Bitcoin ETF Investments Surge Past $5 Billion: What's Driving The Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Surge Past $5 Billion: What's Driving the Growth?

The world of finance is buzzing. Bitcoin exchange-traded funds (ETFs) have just crossed a monumental threshold, surpassing a staggering $5 billion in investments. This explosive growth marks a significant turning point for Bitcoin's mainstream adoption and signals a shift in how institutional and retail investors view the cryptocurrency. But what's fueling this remarkable surge? Let's delve into the factors driving this unprecedented investment boom.

The Rise of Regulated Bitcoin Access

One of the primary catalysts is the increasing availability of regulated Bitcoin investment vehicles. The approval of the first Bitcoin futures ETF in the US paved the way for more accessible and regulated investment options. This is crucial for institutional investors who often face stringent regulatory hurdles when dealing with cryptocurrencies directly. The perceived reduction in risk associated with ETFs, compared to directly holding Bitcoin, is a significant draw.

Institutional Investor Interest Intensifies

Hedge funds, pension funds, and other institutional investors are increasingly allocating a portion of their portfolios to Bitcoin. The growing acceptance of Bitcoin as a potential inflation hedge and diversification tool is a key driver. Many institutional investors see Bitcoin ETFs as a convenient and manageable way to gain exposure to the cryptocurrency market without the complexities of managing private keys and navigating the volatile world of cryptocurrency exchanges. This influx of institutional money is a major factor in the $5 billion milestone.

Retail Investor Participation Booms

While institutional investment is a significant contributor, the surge in retail investor participation is equally noteworthy. The ease of access through brokerage accounts and the perceived simplicity of ETF investing has attracted a wider range of investors, including those previously hesitant to engage directly with the cryptocurrency market. The lower barrier to entry and the familiarity of the ETF structure are democratizing Bitcoin investment.

Gradual Regulatory Clarity

Although the regulatory landscape for cryptocurrencies remains complex, there's a sense of gradual clarity emerging in several key jurisdictions. While uncertainty persists, the growing acceptance and attempts to regulate the space are providing a more stable environment for investment, encouraging greater participation. This positive regulatory shift, however slow, is boosting investor confidence.

Bitcoin's Continued Relevance

Of course, the underlying asset itself plays a crucial role. Bitcoin's continued relevance as a decentralized digital currency and its potential for long-term growth are fundamental to the increasing investment. Despite market volatility, Bitcoin maintains its position as the dominant cryptocurrency, attracting investors seeking exposure to this burgeoning asset class.

What Does the Future Hold?

The $5 billion milestone is not just a number; it's a powerful indicator of Bitcoin's growing legitimacy and acceptance within the traditional financial system. The trend toward increased regulatory clarity, the continued interest from institutional and retail investors, and Bitcoin's inherent characteristics all point towards a future where Bitcoin ETFs play an even more significant role in the global financial landscape. While predicting the future is impossible, the current trajectory suggests even greater growth is on the horizon. This surge is a compelling narrative of the evolving relationship between traditional finance and the exciting world of cryptocurrencies.

Are you considering investing in Bitcoin ETFs? Let us know your thoughts in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Surge Past $5 Billion: What's Driving The Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ufc Fans React To Jon Jones I M Done Statement Aspinall Fight In Jeopardy

May 20, 2025

Ufc Fans React To Jon Jones I M Done Statement Aspinall Fight In Jeopardy

May 20, 2025 -

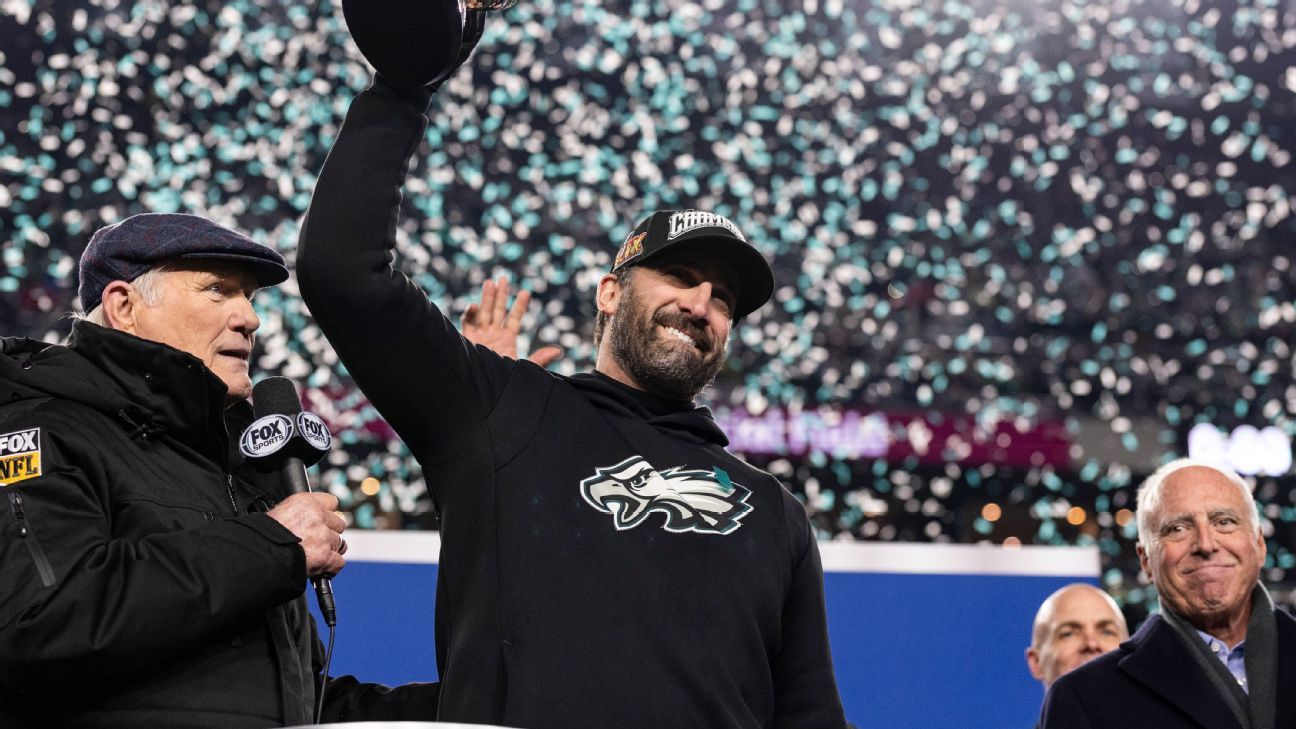

Nick Sirianni Signs Multi Year Deal With Philadelphia Eagles

May 20, 2025

Nick Sirianni Signs Multi Year Deal With Philadelphia Eagles

May 20, 2025 -

Jon Jones Retirement Rumors Ignite After I M Done Comment

May 20, 2025

Jon Jones Retirement Rumors Ignite After I M Done Comment

May 20, 2025 -

The Last Of Us Part Iis Influence Analyzing Joel And Ellies Relationship In The Hbo Series

May 20, 2025

The Last Of Us Part Iis Influence Analyzing Joel And Ellies Relationship In The Hbo Series

May 20, 2025 -

Jon Jones Ufc Hid Aspinall Injury Details From Fans

May 20, 2025

Jon Jones Ufc Hid Aspinall Injury Details From Fans

May 20, 2025