured by metrics like the Average True Range (ATR), contrasts sharply with the dramatic swings seen earlier in the year. While some analysts see this as a sign of market consolidation, others believe it's a pressure cooker ready to explode. The lack of significant price action could be interpreted in several ways:

- Accumulation Phase: Large investors might be quietly accumulating Bitcoin, anticipating a future price surge. This accumulation could be suppressing volatility as they absorb sell-offs.

- Market Uncertainty: Global macroeconomic factors, including inflation concerns and regulatory uncertainty, could be keeping investors on the sidelines, leading to subdued trading activity.

- Waiting for a Catalyst: A significant event, such as a major regulatory announcement or a breakthrough in Bitcoin adoption, could be the trigger needed to unleash pent-up demand.

Potential Breakout Scenarios:

The low volatility could indeed be a prelude to a major price movement in either direction. Here are some possible scenarios:

- Bullish Breakout: If positive news emerges, or if pent-up demand is released, Bitcoin could experience a rapid price increase. This bullish breakout could be fueled by renewed investor confidence and increased institutional adoption. Technical analysis might point to key resistance levels that, once broken, could signal a significant upward trend. [Link to a relevant technical analysis chart]

- Bearish Breakout: Conversely, negative news or a continuation of macroeconomic headwinds could trigger a sharp price decline. This bearish scenario could see Bitcoin test lower support levels, potentially leading to further market uncertainty. [Link to a reputable crypto news source]

What to Watch For:

Several factors will likely influence Bitcoin's future price trajectory:

- Macroeconomic Conditions: Inflation rates, interest rate hikes, and overall global economic stability will play a crucial role.

- Regulatory Developments: New regulations in major markets could significantly impact Bitcoin's price.

- Bitcoin Adoption: Increased adoption by businesses and institutions will likely boost demand.

- On-chain Metrics: Analyzing metrics like transaction volume, mining difficulty, and the number of active addresses can provide valuable insights into market sentiment.

Conclusion: Navigating the Uncertainty

Bitcoin's current low volatility presents a complex picture. While it could be a temporary lull before a significant price movement, it's crucial to approach the market with caution. Conduct thorough research, diversify your portfolio, and only invest what you can afford to lose. The crypto market remains inherently volatile, and predicting future price movements with certainty is impossible. Staying informed and adapting to market changes is key to successful navigation of this exciting, yet unpredictable, asset class.

Call to Action: What are your thoughts on Bitcoin's current price action? Share your predictions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's Quiet Before The Storm? Low Volatility Hints At Breakout. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Benis Speed And Otas Hit Orix Extends Winning Streak To Three Games

Sep 23, 2025

Benis Speed And Otas Hit Orix Extends Winning Streak To Three Games

Sep 23, 2025 -

19 First Alert Weather Day Evening Severe Storm Watch Issued

Sep 23, 2025

19 First Alert Weather Day Evening Severe Storm Watch Issued

Sep 23, 2025 -

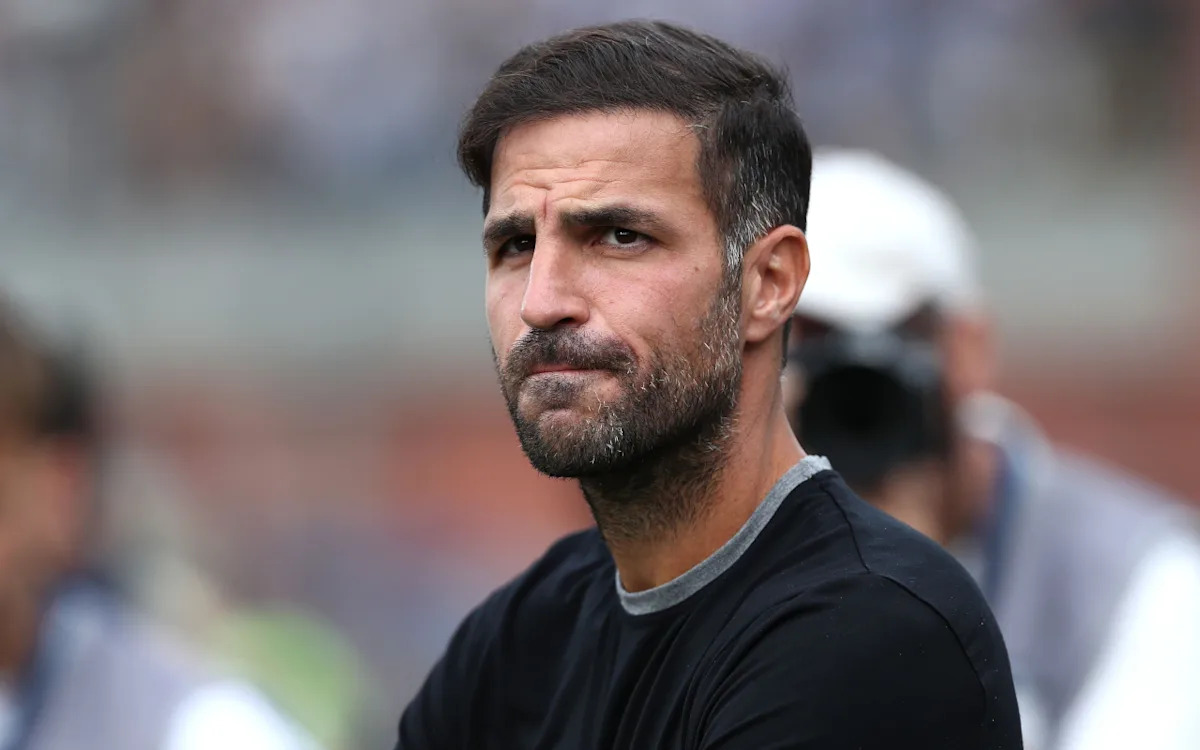

Fabregas And Comos Flood Relief Pledge A Promise Of Financial Aid

Sep 23, 2025

Fabregas And Comos Flood Relief Pledge A Promise Of Financial Aid

Sep 23, 2025 -

Ethereum Eth Price Prediction 10 000 Rally On Cup And Handle Breakout

Sep 23, 2025

Ethereum Eth Price Prediction 10 000 Rally On Cup And Handle Breakout

Sep 23, 2025 -

Bill Gates Perspective The State Of Global Health And The Road Ahead

Sep 23, 2025

Bill Gates Perspective The State Of Global Health And The Road Ahead

Sep 23, 2025